Our focus remains intact. Commodities and Blockchain / Crypto is our “hunting” ground for Ideas. We are beginning to look into some of Cathie Wood of ARK ETF Family of funds for fallen momentum stocks. The addition of Nano Dimensions, (NNDM) is from her list.

Don’t believe for a second Ms. Wood has lost her mojo. Her style of investing is the same as ours. The targets that she hunts are different than ours at the moment. Ms Wood is “hunting” futuristic companies. Whereas we are currently on the “hunt” for value and scarcity of supply type companies. The market makes us all humble, and we will all go through the market’s lessons.

Ms. Wood and LOTM both manage risk the same way. We dollar-cost-average our way through with core positions where we believe management has an advantage and the company has the product to survive and prosper. We tax-manage the position. Meaning we sell our higher cost positions on the next rally phase.

When we get impulsive and a bit afraid of missing a move -and buy, we will use stop losses. But stop losses as a normal risk management tool, is not part of our normal risk management strategy. Ms. Woods will DOWN-SIZE the positions in her portfolio to ADD-TO-THE core positions she has the highest conviction of during a market sell off. We do the same. This current correction is impacting her area of focus more than ours at the moment. Her research is excellent so we will borrow some of her ideas during her tougher time to be ready for the recovery of the momentum stocks ideas she uses.

Consider this notice that we will add some names that are different from our theme as stated.

We believe MKTY shares, under $8, is too cheap. Earnings are out very soon so how the shares react to the news will say a lot about the current trend.

Galaxy Digital recent news did little for the shares. We can say the $30.00 level is strong resistance. We like the position as a core holding so will continue to accumulate Galaxy as one of our top five core positions. What Mike Novogratz is doing at Galaxy is simply amazing.

Gold Silver and its miners along with copper and nickel are core positions though we do dance around within the group from time to time. Silver in particular could see a supply crunch that double or triples the physical silver price. Silver miner price would be amplified from the price move on physical silver. In related accounts, we hold Silver exploration companies as well as the biggest in the industry. This theme for the metals should run three to eight years so lots of time, lots of opportunities.

Energy in whatever form will be in demand with a covid-19 recovery. We prefer Nat Gas, but oil is fine as well. Nat Gas is clean burning and has a high demand from SE Asia for Nat Gas conversion to Liquified Nat Gas (LNG). It is also a substitute for Solar and Wind Power.

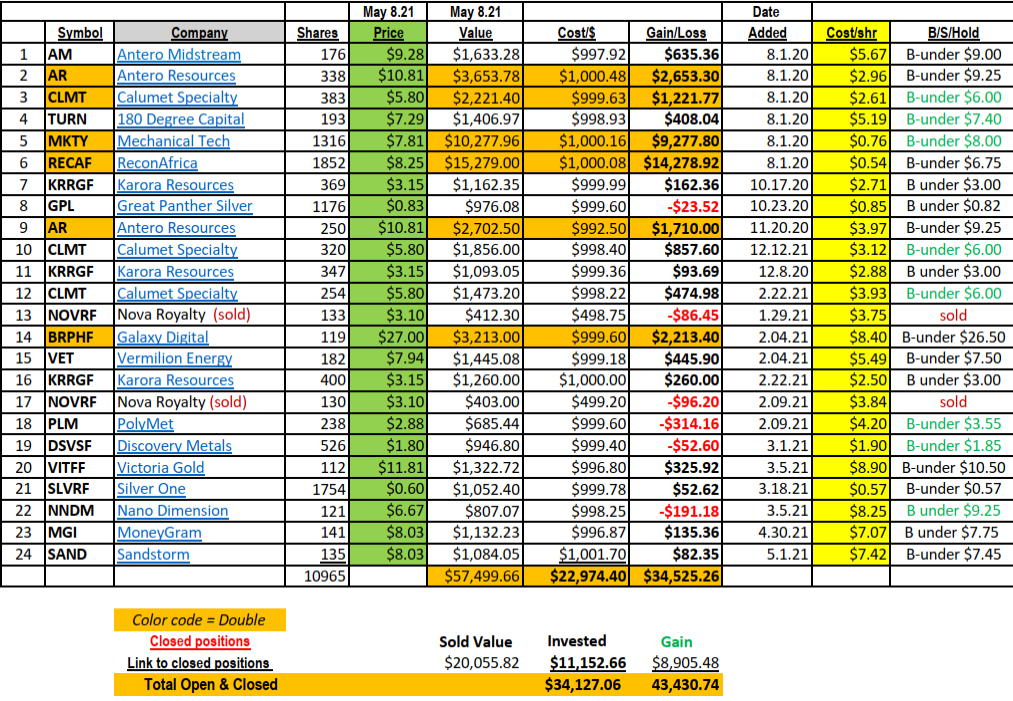

In the chart above, Antero Resources, Vermillion Energy, ReconAfrica and Antero Midstream are oil and Gas plays we like.

Not mention in the chart above, but the largest Nat Gas company in the USA, EQT (symbol EQT) is breaking out of resistance. It is and a name we own in related accounts and would buy more of at the current price of $20.69. we do not have a target price. It is the industry leader. We suggest accumulating on weakness. 50% would be our stated goal but check back for comment when it gets there. This was a $55 stock back in 2015 and it is a much stronger company today than it was then.

Have a great day and may good fortune shine on you!

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()