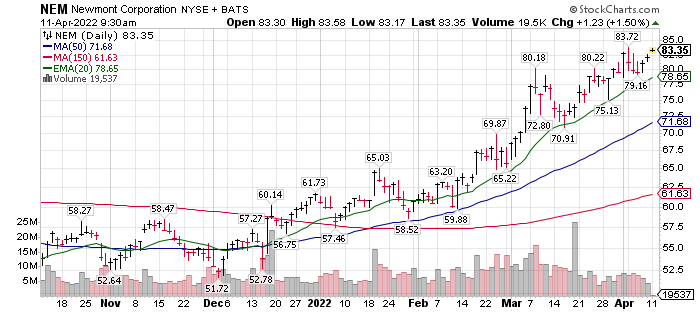

Newmont is an easy Institutional favorite. Its price is showing that it is under accumulation by Institutions shifting towards gold miners. We believe this trend will extend into smaller companies in the industry.

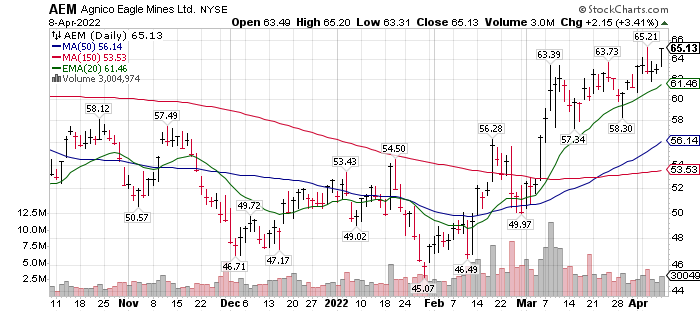

In our opinion – AEM is the Best value of the large cap miners

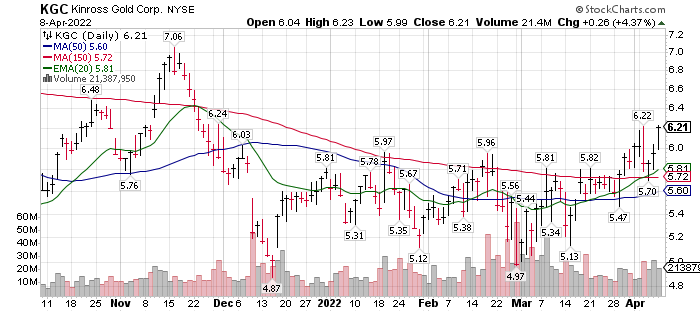

Kinross is Lagging the other big miners but now attractive to re-enter after selling its Russian property. This provides additional cash to develop its recent purchase of Great Bear. Technically and Fundamentally, the stock is coming out of the Russia concerns in good shape. Potential to catch the other top ten biggest miners in price performance. Great Bear is a great property.

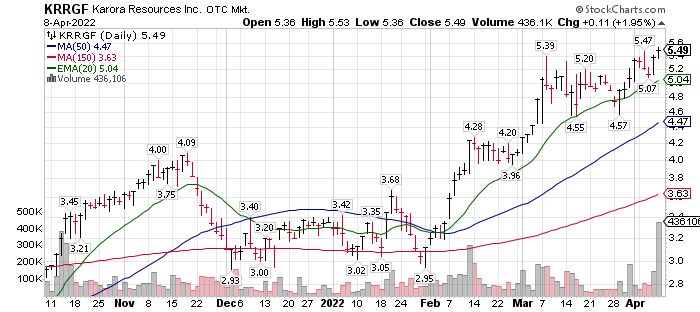

Karora: Best of the Junior Miners and LOTM’s top pick overall though we have a hold comment on the shares at this time. The stock just doubled from its Sept / October lows. Like to see some pull back before buying again. A related account still holds a significant position after scalping some profits.

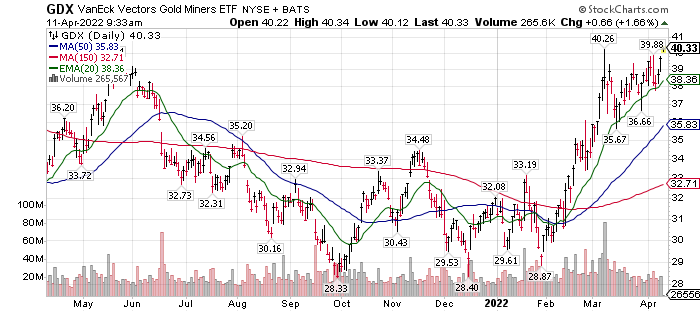

GDX, the Gold ETF – VanEck ETF holds the largest Market Cap gold mining companies. A tool for quick entry and exit.

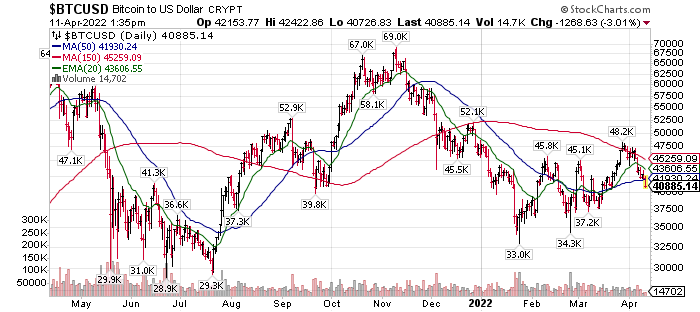

Bitcoin is not a risk-off trade, but it is highly probable Bitcoin is much higher in three years or more. LOTM believes one can accumulate slowly on weakness. Look for the next risk-on cycle for biggest gains in crypto in general. LOTM suggests a slow accumulation of crypto ideas. It is the newest aspect of the software industry with a decade and more of rapid growth.

We love the precious metals and battery metal miners for a three to five year period. We will trade 30% to 50% of positions and look to repurchase. We are active in the sector from a trading perspective. We try to stay to news flow to upgrade in sector companies as fundamental news changes.

Here is a quick list of Mining companies we currently own in different accounts. There is no reference to size of positions, but I will share that Karora is the biggest dollar position after scaling out of half of the position on different phases of the last six month rally. We are adding to multiple companies on an opportunist basis.

Typical movement in Precious Metal Miners

Gold moves before Silver

Big companies move before Small companies

Silver price moves bigger percent swing than gold price

Small miner’s price moves bigger percent than big miners.

Modify what you own to what you want to accomplish. The more you move to small and silver, the lower the liquidity and longer the time-line between movement of the stocks.

In other words, Small silver companies are the most speculative.

Big Gold is the most conservative.

All miners fit in the speculative category.

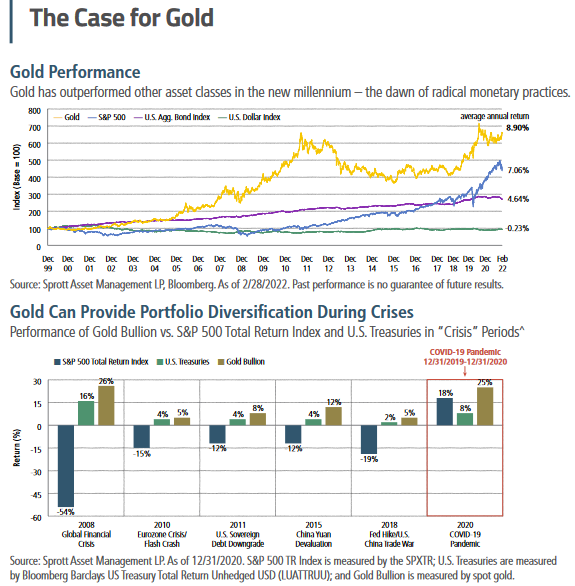

For the most conservative Risk-Off hedge using metals, Physical Gold is what you want to own.

One vehicle that trades well, is the Sprott Physical Gold Trust (PHYS) $15.42 chart linked here.

The physical gold is held at the Royal Canadian Mint, part of the Canadian Government.

Sprott Physical Gold Trust Fact sheet linked here.

LOTM has no affiliation with Sprott Physical Gold Trust

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()