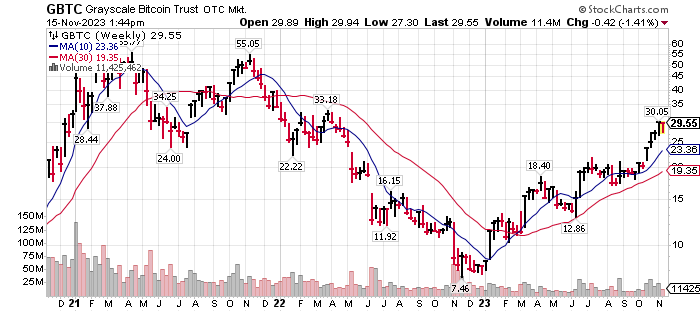

We are sharing the article linked below as an indication of the tight supply and increasing demand for Crypto.

Bottle necks – where demand is greater than supply creates the sharpest price increases. Bitcoin is a once in a life time situation because of it set supply and a massive wave of institutional money heading toward Bitcoin in the coming months.

It is not only Bitcoin but also Ethereum, Polkadot, Chainlink, XRP, Solana and more alt-coins that perhaps you can fill-in the names. The “Use” factor for Ethereum, Chainlink, XRP & Solana is exploding. This does appears to be early in the crypto bull cycle. The “Use” factor is what you want to look for in Crypto. If an alt-coin can provide Multiple use factors that is a big “tell” to consider investing in it. Chainlink, Ethereum and Solana appear to be leading the pack in Use factors.

Look for “The Limited (max coins that can be issued) Factor.” Fewer coins add to the potential for a crypto’s higher price. It is part of the secret sauce than makes Bitcoin special. Max supply of Bitcoin is limited to 21 million coins. This is an incredibly low number hence the very high price predictions for Bitcoin as Institutional money buys into Bitcoin through coming spot ETFs.

As the article below points out, many holders of crypto are recognizing that a crypto bull market has started. This cycle typically run six months prior to the Halving date and eighteen months following the Halving date. The Having date is about mid-April 2024.

Crypto token supplies explained: Circulating, maximum and total supply

Linked at CoinTelegraph

ARTICLE:

In Brief – BE(in)CRYPTO (linked here) by Bary Rahma, November 13, 2023

- The number of Bitcoin millionaires has tripled in 2023, with over 81,000 addresses holding over $1 million in Bitcoin.

- BTC’s market performance is strong, with its price nearing $38,000, influenced by short-term holders realizing profits.

- Institutional interest in crypto is rising, as indicated by a $20 billion open interest and tightening order book depth.

The cryptocurrency market is experiencing a significant shift, evidenced by a surge in Bitcoin millionaires. In 2023, the number of addresses holding over $1 million in Bitcoin has more than tripled, reaching a staggering count of over 81,000.

This remarkable increase, representing a 237% growth since January, coincides with Bitcoin’s price rally, surpassing the $37,000 threshold.

Bitcoin Millionaires Multiply

Bitcoin has been on a remarkable ascent, nearing $38,000 last week and hovering around $37,000 in the early hours of Monday. This price increase reflects Bitcoin’s strong market performance and indicates a larger trend taking shape in the crypto market. Indeed, the spike in Bitcoin millionaires has been substantial, nearly tripling year-to-date.

Short-term Bitcoin holders have also benefited from this upsurge by selling and raking over $1.8 billion in profits. This contrasts with long-term holders, who have been in an accumulation phase before the upcoming Bitcoin halving.

“The majority of inflows into exchanges are attributed to short-term holders, indicating significant profits gained from the recent rally. Short-term Bitcoin holders have been potentially taking profits, and this activity could be influencing

This bullish trend in Bitcoin’s price and the increasing number of millionaires in the market is underpinned by strong liquidity trends. Data from Glassnode, a leading on-chain market intelligence firm, suggests that Bitcoin’s available supply has hit a historical low, indicating a tightening supply and a reluctance among existing holders to sell.

Institutional Interest Spikes

Moreover, open interest in Bitcoin and Ethereum crossed the $20 billion mark for the first time since the FTX collapse. This is indicative of heightened market activity and interest level.

Indeed, these trends are further supported by institutional capital. The increasing market share of the Chicago Mercantile Exchange (CME) suggests it is a preferred venue for large traditional finance companies to get exposure to crypto.

Additionally, the order book depth for Bitcoin and Ethereum has tightened despite the strong price increases. This suggests a relative lack of sellers compared to buyers, further supporting the bullish market sentiment.

The annualized realized volatility for Bitcoin and Ethereum also remains relatively low, further reinforcing the stability of the current market rally.

“Right now, funding rates are at the highest level since October 2021, when Bitcoin reached its last historic price high. This value suggests that optimism is prevailing in the market, driving a high number of futures contracts to bet on an increase in price,” Cauê Oliveira, head of research at BlockTrends, said.

Article by Bary Rahma, November 13, 2023 at BE(in)CRYPTO.

For Actionable Stock Ideas, consider a subscription to Tom’s LOTM Blog.

LOTM Style – We are more a controlled speculator, than diversified investor or short-term trader. We allow 100% loss/risk on some purchases. Often, we dollar-cost-average into losing positions. Volatility is our friend, not something to be feared. We let our winners win, as much as possible. We do not like paying taxes. We love value, yet watch charts. Our goal is to find value stocks that might double in one to three-years.

Written November 15, 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()