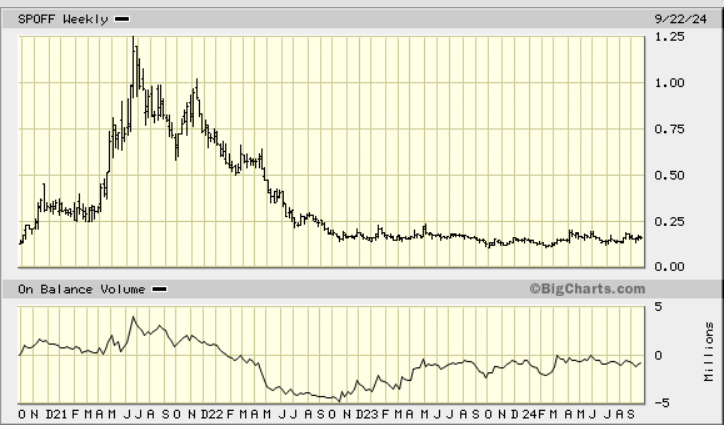

Today I want to share my thoughts on EarthLabs (SPOFF*). The share price has completed a Stage Four Chart Pattern, since its Stage three, 2020-21 bull market high around $1.20 per share. Since September of 2022 Earthlabs has been a Stage One Base building pattern. The company is very different today than what it was in the 2020 to year-end 2022.

I believe that EarthLabs is about to begin a Stage Two Chart pattern. The price rally stage. This is a speculative, and illiquid stock idea. It is a one to three-year project. In related accounts to LOTM, we have dollar-cost -averaged as well as sold higher cost shares for a tax loss. We have begun accumulation shares in EarthLabs for the following reasons.

See: Investopedia’s – Trading With Stage Analysis linked here

Why Mining Stocks & EarthLabs Now:

- The bull market has returned to the metal mining sector. It began with Central Bank buying, moved to SE Asia where the Chinese Public pushed money into gold and now the fever of a gold bull market is beginning in the USA.

- EarthLabs offer a business model related to Gold Silver Uranium and Natural resources different than harvesting the physical product. They are a Media company with royalty ownership in exploration companies. As the bull market progress this media operation could flourish through its physical and on-line magazines advertising and Event hosting business. Though small, they are or near being the largest media company in Canada focused on Natural Resource sector.

- EarthLabs has a royalty interest in Newfoundland gold rush area. This is an area developing into a large gold resource province that is strongly supported by Provincial government regulations and officials.

Once you buy EarthLabs shares, it is difficult to sell at a profit unless the share price moves from apathy to an excitement stage. It appears that we are about to enter that stage. The illiquidity is the primary reason this is a speculation. It something goes wrong at Earthlabs the exit door to sell is small to non-existent.

Note: we are buying this because of Fundamental reasons at this time, not Technical reasons.

The Average daily trading volume over the past ten days is only 42,000 shares.

Accumulate slowly with limit orders if interested!

On the other hand, Earthlabs has a decent balance sheet where assets (investment in royalty properties) exceed the current market cap.

As a project, we place a time line of two-years minimum and a minimum goal of a triple in share price $0.50 as our minimum target. If we get lucky in a gold bull market, a ten-bagger is within a reasonable conversation.

Resources related to EarthLabs for supporting our theme for EarthLabs include:

Company web site:

YouTube Channels:

- CEO.CA https://earthlabs.com/ceo-ca-technologies/ an email / community focused website on the natural resource industry.

- YouTube Channel – https://www.youtube.com/@ceocafilm

- EarthLabs CrashLabs Podcasts

https://www.youtube.com/playlist?list=PLsD-m-bMQxKa0SMdgo0xmSYOmtQswrsDY

Database Services for Mining Professionals:

- powerful online GIS interactive mapping interface that spatially links and displays data from DigiGeoMaps and DigiGeoData.

Magazine channels:

- Northern Miner https://www.northernminer.com/

- Mining.com https://www.mining.com/

- Canadian Mining Journal (CMJ) https://www.canadianminingjournal.com/

Annual Events:

- Canadian Mining Symposium

- Mining Legends Speaker series

- Global Mining Symposium

If you only follow one of the links posted choose the one below on the most recent earnings release.

Earthlabs is still losing money on an operating basis. That is the downside. Most recent earnings report linked here – https://www.newsfilecorp.com/release/219269/EarthLabs-Reports-Results-For-The-Second-Quarter-of-2024

Check out the various media channels Earthlink offers. Do your own fact checking to see if you agree with our conclusion. It seems to me that EarthLabs is a young Media and Royalty growth company in a cyclical industry.

![]()