LOTM: Ten Under $10 for the Double holding, Sassy Resources $0.35 is spinning out Gander gold.

One-Year Sassy Chart below in Canadian Dollars:

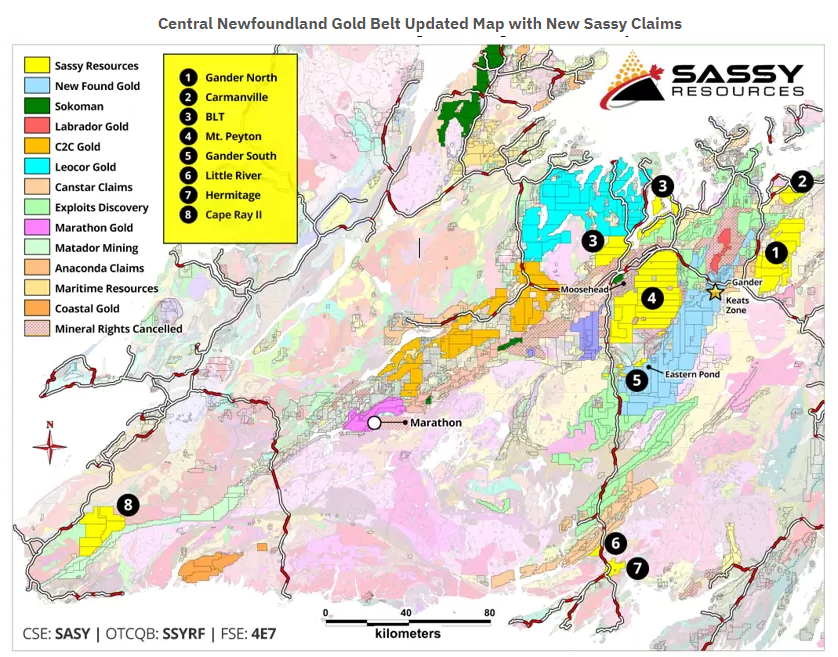

- Gander Gold holds all the mineral claims of Sassy Resources in Newfoundland, Canada.

- Newfoundland is currently the hottest gold rush area in the world for staking gold mineral rights.

- Gander Gold, subsidiary of Sassy Resources, is the largest property holder of mineral rights in Newfoundland.

What is interesting in the Press Release sections below for me is in purple. The number of share given as dividend and trading is 8.83 million shares out of a total of 71.4 million shares. This will allow (near term) for price leverage from the small number of shares trading (float). With some good fortune in actually finding gold in the core samples, this could present price leverage to the upside. Of course, negative news and this works in the opposite way. In the longer-term picture and assuming they find gold, Gander will have to do stock offerings to finance the further build out of the properties in Newfoundland. I view this as a long-term trade for a hoped for double to triple or better. Make no mistake, it is a one to two year investment project.

There are very large findings of gold in core samples in the area near where Sassy/Gander is a stakeholder. New Found Gold’s property is the original mineral find that caused the Newfoundland Gold Rush that started in May/June of 2020.

These findings, below, are the property of New Found Gold (NFGC)* $7.12. The area of strikes of gold is continually expanding.

When looking at the Grams per Ton (G/T) of gold (AU) found in the headlines below, recognize that 8 to 10 G/T is considered an excellent number.

- October 14, 2021 New Found Intercepts 61.50 g/t Au

- October 13, 2021 NEW FOUND DISCOVERS NEW HIGH – GRADE ZONE AT KEATS; INTERCEPTS 88.53 G/T AU

- September 30, 2021 NEW FOUND INTERCEPTS 64.94 G/T AU

- September 23, 2021 NEW FOUND REPORTS 1,131 G/T AU AND 568 G/T AU

- September 8, 2021 NEW FOUND INTERCEPTS 111.4 G/T AU

Eric Sprott, Canadian Billionaire, and precious metals speculator, is an owner of New Found Gold with about 25% ownership. Sprott is also a 15% owner of the Gander Gold, subsidiary of Sassy Resources. One speculation by myself, is that if Gander finds gold in core samples, Sprott will move to consolidate his holding under one company. Since New Found Gold has a billion dollar market cap, that would end up being the parent company, IMO. Accounts related to LOTM hold positions in both Sassy and New Found Gold.

This is a speculative play on my part – a potential lottery ticket, but there is no operation in either New Found or Sassy generating cash at this time. There will not be cash flow in the next few years. This is all about core samples and news flow at this time.

Partial PRESS RELEASE:

Sassy Announces Dividend Spinout of 8.83 Million Gander Gold Shares

7:55 AM ET 10/15/21 | Dow Jones

VANCOUVER, BC / ACCESSWIRE / October 15, 2021 / Sassy Resources Corporation (“Sassy” or the “Company”) (CSE:SASY)(FSE:4E7)(OTCQB:SSYRF) is pleased to announce that its Board of Directors has approved the dividend spinout distribution (the “Spinout”) to its shareholders of an aggregate of 8,833,333 common shares (the “Gander Shares”) in the Company’s wholly-owned subsidiary, Gander Gold Corporation (“Gander”). This number of Gander Shares represents the settlement of 100% of the debt outstanding between Gander and Sassy associated with the acquisition of the Company’s Newfoundland exploration properties.

The Company currently has 47,537,506 common shares (the “Sassy Shares”) issued and outstanding. Accordingly, the planned dividend distribution of 8,833,333 Gander shares would represent a ratio of one (1) Gander share for every 5.3816 Sassy shares owned by a Sassy shareholder as of the record date of February 1, 2022, or alternatively 0.1858 Gander shares for every one (1) Sassy share owned as of the record date. The final spinout ratio is subject to any changes to the Sassy share structure between the date of this announcement and the final record date for the dividend distribution, along with the approval of Gander’s imminent application to list on a Canadian stock exchange.

Sassy is in the final stages of preparing the application to list Gander on a Canadian stock exchange. Upon listing, Gander is expected to have 71,395,556 Gander Shares issued and outstanding, with nil share purchase warrants outstanding. Following execution and completion of the Spinout, Sassy will maintain ownership of 35,330,556 Gander Shares, representing approximately 49.5% ownership of Gander. Eric Sprott will beneficially own 10,666,667 Gander Shares, representing 15% ownership.

Perspective:

- Sassy has about forty-five million shares outstand. Forty-five million times the current price of Sassy ($0.42) is aboot (Canadian for “about”) $19 million market cap.

- Sassy/Gander is the largest Mineral Rights, claim holder in Newfoundland

- Newfoundland is the hottest gold rush for claims area in the world.

- The property adjacent to Sassy is New Found Gold (NFGC)* who has a US stock price of $7.12 and a market cap of $1.2 Billion.

So, my friends, if Sassy / Gander finds one tenth the amount of gold with substantially more property than New Found Gold the potential upside for Sassy / Gander is sixfold increase.

My point is Sassy is a minuscule market cap that could go up 5 to 10 fold with less success that its neighbor, New Found Gold. Think of it like neighborhood comps in Real Estate. We are buying a really low priced property next to a very high priced property in an improving neighborhood.

That’s my Speculative Play on Sassy/Gander and New Found Gold.

Consider the Map below to see where Sassy/Gander holds claims Vs where New Found Gold has its claims. The Keats Zone is a recent major core sample find by New Found Gold. Gander has property rights on both side of the Keats Zone – areas #1 & #4.

One-Year Sassy Chart below in Canadian Dollars:

You can Read, you can watch Videos, but nothing beats Personal Interaction for accelerated learning.

This game has levels of understanding that could take a lifetime of Trial and Error to learn.

Available for Coaching, Training or Mentorships

Contact LOTM For One-on-One consultations.

Rate: $150 per hour / Monthly Retainer, Lowers Rate

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()