Three Market Approaches Integrated in Making a Million$

I: Company and Fundamental assumptions:

In our goal of making a million dollars, there are many factors in our selection of vehicles to create a million dollars. In this quest we look

- First at Companies. Yes, we are approaching this from a Bottoms-Up, position building process.

- In selecting the companies to buy, we have a checklist that includes the capital structure along with value and growth metric readings. This will vary by industry, so we retain flexibility, rather than holding to a structured format. It is nearly impossible to check all the boxes when looking for the desired profile, so we look for a majority rule on the checklist, to qualify a company.

In this writing we will share the Technical aspects of what we desire to see.

II: Behavioral Analysis:

This single factor presents our greatest opportunity on an “annual” discovery basis. The general market might present opportunities on a multi-year basis. Different industries or asset groups, however, are purged each year. It can be rewarding to identify what industries are being purged, are out of favor and also have measurable metrics. Let’s call it profiling. Capital structure, balance sheet and stability of dividend are key factors to consider when stocks are, to use and analogy, kicked out home and living on the streets. We also want to see a catalyst above and beyond oversold metrics. A catalyst allows us to work within a shorter timeline to reach our goal. This is how we work with Time and Space (price) in the market.

III: Technical Analysis Assumptions:

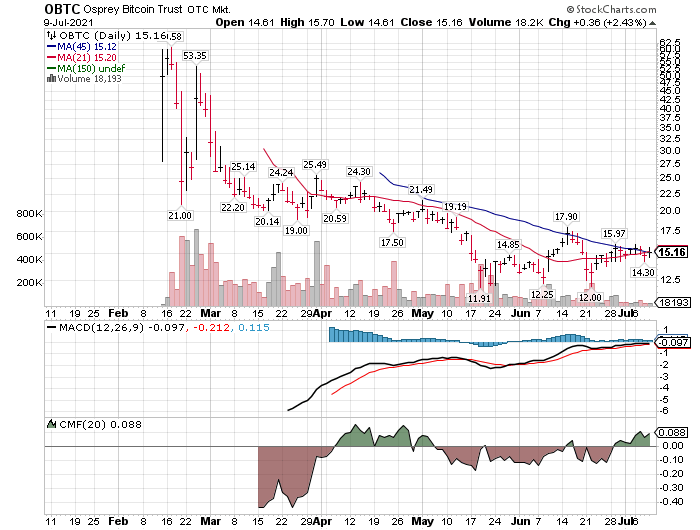

In our screening technically, we have likely decided on what we are trading. Therefore, we are looking for entry and selling points. We desire longer trend following periods so we can rule out many of the oscillator and shorter over-bought/over-sold trading technical indicators.

Price crossing moving average.

Key actions include:

- Price crossing 21 day exponential M.A.

- Price crossing 45 day simple M.A.

- Price crossing 150 day M.A. simple

- 9 day M.A. crossing above 21 day M.A.

- Sequentially, 9-day and 21-day crossing above 45-day M.A.

- Sequentially, 9-day, 21-day & 45-day crossing above the 150-day M.A.

It does not have to be this complicated but as a visual, these are 1) price cross-overs of moving averages and 2) moving average cross-over of longer moving averages.

MACD:

Fast line crossing above moving average. I use the standard measured 12/26 differential with a 9-day exponential moving averages.

Accumulation/ Distribution Indicator:

Chaikin Money Flow (CMF):

30-day moving average as a cross-over trigger.

Example of Technical Profiling as of July 10, 2021

At LOTM: We own companies and manage stocks.

At the end of the day, the stock market is a probability game. Constantly putting money in high probability situations with disciplined management of the stock has a high probability of success.

In a Bull Market, everyone is the smartest kid on the block – until the bear market arrives. Managing your way through the bear market, sets you apart from the rest of the kids.

Training/Coaching Pitch: Buying the right company profile, managing the price, managing the position and managing the portfolio are keys to successful investing. If this interests you and you want to learn more, contact us for your five-hour training and follow up coaching program. Cost is $500.00. Oh, and if you have not made Your First Million$, in the market, we will help get you started with Making a Million$ in this program.

Send us an email to, Money @LivingoffTheMarket.com for more information. First come first serve. Ten appointments scheduled at a time. We will contact you as time becomes available.

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()