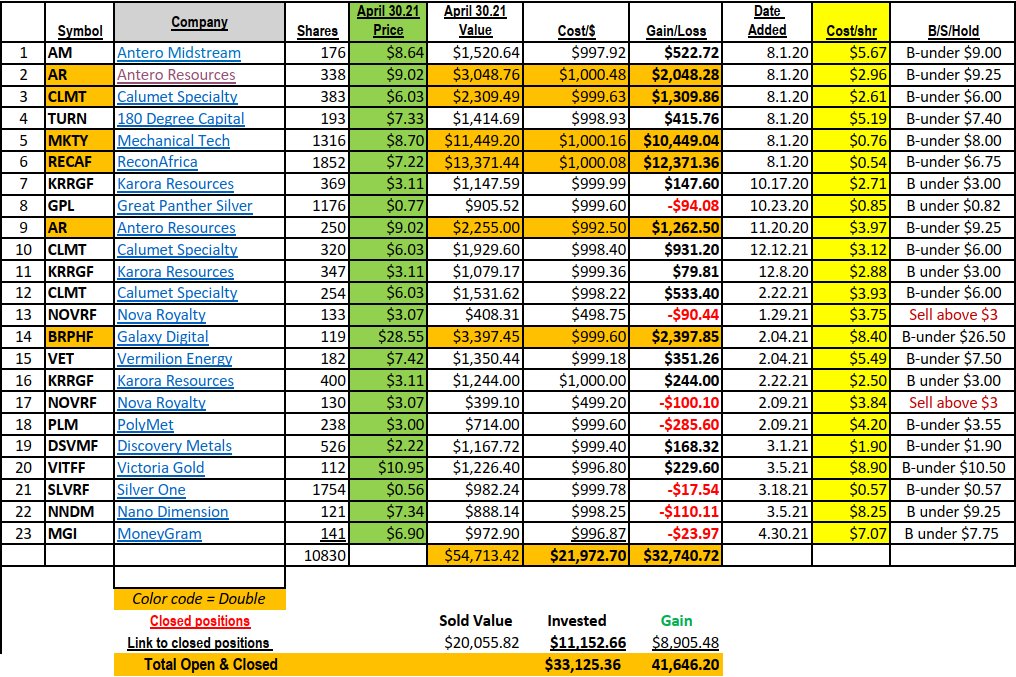

New Number One Gainer since we conceived this Ten Under $10 for the Double list is – Recon Africa

We have a new leader for biggest gainer since we started this project on August 1, 2020.

- Recon Africa is up from $1000 invested to a valuation slightly above $13,000. This is not because MKTY has not done well.

- MKTY is still up at $11,000 from $1,000 beginning point since August 2020. It is down from its high of $18.00 per share from our cost of $0.54. At its high of $18, the 1316 shares of MKTY had a valuation of $23,688. Not a bad pop for $1,000 in seven months. Annualize that number – Tesla, Amazon, Apple, haha. I know its not a forever number…. Just having some fun.

All is good in related accounts. We did harvest some profits from MKTY and reinvested in other positions.

- Karora Resources is now our largest share position in related accounts thanks to the success of MKTY. We still hold half the original position size of MKTY in the related accounts. Over the next 12 months forward we believe in MKTY’s potential for a double from $8.70 close on Friday. Karora is a safer valuation today, however. Karora has extensive holdings in Australian Gold and Nickel properties. At roughly 5 times trailing earnings and now in expansion mode, Karora has potential to double or more in the next year as well.

Enough chit chat. This week we added MoneyGram to the portfolio as we mentioned Friday. Please refer back to our emails or check our comment online for MoneyGram.

Next week we will swap out Nova Resources for Sandstorm. Both are mining royalty companies. Sandstorm is bigger while Nova is a very nice company but also very young. We believe the prices of industrial metals like silver, copper, nickel & cobalt will continue to rise. We want to own companies for royalty income that have established contracts of greater size than Nova has as a young company has.

It has been an amazing market. Galaxy Digital, up 3X in three months, seems like a piker vs Recon Africa and Mech Tech. In case your new to the market, this is not the norm, but it sure is fun when it happens! Knock on wood, please.

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()