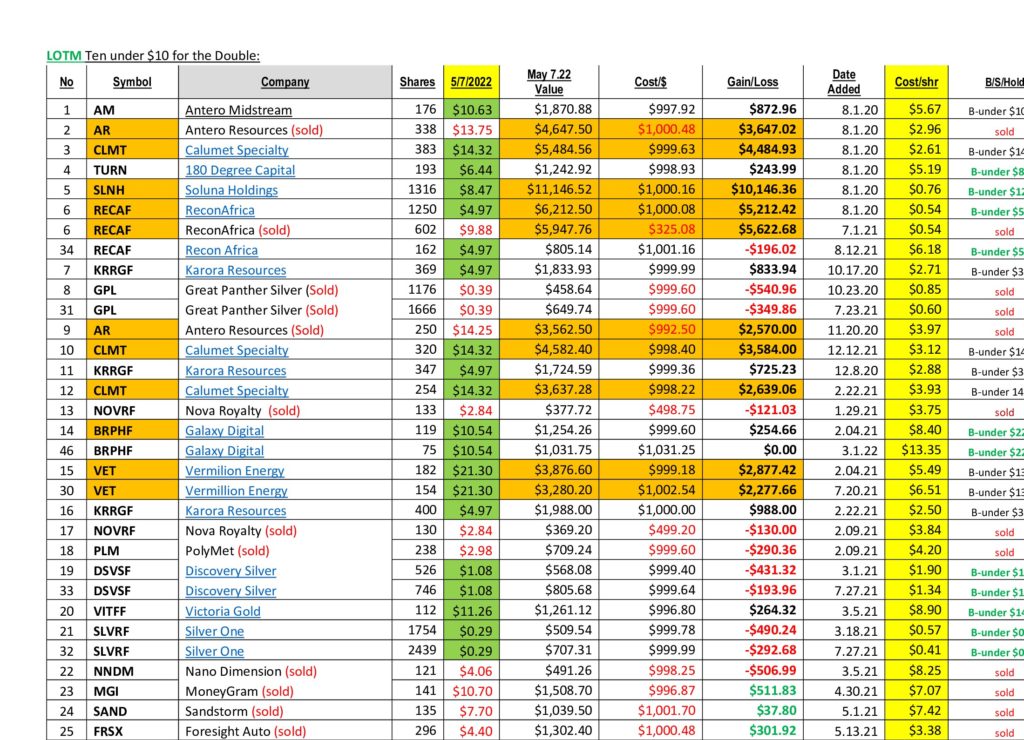

Comments on some of the positions in the Graphic above:

- Anteros Midstream (AM):

This pipeline is in excellent position as a dividend payer. We anticipate the dividend to increase in time, but not soon, but not soon relative to todays writing. Strong hold buy on weakness for the dividend payout of 8.65%

- Calumet (CLMT)

We like CLMT very much for a longer term holding. We do believe there is an other double as potential from todays price. The shares were downgrades by Zacks on Friday from buy to a hold. We have three units (an over-weight for LOTM). We would buy more shares on weakness below the 12.00 area should they get there. If you are concerned about the market lightening up is entirely normal. We do believe this will be an excellent dividend grower over the next three to five years if that is a consideration.

- 180 Degree (TURN)

We like TURN even though it has not performed. It is unlikely to move higher until the trend in the market turns higher. I believe you could sell and return to TURN without missing much upside. If you have high cash levels, TURN is a micro-cap closed-end value fund, so company risk is very small. It is a good position to buy or add to if the market goes into a complete and utter panic selling mode. Not saying the market will do that, Just that if it does, TURN would be a no brainer, low-risk way to enter or “add to” in that environment.

- Soluna Holdings (SLNH)

It is too cheap if looking out six to eighteen months. Buy on current and future weakness would be our opinion.

- Recon Africa (RECAF)

Not much is going to happen for a couple of years. The price still hold very big potential, but the next few years will be exploratory drilling period. The stock’s movement will be dependent on drill results and the price of oil. Buy below $4.50 and sell above $5.80 for activity while keeping a core position?

- Karora Resources (KRRGF)

Still “our” number one pick in the junior Gold and now Nickel miners – perhaps of all miners. Buy below $5.00 with no stop loss – just buy more as it drops.

- Galaxy Digital (BRPHF)

Love the company, think it is too cheap. A must own if you believe in Blockchain / Crypto as a new industry. Needs a couple events to happen, but when they do the stock could be a rocket ship style lift-off.

- Vermilion Energy (VET)

The chart pattern is a bit toppy, but the valuation says it is too cheap and the forward numbers look outstanding with share buybacks and dividend increases.

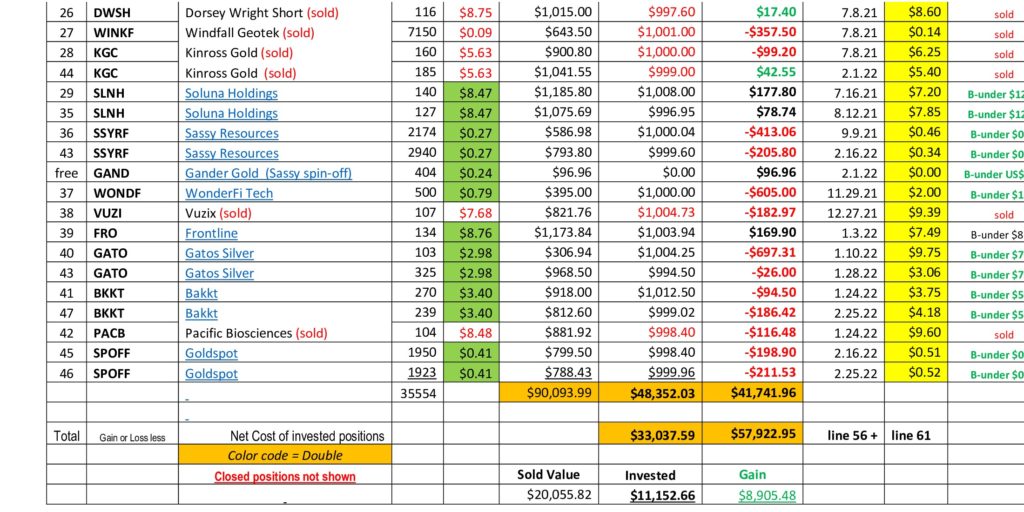

- Mining Positions – Discovery Silver (DSVSF) / Silver One (SLVRF) / Sassy Resources (SSYRF) / Gander Gold (GAND.CA) / Gatos Silver (GATO) / Goldspot Discoveries (SPOFF)

I haven a “no fear” attitude on these positions. Metals in the ground and we are in a commodity decade. The price of materials and minerals of all kinds can be expected to rise. We have many tiny companies because it is hard to pick specific winners in this category. These are all well positioned to be three to five fold movers. The lower the price the more I will try to buy.

- Wonderfi (WONDF)

Excellent leadership in the ownership and board/advisor positions. A company that will rise and fall with DeFi/Crypto/Blockchain. Early stage company that we suggest adding to slowly on weakness like now.

- Bakkt (BKKT)

What a tripper! Public offering at $8.00 in October – $50 bucks in one month and now under $4.00. No negative or positive news from the company. Just buy it and don’t worry about it. 65% owned by Intercontinental Exchange (ICE), owners of major stock exchanges like the NYSE and clearing houses around the globe. Their distribution partners to the banking industry are two of the biggest and most respected – MasterCard (MA) and Fiserv (FISV).

- Frontline (FRO)

One of the major oil tanker companies in the world. Supply-lines / pipeline are disrupted. FRO should do well for years. One of the newest fleets in the business. Known to pay excellent dividends in good times and go to no dividends in hard times. We expect at least two to three good earnings years ahead.

- Tomorrow winners will come from todays depressed prices. Don’t let near-term performance get to you. Consolidate share positions to your highest conviction holdings. Be absolutely sure they can withstand any hurricane the market throws at you. If you have free cash flows, add to your positions in a orderly way on weakness. The key is to believe in your management (the past), the companies financials (the present) and future business prospects.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()