By this title, LOTM is saying that the SEC never intended to stop Blockchain or crypto movement but rather is throwing up road blocks to allow the Traditional Financial (TradFi) industry time to try and catch up.

To allow a Futures ETF in Bitcoin (leveraged) while saying a cash owned “Spot” Bitcoin ETF is dangerous to the public is the height of misinformation, outright lying, and hypocrisy. The courts recognized this and said exactly that in siding with Grayscale. Now the SEC could still not approve a Spot Bitcoin ETF. That is its right. But lets be clear on why – it is not to protect the public.

First bitcoin ETF could be coming soon as court rules in favor of Grayscale over SEC

Grayscale was unreasonably denied its Bitcoin ETF, court rules

Court grants Grayscale’s petition for review in bitcoin ETF case against SEC

Breaking: Grayscale wins SEC lawsuit

Court sides with Grayscale in closely watched Bitcoin ETF case

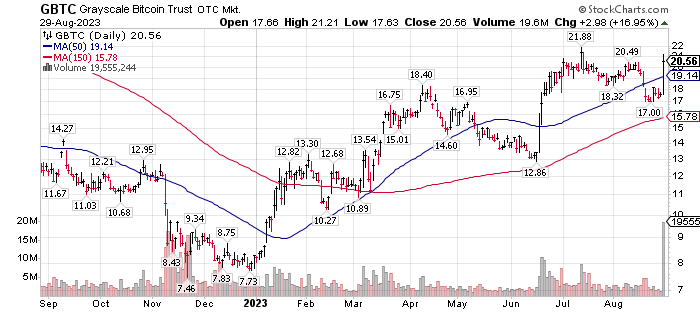

It is possible that the market has priced in Grayscale winning the Suit wit the SEC and this is a top. Even if it is a climatic event, we believe Both one in the next 12 to eighteen months will trade above $50,000. It is a new technology that is changing the entire financial community in a more efficient faster and less risk manner. It cannot be stopped. Crypto is stronger quicker, faster than the current financial industry.

Multiple Headlines on Grayscale and Bitcoin. This is a water shed event. A Spot ETF “should’ be approved within in six months based on this news. Likely sooner. This unleashes a flood of money into Bitcoin through the like of Blackrock, Fidelity, Invesco (Galaxy Digital Partner in launching a spot bitcoin ETF) among others.

LOTM suggest the continued accumulation of bitcoin and blockchain related investments, especially on weakness. Mark Yusko, asset manager, founder of Morgan Creek Capital, has a network valuation on Bitcoin of $55,000 per coin – today. If you accept his valuation methodology, then based on use and network valuation, Bitcoin is still undervalued. Yusko’s one-year target for Bitcoin, based on network valuation of $100,000 and on market excitement, $150,000. Yusko is very credible. Do a YouTube search for “Mark Yusko” to hear his comments in his own words.

Grayscale Bitcoin Trust (GBTC) and Osprey Bitcoin Trust (OBTC)* are market place, custodial ways to buy into Bitcoin. We like Galaxy Digital (BRPHF*) as a indirect play of venture funds related to Blockchain & Crypto combined with an Institutional trading desk and crypto mining access exposure to the blockchain / crypto world.

SILVER & GOLD:

By the way, Physical Silver looks very strong. Pan American (PAAS)* is the largest holder of silver reserves in the world – second in the world in silver production. Stock is at $16.50, with multiple analysts with a twelve month price target of $24 to $30. Pan America is about 55% gold production and 45% silver production. Revenue from the end of June 2023 to the end of June 2024, is expected to double on a twelve month comparison. The balance sheet is healthy, and the dividend is about 3.6%.

Good luck to all.

Written August 29, 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

For Actionable Stock Ideas, consider a subscription to Tom’s LOTM Blog.

LOTM Style – We are more a controlled speculator, than diversified investor or short-term trader. We allow 100% loss/risk on some purchases. Often, we dollar-cost-average into losing positions. Volatility is our friend, not something to be feared. We let our winners win, as much as possible. We do not like paying taxes. We love value, yet watch charts. Our goal is to find value stocks that might double in one to three-years.

See our website for our doubling to a Million$ game. We were playing this game of doubles before Patrick Ben-David talked about it. Ideas in this blog are highly volatile and only for use by those who are comfortable with high-risk, high-reward investments.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()