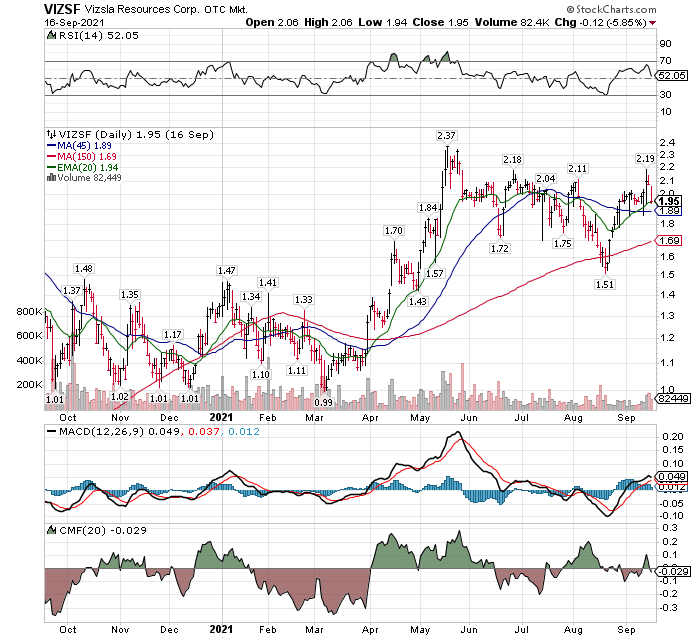

- Vizsla Silver (VIZSF)*

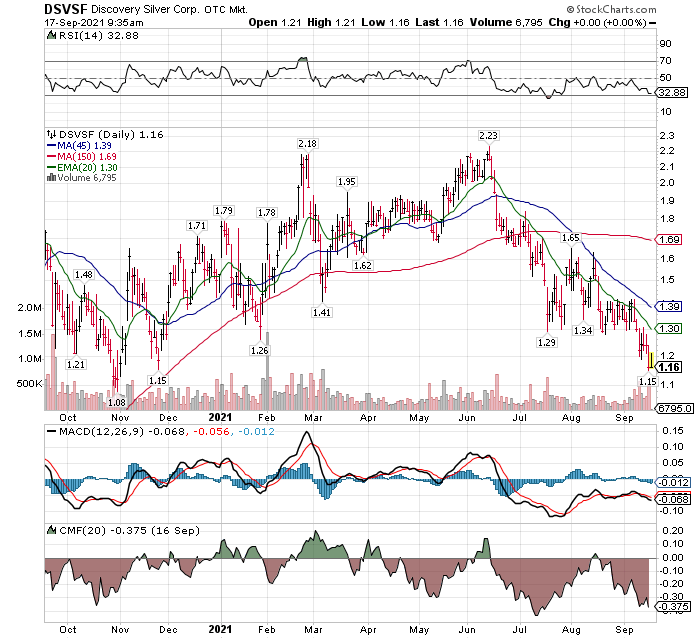

- Discover Silver (DSVSF)*

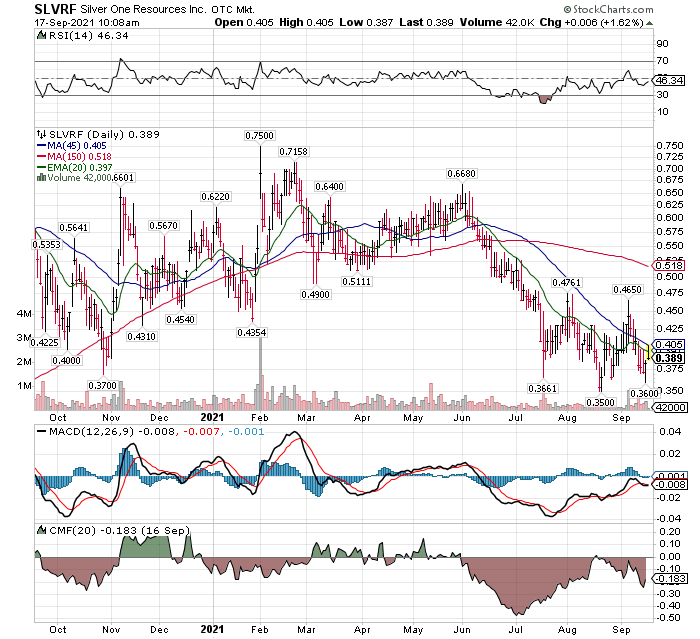

- Silver One (SLVRF)*

Technical analysis & update for three Silver Resource companies in the LOTM: Ten Under $10 for the Double Portfolio.

Vizsla Silver (VIZSF)*

Technically, systems are a go for Vizsla Silver. There is an event happening on Monday Sept 20 than could be a buy the rumor sell the news event. I suspect it is not a problem. Vizsla will spin out its British Columbia, Canada, Copper business into a separate company on Monday Sept 20. The Vizsla share price will be adjusted for the spinout. Holder of Vizsla will receive the Vizsla Copper in their accounts. So, post Friday Sept 17, add the two prices together for the comps to your original cost in Vizsla.

The recent consolidation range for Vizsla is between $2.10 for high price and $1.50 for a low price. Fundamentally, Vizsla is building a world class district. It is about 50 miles east of Mazatlán, Mexico. The grades are larger than normal and the area they control is extensive. VIZSF is still an Exploration & Development stage company. In this regard Vizsla in building something special. The stock performance over the last year shows the recognition of their progress. Price weakness towards the 150-day moving average is consider a buying opportunity, however, unless there is a macro selling event, I do not expect a big drop like we saw in Aug 2021. Accumulate now and going forward on an opportunist basis. This is a fundamentally based comment. Vizsla is a big deal in the making. The market cap is about $254 million. Management team is experienced in the Precious Metal business. If there are surprises on the negative side, it is likely to come from issues with the Mexican government wanting higher taxes, royalties or other demands. Mexico is not the friendly mining jurisdiction it once was. Technically, we expect further consolidation with an eventual break-out higher as the likely direction. The reserves for Vizsla will continue to expand. Core drilling results are very positive and not yet included in reserves. They are well funded with an Enterprise Value (EV) of about $127 million. EV is Market Cap plus Debt minus Cash. Over-all we consider Vizsla, an accumulate shares during this consolidation period with an expected break-out upwards.

Discovery Silver ((DSVSF)*

Silver miners in general, are greatly discounted to the price of physical silver. It is not shown any more dramatically than in the price of Discovery Silver. I have no explanation on the decline in Discovery from $2.30 in June to its current price of $1.16 today. Nothing technically, is showing positive in the chart. On an over-sold basis and valuation basis, we consider Discovery Silver an aggressive buy. Discovery Silver is a world class silver resource. The news flow has been positive. It is possible the price is discounting a fund raise in the near future – however they are well funded now. Currently the company has about C$76.7 million in cash equivalents. Here is a link to company news flow. Ownership is strong with Eric Sprott owning about 19.5% of Discovery Silver. Discovery Silver is still about four to five years away from production. As such it is a well-funded, silver in the ground asset, that will trade emotionally with changes in physical silver price and investor attitude towards precious metals in general and silver in particular. Based on the current price and asset reserves, LOTM believe the shares are over-sold and an aggressive buy on a fundamental basis.

Silver One (SLVRF)*

Silver One is a similar story to Discovery Silver. Silver assets in the ground and claims “to be proven”. They are moving to process a heap-leach asset in Nevada now. Cash will flow sooner at Silver One than at either Vizsla or Discovery Silver. We are not as excited about the heap leach project as we are about the people and the claims they hold for future reserve upgrades. Eric Sprott is a significant owner of Silver One as is Keith Neumeyer founder of First Majestic Silver (AG) and SSR Mining (SSRM) . These are three of the best groups in the mining business. Link to the March 2021 Fact Sheet. We view Silver One as silver in the ground that has a high probability for positive surprise in reserve expansion. No reason to buy Silver One based on technical reasons. Over-sold, a low valuation (Mkt Cap of $82 million), strong ownership indicates future finance sources, Nevada and Arizona jurisdictions are strong jurisdictions. Cheap and over-sold, we consider Silver One an aggressive buy for a two year time horizon.

Why Own Silver in the Ground?

Ok I have mentioned “silver in the ground” a number of times and it applies to all three of these companies. Why do I say this? Because the “going electric” movement, unstoppable at this time, will require a lot of silver. I can’t give you a number – no one knows. But what we do know, is that demand for silver, has out stripped supply for the last seven years. Silver has nearly doubled from the $13 area in March of 2020 to $22 today. That is pretty good performance, yet silver miners get little respect. That is opportunity. Yes, I am early in accumulating a silver position. Mass adoption of electric cars is still two to three years in the future. Electric vehicles will require a lot of silver. The Space Race, (related to military reasons) is bigger deal than given credit, requires gold and silver for electronics and non-corrosive exposure to space. Solar panels and electronics use will continue to grow as will demand silver as an enabler. As Keith Neumeyer says in one of his interviews, there will come a time when industrial users of silver simply buy the majority of silver miners to assure themselves a supply of silver. Those that don’t own silver mines will pay much higher prices. Millions to be made here my friends.

The final reason and most important reason to own silver in the ground is that Exploration & Development companies increase multiples of the increase in physical silver and Silver mine producers. Millions to be made here my friends.

Industry Experts on Silver:

- Will Green Infrastructure Spur Silver Demand? Forbes Aug 13, 2021

- Here’s How Silver Will Move Like Bitcoin | Michael Oliver Premiered Sep 11, 2021 – hosted by Liberty & Finance

Michael Oliver writes an excellent newsletter with a unique view on discovering trends in different markets. He is very good and survived the test of time. This video (29 minutes) discusses why Michael thinks a breakout on gold but especially silver is about to happen. Michael’s first target for silver is $50, the all-time high price.

- Keith Neumeyer Interview with Jake Ducey, Sept 8, 2021

Silver is NOT What You Think – discussion on supply and demand for silver. Manufacturing Industry will buy silver miners and silver in the ground as future resources.

- Silver Price Will 10X Once This happens No Matter What. A Fait Currency perspective on Silver

Egon Von Greyerz, Financial Ally Sept 15, 2021.

- Francis Hunt: Silver Will be The Shooting Star – A technical perspective on Gold and Silver

Palisades Gold Radio – Sept 17, 2021

In Summary – LOTM is not buying these resources for 20% or 50% profits – we are buying these resources for 500% to 1,000% potential profits. To do this we have to be early or buy when no one wants them. We feel this is an excellent time to be doing this.

Available for Coaching, Training or Mentorships

Contact LOTM For One-on-One consultations.

Rate: $150 per hour / Monthly Retainer, Lowers Rate

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()