- Mark Moss’s explanation of the “Why” behind the conflict in the Ukraine with Russia

- “What” is Putin’s goal to be achieved from the Conflict in Ukraine?

- “How to Invest” to Protect and Profit from Macro events in motion.

- “The Energy Trade Has Gone Too Far” by Jared Dillian at Blockworks Macro

- Matt Piepenburg, Kitco interview about Russia/Moscow forming a Gold Exchange and what it means for gold.

The “Why” behind the conflict in the Ukraine with Russia

- Putin’s Sinister Plan To Bring Europe To Their Knees – Mark Moss 31 minutes Sept 13, 2022

It this theme, Moss takes Putin literally at his word as stated in public forums.

Putin’s View:

- Global problems require global solutions. To do global solutions, nations must bow to a global non-governmental power. Putin/Russia will not do this.

- The West has gone Woke. The west is rewriting its history. Giving-up the traditional concept of the “family nucleus.” Giving-up the traditional concept of Gender. Create reverse discrimination against the majority by a minority. That is ok for the United States and Europe. They have the right to do this. Europe and the USA are none of our business. Russia will not give up traditional beliefs of who we are or submit to an outside global organization. They went through this phase in the 1917 Russian revolution and have no desire to do it again.

LOTM observation: The Ukraine and Russia conflict is a war of Nationalism Vs Globalism. It is an observation, not an endorsement of one over the other.

“What” is Putin’s goal to be achieved from the Conflict in Ukraine?

- Simplified, the goal is to bring Germany and Western Europe to their knees.

Putin paraphrased: The West has devalued their currencies, creating an imaginary world of wealth. Why would we want a depreciating asset? We will not accept depreciating currencies in exchange for our “real or physical” products.

Putin:

- “The economy of imaginary wealth is inevitably being replaced by the economy of Real and Hard Assets”

Moss then goes into examples of how Western Europe developed through lower interest rates and expanding debt.

Mark goes on to describe that in going green, the EU and Germany especially, have given up their “energy independence” provided by its fossil fuels to include uranium for nuclear. Germany imports its energy and for Russia s this as an opportunity to bring the EU and Germany to its knees. Germany is dependent on others for its energy and without energy there is no productivity.

At this point Moss goes into a discussion away from the Russian and Ukraine conflict and gets into inflation, debt and how the EU created their debt inflation problem and how the EU will try to resolve their problem.

Returning to Russia’s goal, is Moss’s reasoning on what Putin is really attacking. It is the EU currency and US Dollar. In the video Moss recommends staying short the Euro currency but long the US Dollar at this moment.

Next, he promotes his upcoming (free) workshop and discussion group. If you want to register, the link is here. I have no affiliation or relationship to Mark Moss, his company or his video.

“How to Invest” to Protect and Profit from Macro Events in Play.

At this point I would like to give the LOTM perspective on what is unfolding short-term and long-term.

In the video Mark, quotes a consulting group that states of 52 countries that taken their debt above 135% debt to GDP, 51 have not recovered. Japan is the 1 than has not failed. In checking the current numbers, the United States is at 137% debt to GDP. The USA now joins Japan as one of 53 countries who have Debt to GDP of 135% or higher where 2 have not failed to date. The probabilities are not good for the USA and Japan to avoid failing. Historically every fait currency has eventually failed.

The overwhelming number of macro advisors I see, have strong negative opinions on the stock market. It is being shouted at us to expect the worst. In opposition to this is the reverse opinion that oil and gas prices are going much higher. Investors should have exposure to rising fossel fuel prices.

Ignoring the logic and numbers behind the fundamental reasons for negative reaction for Equities and positive for Fossil fuel energy prices are the technical actions of the stock market and in most fossil fuel companies. On checking the technical factors of two fossil fuel companies LOTM has mention frequently in the past – EQT (EQT Corp) and Vermilion Energy (VET), the technical indicators are breaking down. In fact, the Technical factors suggest selling the shares of both – even while the Fundamental factors are very bullish. If we then look at Sentiment (Behavioral Finance), the headlines shouting so strongly in one opinion suggest beware. Life is simply – not that simple. A good interview with a Sentiment trader recently done (Sept 8) through Blockworks discusses how he uses sentiment then technicals to work the market. It is a good educational and mine broadening video.

- The Energy Trade Has Gone Too Far | Jared Dillian – Blockworks Sept 8, 2022. One hour.

It does make sense that if energy comes down more than expected the general market can rally more than expected and inflation can come down more than expected.

In the Short-term performance, the next three to four months, I am holding back on market negativity and on my bullish feelings towards energy. It is possible for energy prices to fall faster than expected and risk-on growth stocks can catch a bid and rally into year-end ’22. This could be a surprise few expect. Everyone is leaning to one side of the canoe, to borrow an old saying.

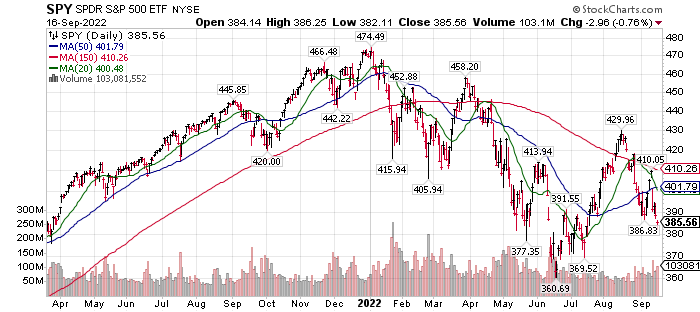

There is no reason to buy this chart pattern, however it is still in a sideways consolidation pattern with an extreme low in June and a solid bounce higher in August.

For Longer-term performance, we’d use weakness in commodities, including energy, to buy commodity related investments. Expanding on Putin’s longer-term plan and Putin’s view that the world is moving to hard assets, is a very good presentation by Matt Piepenburg of Matterhorn Asset Management.

Moscow Gold Standard could expose fair gold price, end market manipulation – Piepenburg (Pt. 2/2) presented by Kitco, Sept 16, 2022 – 31 minutes in length. Of note: on the 17th of September this video already has 75,000 views.

We have had 40 years – 1982 to 2022 – of globalization, deflation and falling interest rates. It only makes sense that we will balance that out with at least a decade (probably more) of inflation, rising interest rates and nationalization. Think about the reshoring expense of bringing manufacturing back from China. It appears that Putin (Russia) is more realistic than Biden (United States) concerning the end of one cycle and the beginning of a new cycle.

A large portion of the population of planet earth wants to move away from using the US Banking system. Piepenburg’s price potential for gold is in the $5,000 to $10,000 area over ten years. That could be conservative if the US Dollar falls from importance as a global reserve currency.

Additional article support:

Putin’s 12,000 Tonne Gold Hoard Sets The Stage For Asian Bretton Woods And The New Moscow Gold Standard – King World Productions, a division of CBS News September 8, 2022.

Unreported by western media, there are some interesting developments taking place in Asia over the future of currencies. As put forward in Russian and EAEU media, the new currency is to be comprised of a mixture of national currencies and commodities. A weighting of some sort was suggested to reflect the relative importance of the currencies and commodities traded between them. At the same time, the new trade settlement currency was to be available to any other nation in the Shanghai Cooperation Organisation and the expanding BRICS membership. The ambition is for it to become an Asia-wide replacement for the dollar

More specifically, the purpose is to do away with the dollar for trade settlements on cross-border transactions between participants. It is worth noting that any dollar transaction is reflected in US banks through the correspondent banking system, potentially giving the US authorities undesirable economic intelligence, and information on sanction-busting and other activities deemed illegal or undesirable by the US authorities. Furthermore, any transaction involving US dollars becomes a matter for the US legal system, giving US politicians the authority to intervene wherever the dollar is used.

Mentioned in the King World article linked above, is that the US Dollar has lost 98% of its purchasing power since the 1971 separation of the dollar’s gold backed policy.

Oil priced in gold from 1986 to present – source TradingView.com

Oil’s price is very stable when priced in gold. This implies that the volatility in oil’s price is due to the US$, not the price of oil.

Bottom-line is that if we are in a prolonged period of inflation, owning physical gold is better than holding US$ or other financial assets. Gold and Silver miners are more volatile than physical gold or silver. Gold is more stable than silver. GLD, paper gold is no different than paper dollars from the perspective of being backed by physical gold. It says so in the prospectus. Legal settlement can be in US dollars, not physical gold.

Times are changing rapidly, owning gold specifically is not a tool for appreciation but a tool to preserve purchasing power. Look at the oil chart above again. Secondarily it can be used for appreciation. Its primary purpose is similar to acting as an insurance policy.

Written September 16, 2022, by Tom Linzmeier, editor Tom’s Blog for LivingOffTheMarket.com

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()