- KRRGF: (Karora)* $3.15 – Our favorite Gold / Nickel company.

- KGC: (Kinross Gold) $6.38 – An Excellent Value – Too Cheap

Karora Resources:

On Monday, June 28, Karora will release their growth plans extending over the next two to three years. From the tone of the interview, it is safe to say that Karora is projecting a double in revenue over the next two to three years. The price of Gold is a factor in that revenue growth projection. If gold rises in price the goal is easier than if gold falls in price. The grams per ton harvested, is expected to grow starting in Q3 2021. That also helps revenue. In addition, Karora has been positioning properties to expand production in a number of different producing areas.

Karora was interviewed on June 19 by CRUX Investor.

Karora Resources (KRRGF) – Setting the Stage to be a Monster in 2022

I would be very surprised to see Karora fall below $3.00 before the growth initiative is released. If it does, we feel it is a very good buy-in price. I am not afraid of this company. Balance sheet is strong – revenue, earnings and cash flows are strong and growing stronger and management is excellent. Our goal from the $2.70 area has been a double in price. As the plan is announced and executed, we are raising our two year price target to the $6.00 to $9.00 area. Karora is trading at about 6 time trailing earnings. We believe the market will increase the valuation of Karora’s P/E ratio to a ten number in combination with a doubling of earnings over the next two to three years. Stating that, it leaves room for Karora to hit above $10. There are multiple variables involved so we’ll keep our price target on the modest side of want we actually are thinking.

We consider Karora Resources a buy at the current price. Fundamentally, the company had a great year in 2021 generating more than $80 million in cash (shares outstanding are 147 million). It is not taking much of a risk to say this story is just getting started. After all, 2020 was Karora’s first full year of production! It is a core position for LOTM related accounts.

Link to current analyst’s price targets on Karora Resources.

KINROSS GOLD:

Kinross Gold Corporation is a Canadian-based gold and silver mining company founded in 1993 and headquartered in Toronto, Ontario, Canada. Kinross currently operates eight active gold mines and was ranked fifth of the “10 Top Gold-mining Companies” of 2019 by Investing News. Link to statement

Technical Observation:

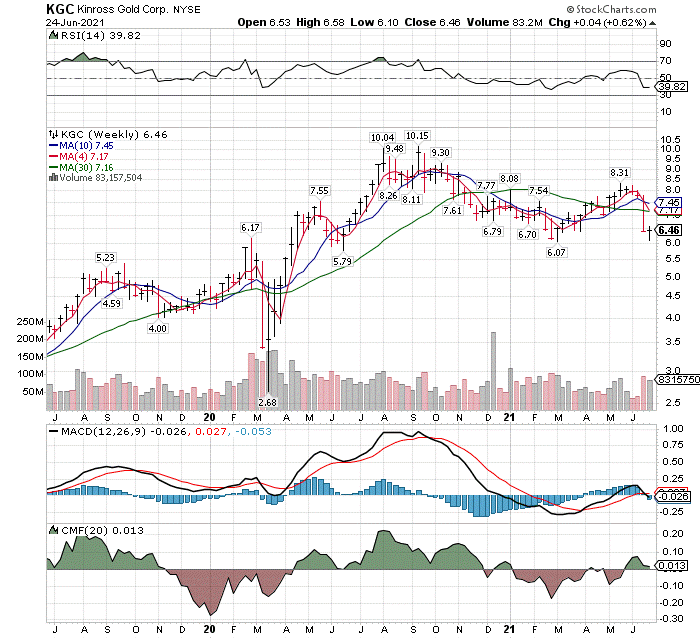

The Chart above is a monthly chart.

- Kinross has a high probability, monthly, cup and handle chart pattern.

- The share price is now in a stage two chart pattern.

- The $6.00 area is the lip of the cup. The average target price is about $9.60 from nine analysts with a high target of $11.50.

Fundamental View:

With a P/E ratio between 6 and 7, certainly there is room for the P/E ratio to expand with a risk off crisis or rising gold prices. The infrastructure bill in the USA was approved today. This will require more money printing to pay for it.

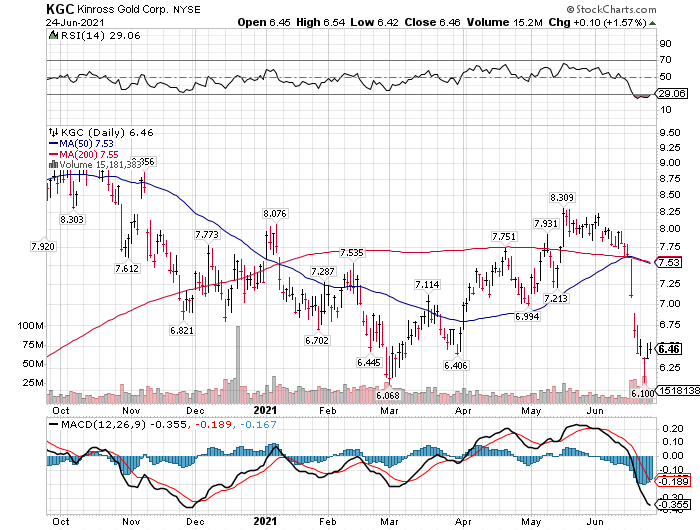

Nine month daily chart below:

LOTM believes the stock is over-sold on the daily chart. Eight dollars is the first target.

Weekly chart below.

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()