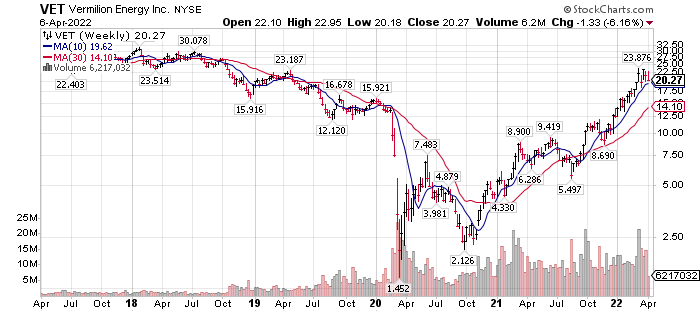

Technical call to be ready to buy the dip if the shares retreat towards $18.00

Vermillion (VET)* $20.36 appears to be entering a two to three month correction. This company is very inexpensive on a cash flow basis. Cash flows are in the 2 to 4 times area for 2022 and 2023 – depending on oil and gas prices. Two recent small acquisitions will add to cash flows in the one to four year time line. The future looks very good for vet. Producing properties in the North Sea and eastern Europe will allow VET to capture the higher energy prices brought on by the Russian / Ukraine conflict in the EU.

This is an alert that should VET drop below its 50-day moving average trigger additional reactionary and technical selling. A price, plus or minus the $18.00 area, is viewed as an attractive buy-in area. The dividend today is small. About

- Vermilion Energy is currently sporting a Zacks Rank of #1 (Strong Buy).

- Vermilion Energy: Dividends Returning In 2022, 5% To 10% Yield – Oct. 16, 2021, Seeking Alpha article projecting much higher dividend coming in ’22 & 2023. Management has already mentioned that besides paying down debt, they anticipate raising the dividend, perhaps pay a special dividend and share buy-back program as ways to get money back to shareholders.

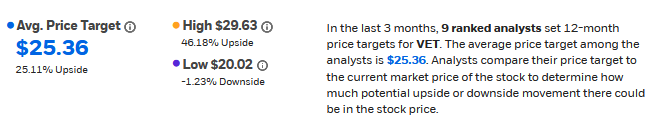

TipRanks comment

The Stock Market is beginning to price in a recession. Risk on assets are being dumped. We believe Vermillion is immune from the recession. People will want to heat their homes recession or no recession. There is a tight supply in the EU where Vermillion has operation. That is LOTM’s guess as to the drop in Vermilion’s price. Prices might come down for Oil, but Nat Gas is more localized. Prices for Nat Gas in the USA will likely rise as well as higher prices from LNG cause Nat Gas in the USA to be converted to LNG and sold into higher prices abroad.

The biggest risk in owning Nat Gas (and Oil) is from governments issuing an excess profits tax on fossil fuels. This is a real risk. Not to the company’s survival, but to potential dividends or returns to shareholders. The number one goal of the current administration (stated by them – USA) is climate change. Canada is in the climate battle as well. Part of the fight for the climate is to get rid of the fossil fuel industry. In the mean time higher prices for energy is simple a cost of climate change. It is a tough statement, but life can be very real at times and does not always go in our favor.

Multi-year chart of Vermilion:

Accumulate at prices below $18.00 should they be available.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()