PAAS* – The physical silver price popped big yesterday. It is the favored metal at this time. As one of the largest silver miners, Pan America’s price reacted accordingly. Note: we did buy shares in a related account yesterday. I would, money allowing, add to the position, especially on any price weakness. $17.00 dollars, plus or minus $0.20 cents would be our buy in target goal.

GORO* is breaking out. It has one of the best charts in the mining sector in my opinion. Gold Resource’s price has to get above $4.00 to confirm the breakout. The next targets are $4.50 and followed by $5.00. Two Wall Street firms put price targets of $6.50 and $7.25 on GORO. These could end up being conservative targets, if the miners get as hot as I think they will in coming months. Two company has started production in June 2019. The second half of 2019 is expected to have this additional production in the Q3 earnings report so expect good news. Higher silver prices would be on top of the expanded operating production. We like this company for its organic growth as well as physical metal’s added revenue. The price is already above all major moving averages. The shorter term 20-day M.A. is above the 50-day M.A. This is also a positive signal in trend following perspective.

ASM* – Avino, Very nice price action this summer – $0.40 to $0.80 with a pull-back of 50% to just under $0.60 this September. $2.00 to $2.50 is a normal high price resistance area if one were to look at a longer-term chart. $2.50 would be our longer-term price goal

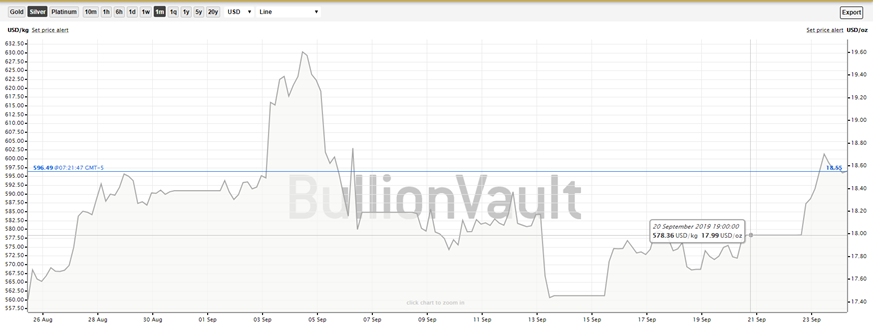

Physical SILVER Price chart:

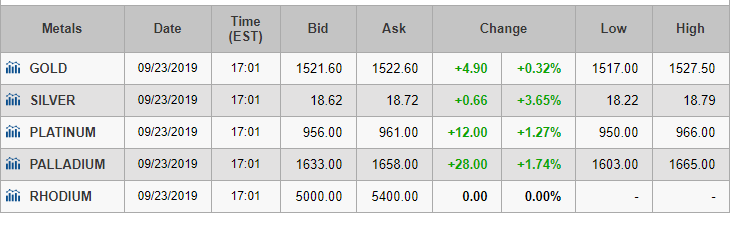

Silver was up 3.65% yesterday with Gold only up, 0.32% – Action is in Silver

Silver is undervalued to gold. The Silver to Gold ratio is about 82.15. Believe the ratio will go to 60 to one ratio on this move. 60 to 1 is a more historic number. That projects to a price on silver of $25 an oz with gold at $1500 per oz.

Posted: Sept 23, 2019, Tom Linzmeier editor, LOTM

* An account related to LOTM holds a position in this security. Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket

ZTA Capital Group, Inc.

Attn: Thomas Linzmeier

339 Summit Ave, Suite 4,

Saint Paul, MN 55102

![]()