The world will function much differently in five years because of Blockchain. There is no turning back. Yes, governments will regulate different crypto coins. Some governments more so than others. Blockchain is here to stay.

Blockchain is a new asset class, and it is in a similar stage of development as the Internet was in 1997 – 2000. The Blockchain evolution will unfold over the next twenty-years. It will bring greater change to this world than the Internet brought. You can Fight it, or you can Ignore it, but it will be at your expense. Consider learning and embrace the change because it is to your benefit.

Bitcoin is “the” Crypto coin. It is (or should be) considered an asset not a currency. At this point in time all crypto currency moves are in harmony with Bitcoin movement. Some move in a greater percentage trading range than Bitcoin. Bitcoin can be a core holding, but in time others may perform better than Bitcoin. It is worth some time to understand the evolution of Blockchain. In time, some crypto currencies could become more valuable than Bitcoin.

I hope the following is a simple, yet knowledge filled understanding intro to this new technology that is changing the world. I have no doubt some of you are old hands at this. Feel free to forward this to others who maybe at an earlier stage of learning.

Please read: Coinbase adds Polkadot’s DOT to its selection of tradable cryptocurrencies, fueling the bull case for ethereum’s closest rival.

PolkaDot and Cardano (below) enhance the use of Ethereum therefore are important to the future use of Ethereum. There is potential for Ethereum to be more valuable than Bitcoin, as well as the possibility Polkadot and Cardano become more valuable than Ethereum!

See what trading platforms can operate inside Vietnam

- Most Popular Bitcoin Exchanges in Vietnam

- Suggest Binance in Vietnam, as it is the largest exchange in the world and has an excellent reputation. Crypto trades 24/7 around the world. It never sleeps.

- Vietnam to pilot virtual currency as crypto thrives in gray zone – VN’s Central bank instructed to develop blockchain-based digital money

- Crypto can be bought in fractional shares so whatever money you have, can be invested. Suggest minimum US$50 as there are fees & transaction expense with most exchanges.

- Best Trading Platforms for USA based Crypto Investors – Not mentioned in this article is fast rising Voyager Digital. Voyager (VYGVF) $13.47, offers no fee or commission trading and is not a trading platform in and of itself. Rather Voyager accesses all trading platforms for the best price at that moment for buying and selling crypto on your behalf. Trading with Voyager will soon be offered in the EU and Canada.

Crypto coins gaining importance:

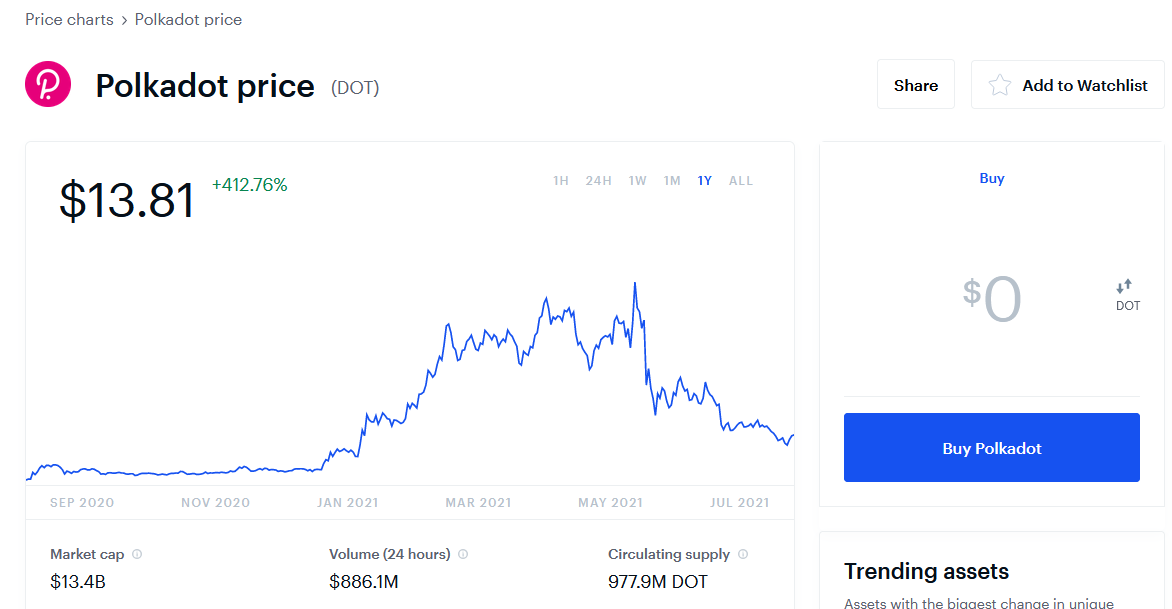

- PolkaDot – DOT: Polkadot is a protocol that enables cross-blockchain transfers of any type of data or asset. By uniting multiple blockchains, Polkadot aims to achieve high degrees of security and scalability. DOT serves as the protocol’s governance token and can be used for staking to secure the network or to connect (“bond”) new chains.

- Cardano – ADA: Cardano is a blockchain platform built on a proof-of-stake consensus protocol (called Ouroboros) that validates transactions without high energy costs. Development on Cardano uses the Haskell programming language, which is described as enabling Cardano “to pursue evidence-based development for unparalleled security and stability.” The blockchain’s native token, ADA, is named after the 19th century mathematician, Ada Lovelace.

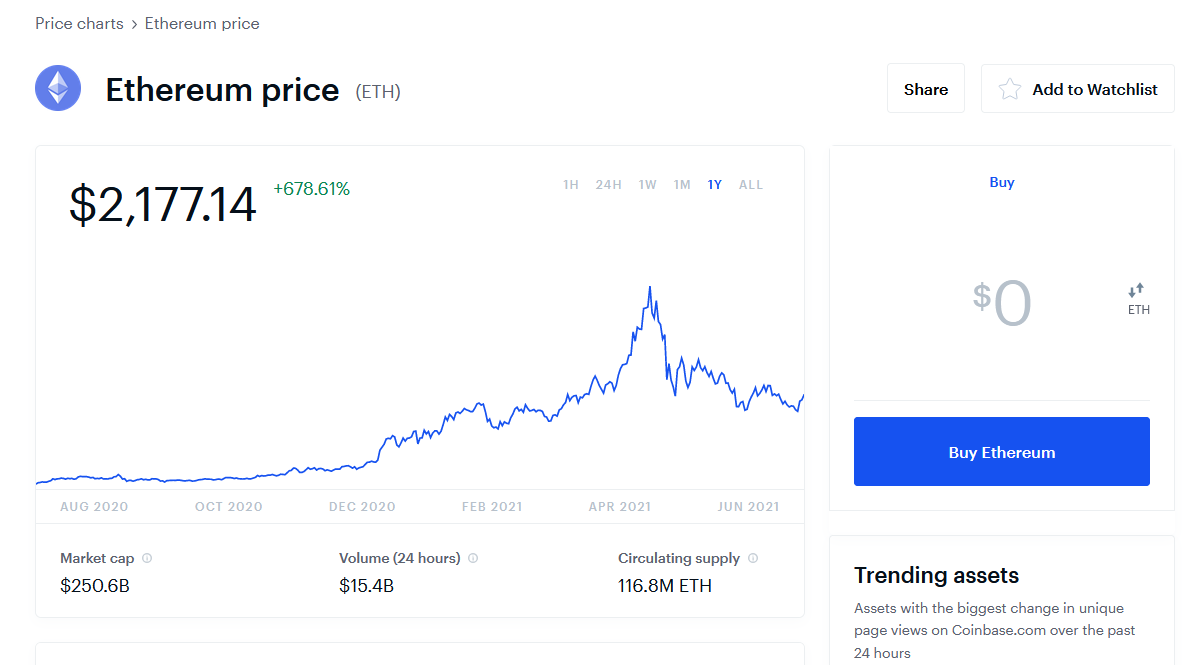

- Ethereum – ETH: Ethereum is a decentralized computing platform that uses ETH (also called Ether) to pay transaction fees (or “gas”). Developers can use Ethereum to run decentralized applications (dApps) and issue new crypto assets, known as Ethereum tokens.

- ChainLink – LINK: Chainlink is an Ethereum token that powers the Chainlink decentralized oracle network. This network allows smart contracts on Ethereum to securely connect to external data sources (eyes & ears for Ethereum on the Internet), APIs, and payment systems.

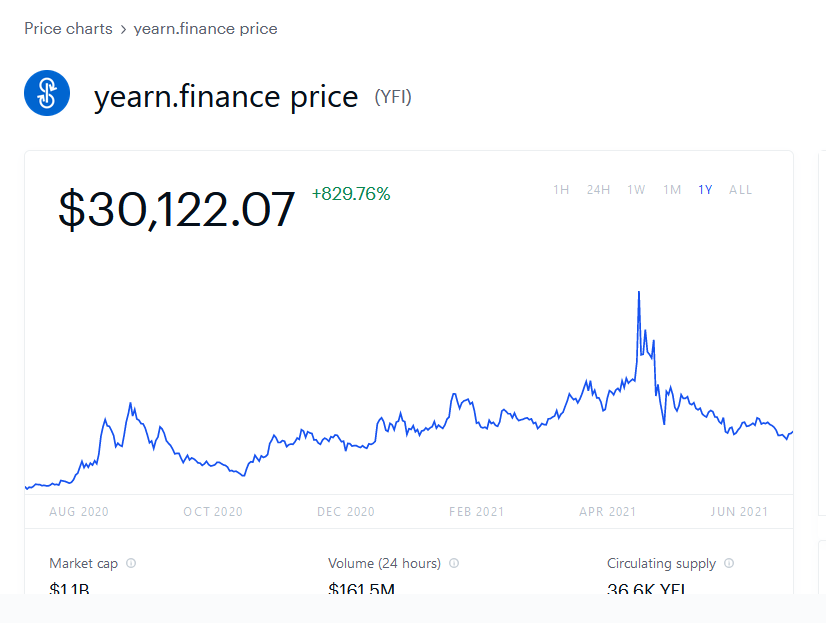

- Yearn.finance – YFI: is an Ethereum token that governs the Yearn.finance platform. The platform is a yield optimizer that moves funds around the decentralized finance (“defi”) ecosystem in an effort to generate a high return.

Also:

- NEO – NEO: NEO is a cryptocurrency and smart contract platform that supports applications written in a variety of programming languages. Fees for deploying and running smart contracts are paid with GAS, a separate token.

- Uniswap – UNI: UNI is an Ethereum token that powers Uniswap, an automated liquidity provider that’s designed to make it easy to exchange Ethereum (ERC-20) tokens. There is no orderbook or central facilitator on Uniswap. Instead, tokens are exchanged through liquidity pools that are defined by smart contracts.

- Mirror Protocol – MIR: MIR is an Ethereum token that governs the Mirror Protocol which “allows the creation of fungible assets, that track the price of real world assets.” The project aims to enable 24/7 equities trading by minting “synthetic” versions of the real thing. MIR tokens can be used to propose and vote on important changes to the protocol.

- Stellar Lumens – XLM: Stellar Lumen, powers the Stellar payment network. Stellar aims to connect banks, payment systems, and individuals quickly and reliably. Stellar makes it possible to create, send, and trade digital representations of all forms of money: dollars, pesos, bitcoin, pretty much anything. It’s designed so all the world’s financial systems can work together on a single network.

You can see above that many crypto coins are based on the Ethereum protocol. Ethereum can be a core position with other coins held as complimentary positions or trading positions.

The path to ‘wealth” runs the same in all markets:

- Buy low and sell high – the longer you own and the more you buy when the price is low – the greater your wealth. Same is true in real estate and stocks. Buy low / sell high / cut your losses / let your winners run. Trading is for making a living day-by-day. Ownership of assets is for growing wealth. Most of us need both but consider what is most important for you over time.

Charts below are from https://www.coinbase.com/

- Time period in the chart is One Year.

- Currency is US$.

- Percent next to the price is the gain in value over one year.

- The rise and fall of prices is correlated to Bitcoin in all coins.

Informative:

- INTRO TO CRYPTO / BLOCKCHAIN By InvestorJunkie .

- Bitcoin, Cryptocurrency & Blockchain: What’s driving the craze? April 25, 2021, excellent nine minute Video.

Top Blockchain News Sources:

Contact LOTM For One-on-One consultations.

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()