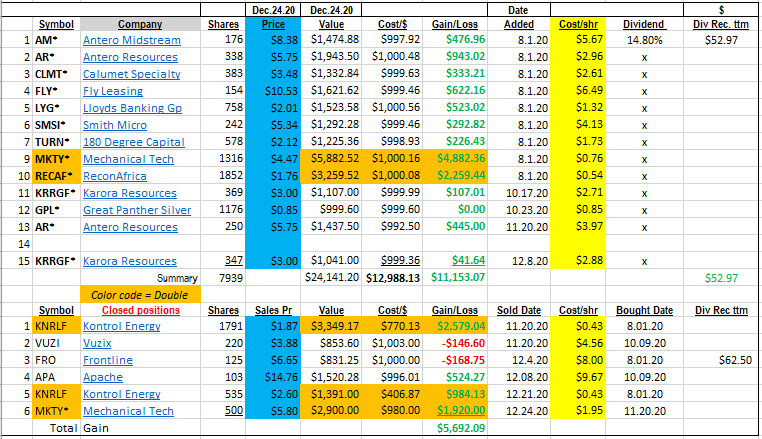

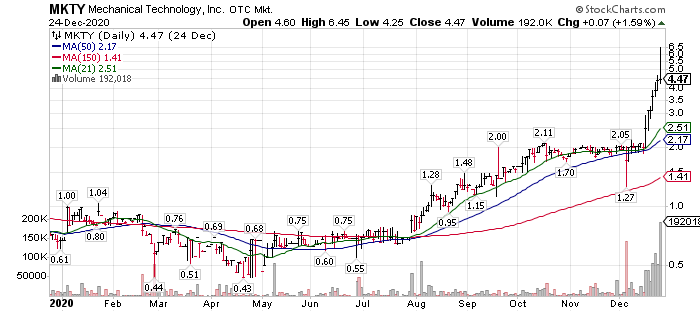

We Sold part of the MKTY Position on Dec 24:

- In our online TEN Under $10, we sold the second block of 500 shares that we purchased in MKTY at $1.98. We announced this Thursday before we saw the news story on MKTY’s subsidiary, EcoChain. We got very lucky. Instead of getting the double we expected we ended up selling into the reaction to the December 23 announcement and ended up with a near triple. The sale was at $5.80 a share. We still have the bigger position of 1316 shares added at $0.76 in August. Link to today’s letter to shareholders.

We would buy MKTY back in the near future at a price under $4.00. We think the news is great!

Best Ideas for Buying:

- Calumet: Buy on this pullback – If the stock is at or under $3.50, we will add a second lot on Monday. We continue to believe a partial company sale will happen in 2021 and it is a positive catalyst.

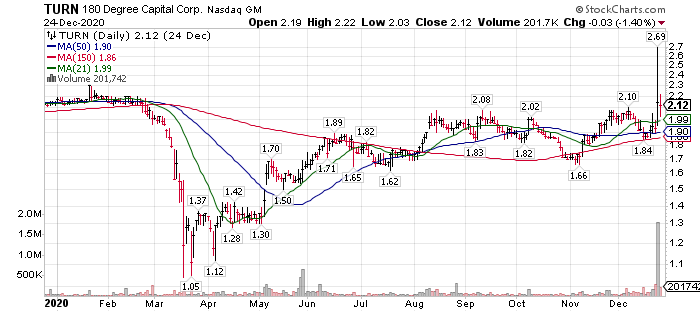

- 180 Degree Capital is doing a reverse share split and buying back shares in the Market to close the spread between the NAV and the stock price. We applaud managements actions. We will consider adding a second lot to TURN in the holdings above. Link to Management’s plan. Today’s investment money flows are buying Commodity related, Small Cap stocks and Value stocks. TURN is a portfolio of small cap & undervalued companies. We believe 2021 could be a very good year for TURN stockholders with modest risk of ownership. Management at TURN is an activist investor in its own portfolio companies and now is turning this same activism onto its own stock. Oorah!

- Sectors we like that we might choose new holdings from are Miners, Oil & Gas & Insurance/Finance related companies. We are on the hunt for new ideas.

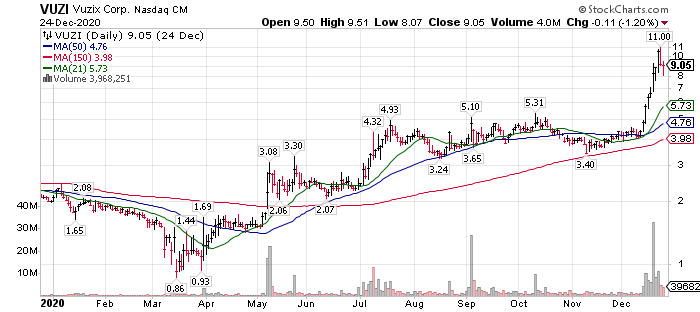

A Double Missed in Vuzix (VUZI)*

- We added VUZI in early October at $4.56 after seeing a continual stream of trials for their product signed. It seemed like there were three a week for a while. After the third quarter earnings report, we sold the shares when there was little growth in revenue Vs what we expected. It is a habit of mine to be early in a stock with my expectations Vs when a stock moves so in this case, I thought I had time to wait and watch when the shares did not react to the Q3 report. I was wrong. In mid-December, the continual flow of news caught someone’s attention and the shares popped to a high of $11. Oh well, can’t catch em all.

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()

SIRC OTC is the next rock star