New Found Gold (NFGC*) $2.85

The stock has not had a good year. Not much to say… It has been a lousy year for NFGC “stock.

The Company:

At the company level, NFGC might be the largest and high grade gold discovery of the last thirty or forty years. The news keeps getting better and better.

News flow from NFGC https://newfoundgold.ca/news/ for first two stories below.

July 11, 2024 – New Found Intercepts Nine New Gold Zones Spanning 3km in Strike, Doubles Known Vertical Extent of Gold Mineralization to 820m Depth at the Queensway Project.

July 9, 2024 New Found Completes Acquisition of Labrador Gold’s Kingsway Project

April 22, 2024 New Found grows portfolio with Labrador Gold project buy Staff Writer @ Mining.com

About New Found Gold Corp.

New Found holds a 100% interest in the Queensway Project, located 15km west of Gander, Newfoundland and Labrador, and just 18km from Gander International Airport. The project is intersected by the Trans-Canada Highway and has logging roads crosscutting the project, high voltage electric power lines running through the project area, and easy access to a highly skilled workforce. The Company is currently undertaking a 650,000m drill program at Queensway and is well funded for this program with cash and marketable securities of approximately C$54 million as of July 2024. The Kingsway and Queensway projects are both on the Appleton Fault line.

Queensway Project Presentation PDF from New Found Gold Linked Here

The mining claim keeps expanding with high grade discoveries. The claim is 80 miles long on the Appleton Fault line. Let that sink in – 80 miles of Fault line with high grade mineralization. That is a big mining claim and with high grade core samples where they have drilled.

The Stock: when this was first discovered the share price went from $1.00 to above $12 per share. Now three years later the news is still coming in positive. NFGC has no debt and about $45 million USD in cash.

If one does not need the thrill of victory adrenalin rush this is an excellent time to be buying shares of NFGC! Call it garage sale or fire-sale, the gold is in the ground. It is just a question of when the price will run.

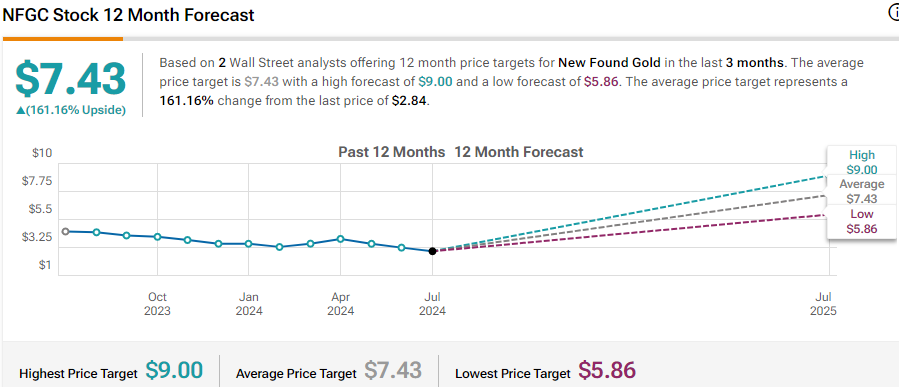

Five year chart below: TipRanks projection above.

In the chart above we project this dip is the last drop below $3.00 – we will see. NOTE The volume of trading in the stock at this time. Volume precedes Price. Big volume comes in at turning points.

I am encouraged to be greedy and excited when we know the “company story” and it is not reflected in the “stock’s price action.” My guess is that this price dip is a two to three month dip and in the scope of a one to two year time frame, this weakness is a good time to accumulate shares of New Found Gold. The goal for shares bought under $3.00 is a double to a triple in price. We like long-term capital gains so the year or two timeline does not bother us.

This is a two to three fold mover at a minimum – in my opinion. The bigger questions are when and over what time line. I don’t know the when and time answers but, the outlook for physical gold is very positive. This is a very favorable mining jurisdiction, and we know there are high grade gold deposits on New Found Gold’s mining claims. Two investors own 46% of New Found Gold. Mr. Eric Sprott own 19% and Palisades GoldCorp. (PLGDF*) owns 27% of New Found Gold.

Accounts related to LOTM added shares as recently as Friday July 19, 2024.

LOTM hunts for Doubles and Triples in stock prices. We use DCA, we tax manage positions and we seek long-term capital gains. Our position holding time-line is one to three years. We let our winners run, rather than trading them. Because we use concentrated positions, we are stock speculators. We profile and use probability in our selection process. Position management is central to our process. We are not always right but we let our winners pay for our losers. Concentrated positions can cause high volatility in account values.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()