An account related to LOTM has a small share position in this company.

We are trying to diversify into industries that we believe are over-sold and worthwhile and calling a core holding. Signify Health fits this description.

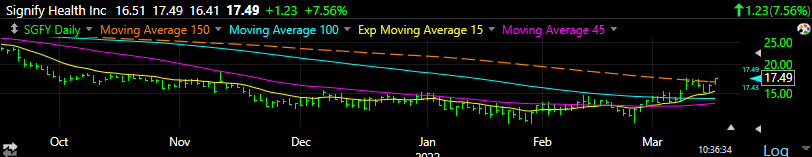

Technically the shares are breaking out above its 150-day moving average. It is already well above its 50-day (in the chart I have a 45-day MA). This will get the attention of algos as it crosses the 150 MA.

The company is basically a data analytics and payment company in the Healthcare field. They have about $345 million more in cash than they have in debt.

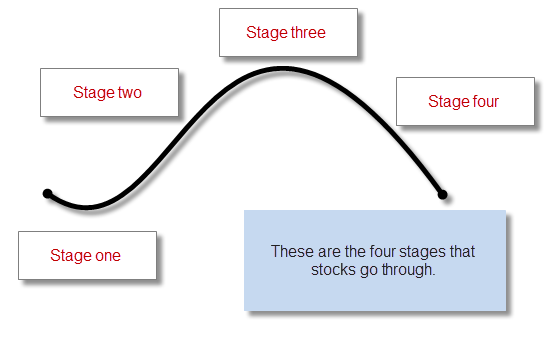

The share price is emerging from a Stage One Chart Pattern into a Stage Two Chart Pattern.

A key factor is the short interest is very large. eTrade has it at 29.5% of float. Finviz (below) has short interest at 12.9%. Price crossing mA of 150 has got to get some of them thinking they are on the wrong side of the trade. There is a potential for a short squeeze however we are not buying as trade – we consider this a potential core holding.

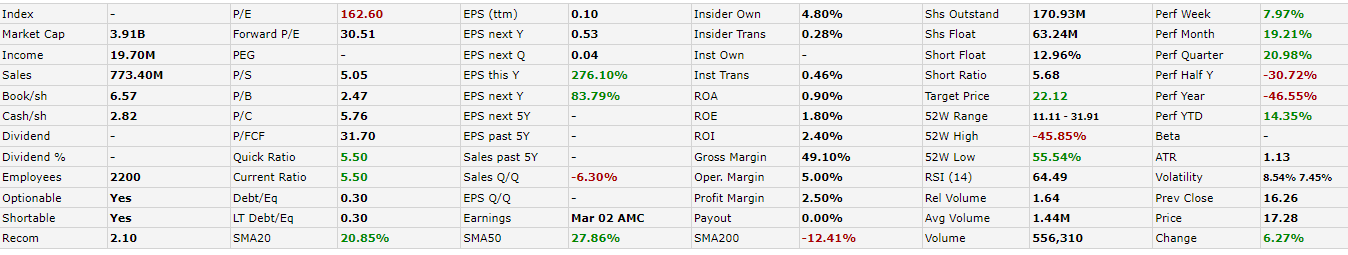

Stats from Finviz:

Biggest negative is revenue is flat – thus showing no growth. 2022 does project a pick-up in revenue.

From the recent 2021 year-end numbers Press Release.

Financial Highlights

Full Year 2021:

- Full-year revenue of $773.4 million, an increase of 27% from 2020

- GAAP net income of $9.9 million compared to net loss of $14.5 million in 2020

- Non-GAAP adjusted EBITDA of $171.2 million, an increase of 37% from 2020

Fourth Quarter 2021:

- Fourth quarter revenue of $181.4 million compared to $193.5 million in 2020

- GAAP net income of $32.4 million compared to $0.7 million in 2020

- Non-GAAP adjusted EBITDA of $40.2 million compared to $38.9 million in 2020

2022 Guidance:

- Signify Health estimates the following full year 2022 results, which reflects Caravan Health results for ten months of ownership in 2022:

- Total GAAP revenue in the range of $948 million to $971 million; and

- Total adjusted EBITDA in the range of $212 million to $222 million.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()