Written for subscribers of LOTM Daily Notes, Dec 28.

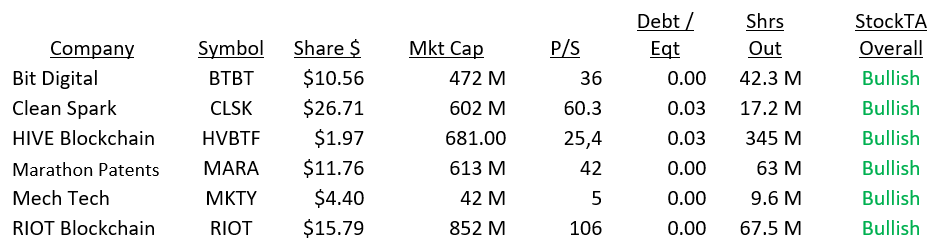

Below are some general comps of the more popular small cap crypto miners.

Top Picks from above:

- #1 MKTY for a catch up appreciation potential to peer group

- #2 Riot Blockchain for the established leading role of small-cap crypto miners

- #3 Clean Spark for capital structure and strong core business in addition to crypto mining.

I would like to draw your attention to valuation metrics of the companies above as it relates to MKTY

- Market Cap: MKTY is lagging the rest by more than ten-fold and closer to 15-fold.

- P/S: Price to Sales – MKTY is still a value Vs the peer group.

- Debt/ Eqt: Financially they are debt – free or have low debt levels

- Shrs Out: MKTY has by far the fewest shares outstanding. This is price leverage without borrowed money.

MKTY needs event catalysts along with good PR news flow presenting these catalyst events to attract more attention. Not many know the story yet. It is my projection, from what I know about Mechanical Technology, that you will see catalyst events. A quick review of the companies share holder letter Dec 23rd gives a look at MKTY’s 2021 goals. Shareholder letter linked here. I don’t see MKTY meeting its goals without a secondary offering. Wall Street would love to do the deal as it should be an easy placement. I would expect a secondary in late Q1 or Q2 2021.

In my humble opinion, a secondary stock offering would be the best news we could get for MKTY. The market is hungry for new ideas and crypto mining is hot. It will likely never be hotter than it is now. It is the new kid on the block. Imagination and greed are strong. A secondary would be the best PR exposure the company could get at this moment.

Accounts related to this writer have a position in MKTY and may buy or sell at any time. We are active in the market in multiple companies and industry sectors. Our top sectors at this time are crypto currency related, Commodities, especially miners and oil & gas.

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()