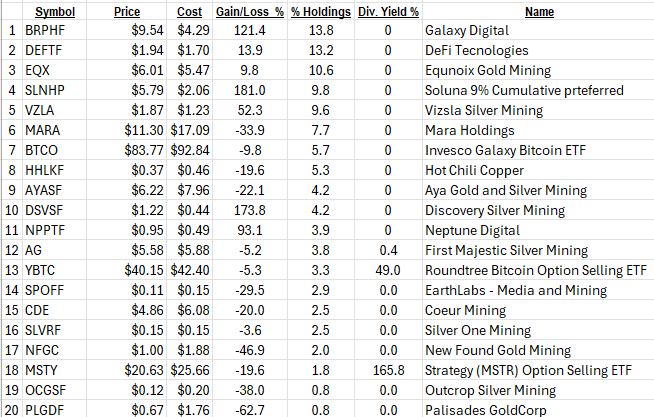

Below are our top twenty positions in the ZTA Partnership. They comprise 107% of the total holdings of a total number of 108.56%. We have Margin (borrowed money) so the count can exceed 100%.

We have two option selling positions – MSTY and YBTC – that pay dividends weekly in the case of YBTC and monthly in the case of MSTY that more than offsets margin interest expense.

Positions as of April 4, 2025

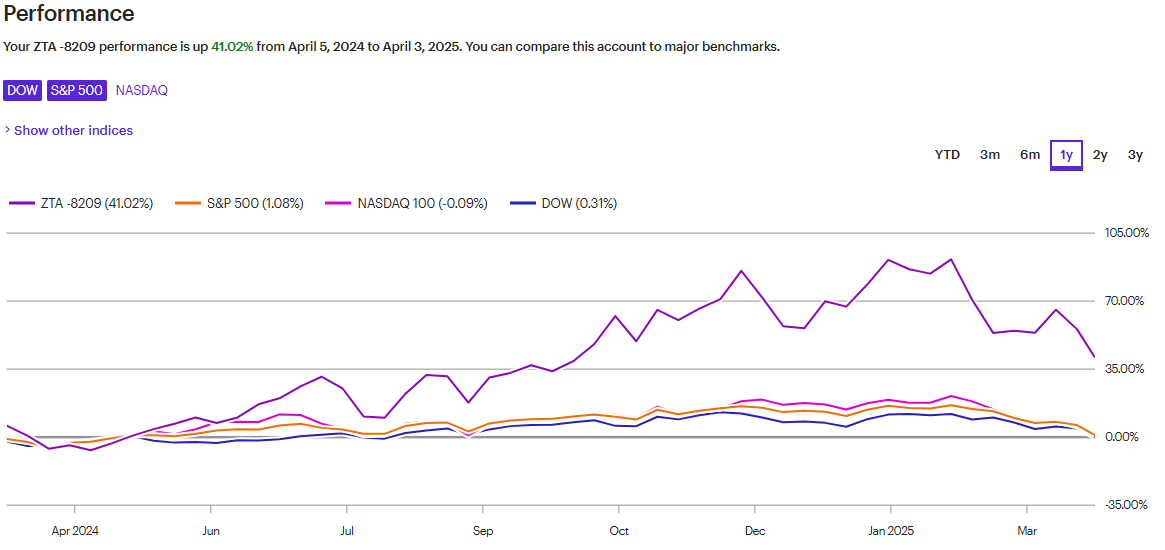

The market has not been kind to us over the past five weeks. That is a truism for nearly everyone.

ZTA is concentrated in two industries –Crypto/Blockchain and Gold, Silver, and Copper miners. Both have sold off in the past few weeks.

Crypto/Blockchain is the fastest growing revenue generating technology humans have ever experienced. AI is growing faster than Crypto/Blockchain but as of yet, is not generating meaningful revenue. Prior to AI and Crypto/Blockchain the internet was the fastest growing technology.

The second industry is involved in the longest established store of value humans have had. Gold, Silver, and Copper mining.

Best-selling Author and money manager, Larry McDonald discusses Gold, Silver & Tariffs.

Larry McDonald: Investors Fleeing U.S. Markets – Where the Smart Money Is Going | Part II

Wealthion, Published early April 2025.

Short comments on the top ten positions in ZTA

- Galaxy Digital (*BRPHF) Global leading Investment banker for all things related to Crypto & blockchain. #1 one choice by Piper Sandler for their top performing stock in 2025. Expected to be uplisted to a major US stock exchange in mid-year 2025. Listed as the most diversified way to participate in Crypto and Blockchain industry. 2024 revenue tripled from about $200 million in 2023 to $600 million in 2024. The average 12-month price target by analysts on TipRanks is $27.00.

- DeFi Technologies (DEFTF) – Expected uplifting to a major US stock exchange in mid-year 2025. Leading asset manager trading desk engaged in crypto and blockchain in the EU, Africa, Middle east, and SE Asia. Expected to enter the USA market once regulations are set – expected mid-year 2025. The average 2025 price target by analysts on TipRanks is $4.68.

- Equinox Gold (EQX) Mid–sized gold miner with seven producing mines. The proposed merger with Caliber Gold would accelerate the growth rate of both revenue and positive cash flow. EQX has strong fundamentals. Analysts, through TipRanks, have an average price target for 12 months of $8.26.

- Soluna 9% cumulative preferred Our cost is under the $2.25 annual dividend SLNHP owes us since October 2022. Soluna is growing revenue but is not earning the dividend owed to us. We continue to accrue annual dividends in excess of our cost at a rate above 100% annually. The only way Soluna can get out of the dividend is through bankruptcy. They could offer commons stocks in leu of cash payment.

- Vizsla Silver (VZLA) Vizsla has what will be and projected by third parties to be, the largest, high grade, single location silver deposit in the world. Management is among the best. Major asset managers Fidelity and Franklin-Templeton own significant positions. Mining industry notables’ own positions – Sprott Inc as a corporation, Eric Sprott and Rick Rule personally, own shares of VZLA Silver. TipRank’s analysts’ average price for the next twelve months is $3.16.

- Mara Holdings (MARA) is the largest crypto miner in the world and the second largest public company owner of a bitcoin treasury, in the world. Only Strategy (MSTR) is a larger public owner of Bitcoin treasury in the world. Average TipRanks analysts projected price for twelve months is $23.00.

“Bitcoin is Going WAY, WAY HIGHER”: U.S. Commerce Secretary – Howard Lutnick

Published Four weeks ago – ten minutes in length.

- Invesco/Galaxy Bitcoin ETF. This ETF only holds Bitcoin.

- Hot Chili Copper (HHLKF) – hot chili has two large copper deposits it is developing to production in Northern Chili. A secret sauce that Hot Chili holds is a large-scale water desalinization project. No water from surface sources or ground can be used for mining. It takes ten years to get a permit for the desalinization of ocean water. Hot Chili has the permit and permissions to move forward. Hot Chili has already received offers to buy the desalinization that is not yet completed. Hot Chili intends to sell the desalinization plant within two years to finance its copper projects. The value of a water desalinization plant in this part of the world is above $400 million USD. The market cap on Hot Chili today is $48 million. This is an undervalued water play first and a copper play second.

- Aya Gold and Silver (AYASF) – AYA is a producing, positive cash flow, high grade, and large-scale silver deposit in Morocco. Revenue is projected to triple in the next twelve to eighteen months. The company is undervalued to the scale and grade of the deposit and in operation currently.

- Discovery Silver (DSVSF) is a large scale, low grade open pit silver deposit in Mexico. Once in operation (three to four years forward) this is projected to be a top five silver producers in the world. Final permitting from the Mexican Government is expected in Q2, 2025. Discovery recently purchased a producing gold mine in Canada. The news on January 27, 2025, was well received. The stock price advanced from about $0.45 to the current $1.20 area soon after the deal was completed.

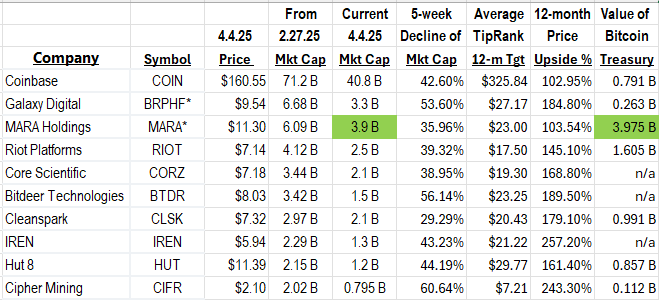

BELOW – Why MARA Holdings and Galaxy Digital:

The top ten largest publicly traded blockchain companies, as listed by CoinGecko on February 27, 2025.

The numbers and columns that follow CoinGecko’s Markert Cap numbers, have reduced by the market’s correction since 2.27.25. Addition info columns were added by LOTM.

We own Galaxy as the most diversified way to invest in Crypto/Blockchain.

We own MARA as their value in their Bitcoin treasury is about equal to MARA’s current market cap. We believe Bitcoin’s price can increase substantially, especially over the longer timeline. This gives us leverage to Bitcoin’s rise without the direct risk of Bitcoin leverage. Recent good news from MARA has been positive.

Comments in Closing: We are reducing total positions in a measured process. Proceeds from sold positions are used to reduce margin debt exposure and dollar-cost-averaging to existing selective core positions. Margin level to the value of this account is at 10% of the total account value.

We hope, by our sharing this information it provides a helpful aid to your understanding of the market and investing.

![]()