It appears to our chart reading eyes, that blockchain companies and crypto coins are now in a basing chart pattern. We suggest adding to or initiating positions in a number of positions to participate in this sector, at this time.

Names we own, like or have mentioned in this area include.

- COINS: Bitcoin – Ethereum – PolkaDot

- Galaxy Digital (BRPHF)*

- Mechanical Tech (MKTY)* $7.68

- Grayscale Bitcoin (GBTC) $31.10

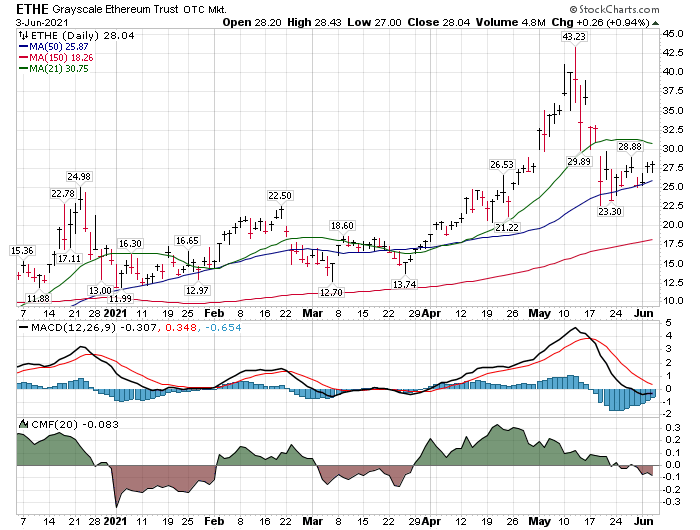

- Grayscale Ethereum Trust (ETHE)* $27.78

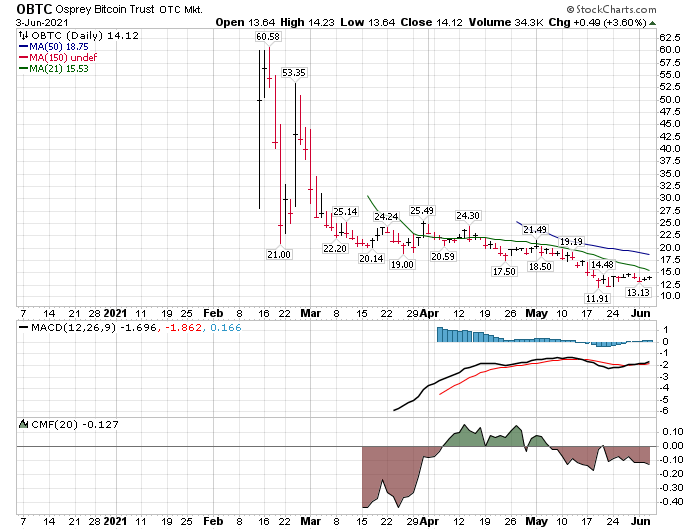

- Osprey Bitcoin Trust (OBTC)* $13.63

- Amplify Transformational Data ETF (BLOK) $46.81

- ARK Next Generation ETF (ARKW) $138.49

Thursday, related accounts added shares of Osprey and Grayscale Ethereum to accounts.

OBTC – MACD has a positive cross-over. Still waiting for price to cross above MA’s.

We are early in this technical call. We suggest “staging in” as support levels hold, and prices then work higher. A basket of names is better than one position but the sector trades as a unit, so money coming in will raise all boats to some degree.

Fundamentally, we believe in the Blockchain / Crypto movement. We believe investors have to have some exposure to the industry just as we believe investors should have exposure to the energy sector (pay attention to nuclear) and precious the metals sector.

ETHE – support at 50-day MA has held so far. Appears MACD will have a positive crossover next week if the price holds the $25.00 area.

We are taking a scale in approach of a minimum of three equal dollar purchases over the next few weeks. This week we did the first purchase. Knowing myself over the decades of investing, I am usually early to buy and early to sell. By staging in and staging out in three units each way, I moderate my own behavior. If I use a stop loss, it is on the average cost after three equal dollar purchases. I have found this approach to managing my own emotional tendencies and managing the position highly effective.

Take a moment and review the charts of the names above. Price crossing moving averages is a good indicator that a stock is emerging from Stage one basing pattern. MACD cross-over is effective for shorter-term trading as a buy-in trigger or sell trigger. As mentioned, – I am early on this call but also comfortable in doing so due to the volatility nature of Crypto. The moves are so explosive that trying to pin-point the exact buy-in or sell-price is a fruitless waste of time, money and energy.

We could hear news of a household names who bought the dip in crypto. Cathie Wood from ARK ETF’s is one name in this camp we know is buying. ARKW above, is one of her etfs.

There are rumors that Elon Musk was a buyer on the Bitcoin drop near $30,000. Rumors are rumors – let’s see. Interesting times.

All things equal, LOTM is a longer-term accumulator of digital assets and blockchain companies.

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()