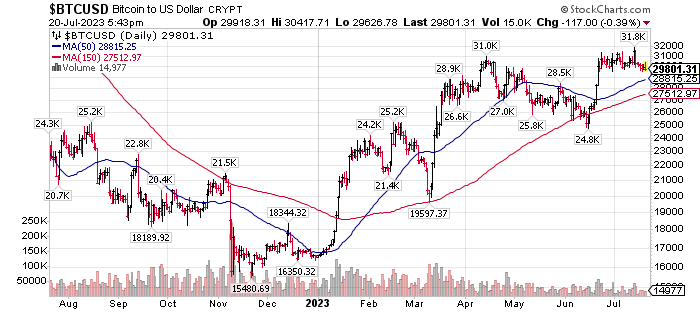

These two Videos popped up in my daily search for Strategies & Tactics in the market. They are worth watching. They are both related to the MACD indicator but used in different ways. We suggest you listen to both in the order presented. Video #II builds on video #I. Enjoy. They are really good and can help your trading success.

MACD

I: Best MACD Trading Strategy – 86% success rate

The MACD indicator. Probably one of the most well-known / widely used indicators in the trading world. By itself, not that powerful. When paired with other indicators, easily one of the highest win rate strategies you can choose from. In this video I show you exactly how to pair the MACD trading strategy with others to get an insanely easy to use trading strategy that profits extremely well. Continue reading

![]()