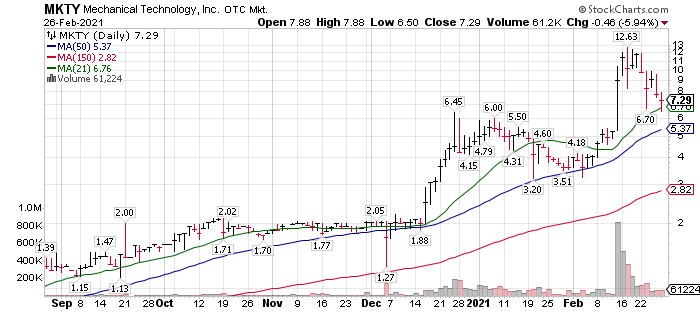

Technically speaking, MKTY is still in a rally phase. The shares are thin – about six million out-standing. If trading this stock will give you many outsized trading swings. If you are position building for a longer time period, trying to trade your core position could leave you on the sidelines following a news announcement. Only time and price performance can address that aspect. Related accounts are managing share position based on a percent of portfolio when selling and buying. We have additional company positions we have as “core positions” we will add to on weakness, should the “cash available” opportunity present itself. We will also expand the position size in MKTY should out percent holding shrink for whatever reason. It is our management style.

Mechanical Tech (MKTY) $7.30 has been busy in adding two new seats to the board of directors.

Both are impressive individuals. These two appointments are a positive statement about where Mechanical Tech (MKTY)* heading. We anticipate additional positive news flow over the next 30 to 90 days. This has been announced by MKTY management.

Two key areas are covered in the new additions – An experienced energy connection in Mr. Will Hazelip and in Mr. Aly Madhavji, a blockchain expert and venture capital firm connection.

First announced appointee: Mr. Will Hazelip, is an accomplished leader in the energy industry, with deep experience in utility project development, financing, regulation, and operations. He currently serves as President, Global Transmission (US) and Strategic Growth, for National Grid Ventures (“NGV”). In this role Will develops new business opportunities in electric transmission, energy storage, and renewable energy. Previously, he was the Managing Director, Business Development at Duke Energy Corporation and the President of Path 15 Transmission, an independent electric transmission company in California, where he led the acquisition for Duke Energy Corporation. Mr. Hazelip also provides extensive Board experience having served as the Chairman of the Board of a multi-billion-dollar natural gas pipeline company, the Vice-Chairman of the Board of a growing electric transmission company, and a Board Representative of a renewable energy and battery storage joint venture with NextEra Energy Resources (NEE) $73.49.

Second announced appointee: Mr. Aly Madhavji is the Managing Partner at Blockchain Founders Fund. He also consults leading organizations, such as the United Nations, on emerging technologies. Mr. Madhavji is a Limited Partner at Loyal VC and Draper Goren Holm, an award-winning author, a Senior Blockchain Fellow at INSEAD and recognized as a “Blockchain 100” Global Leader by Lattice80. He holds a Bachelor of Commerce from the University of Toronto, a Master of Business Administration from INSEAD and a Master of Global Affairs, as a Schwarzman Scholar, from Tsinghua University.

- It could very well be, that Mr. Madhavji as Managing Director of Blockchain Founders Fund is a potential investor in MKTY’s money raising efforts. It is only a speculative guess on my part.

MKTY is a core holding for related accounts to LOTM. We will scale in and out, based on price movement, but we believe in the direction and activity the company is doing and would like to build size in the position as price weakness allows.

MARKET ACTIVITY: the past few trading days confirms the market is in a correction. How badly it will get is an unknown. Get off margin if you have margin is our major message. We like the companies we have and the sectors we are in and would, proceeds allowing, accumulate more shares. We are primarily in the commodity asset class. Precious metals is our primary commodity asset. We like Natural Gas (oil is ok but gas is better). And we do like Blockchain and crypto although here we like the companies building the infrastructure around Blockchain and Crypto more than we like direct ownership of Bitcoin or other Crypto currencies.

Training, Coaching & Mentoring available

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()