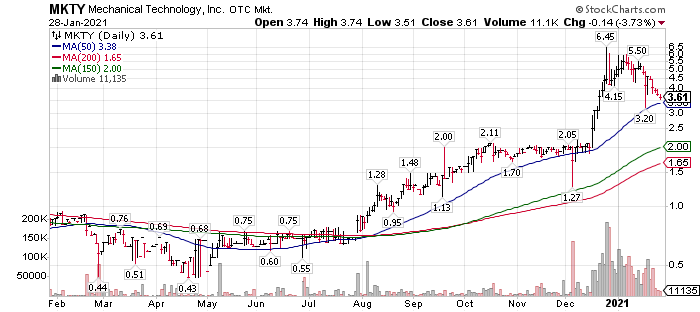

Still a bullish chart pattern!

One of the highest risks for a newsletter writer or analyst is to try and pick a stock’s price bottom before the trend reverses and we see rising prices and rising moving averages.

Well, here goes.

- Yes, I think we are close to the bottom of this correction.

- All three major moving averages are still rising, and the stock price is above them. Bullish.

- Volume has shrunk in the trading activity of MKTY. Certainly, there is no panic to exit the shares. Some say we need a panic selling action to mark a price bottom. I don’t believe we will see this in MKTY. Why? It is very thinly traded for one and the other is we think there are not many sellers and boredom could drift the share price lower – but with news, it spikes higher in a sharp and sudden manner.

- The high price in late December (on news) was about $6.50 so the rally was $5.75 per share from an August base price of $0.75. The current price $3.75 is $2.75 below the high of $6.50. About a 50% correction of the move.

Yes, this is not very scientific, but it does fall into the area of the natural rhythm of price movement in the market. 33%, 50% and 66% retracements are pretty normal. Especially in the early stages of a longer price move.

Some of you have asked should I buy MKTY on this dip and where?

This is my reply:

Yes, I think it is safe to go into the water. Few sellers, but no buyers either, so accumulate slowly and consistently. Trading volume is very thin. There are event announcements in thirty to ninety days that could draw attention to the company and stock.

Coming events might include:

- We believe the bottom is in for Bitcoin’s correction and MKTY was sensitive to Bitcoin action.

- Probable fundraiser – I am saying this: a secondary offering is great advertising for a small company.

- A move to the National NASDAQ trading platform – high probability but not locked in. We think in early Q2, 2021. Also, a benefit for trading exposure and required for some institutions to trade the shares.

- A presentation of a more detailed business plan for the rest of 2021 and beyond in the Q4 final announcement.

Messaging LOTM hopes to hear from MKTY management:

A clear Branding of who MKTY is and where they are most focused for Growth.

As Scientific Instruments Company?

As Bitcoin Miner?

As an Alt-Energy Data Center?

MKTY is doing all three – That is great, but for the branding, I see them as an Alt-energy Data Center who also does Crypto mining and provides services to facilitate Blockchain and Crypto activity within its Data Centers. The Scientific Instruments division is excellent, the core and stability to launch the new Alt-energy Data Centers and MKTY’s, Bitcoin activity within. This will be done under the EcoChain brand, MKTY’s 100% owned subsidiary.

Is that how management sees themselves and if not, how do they define themselves? This is young company fun folks, but the company is young, and there will be growing pains. Expect volatility, accumulate weakness and believe in their future. If we are right, we make really good money along with management.

A bit of religion here; this is what we consider a core position in an early-stage growth period for MKTY, for Blockchain and for Alt-Energy Data Centers. Less Trading and more constant accumulation. Think BIG.

What do Institutional investors want?

Institutional investors are going 90 miles an hour inside their brains. A simple, clean story for them to grasp, understand and buy into will be key in messaging the goals of management and therefore the stock price of MKTY.

May positive energy, freedom of thought, speech and religion be our creative spirit and leadership to the rest of the world!

Go forth and have fun!

Contact us if interested in Training, Coaching or Mentoring

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()