“In terms of total aggregate mineral demand [to build these EVs], it’s just outlandish.”

Mining Audiences Manager, Michael McCrae and Kitco correspondent Paul Harris.

Kitco – October 15, 2021

Never mind the current rush into electric vehicles, coming regulations are going to drastically increase EV adoption and mineral demand, said Matt Watson, founder of Precious Metals Commodity Management.

On Friday Watson recorded Kitco Roundtable with Mining Audiences Manager Michael McCrae and Kitco correspondent Paul Harris.

In the seven months up to July, global sales of electric vehicles were up 150% to just over 3 million units, compared to the same period in 2020, with about 1.3 million sold in China, according to the consultancy Rho Motion and reported by Reuters. And in Norway sales of EVs have been so successful, trends point to 100% market share by spring at the expense of internal combustion engine sales.

Consequently, battery metals have been on a tear. Lithium is up 159% for the year based on Benchmark Lithium Price Tracker.

Watson estimates that EV penetration currently sits between 4% to 5%.

“I think the message is: you haven’t seen anything yet. By 2030 to hit the zero emission mandates that have been put into place by different governments, 25% penetration is needed,” said Watson.

“And then jumping ahead to 2035, then the numbers get really silly. Then you need 62% of the global feet transitioned to EVs.”

“In terms of total aggregate mineral demand [to build these EVs], it’s just outlandish.”

Link to audio interview. 48 minutes

Silver, Copper, Nickel, Magnesium, Lithium – the list goes on:

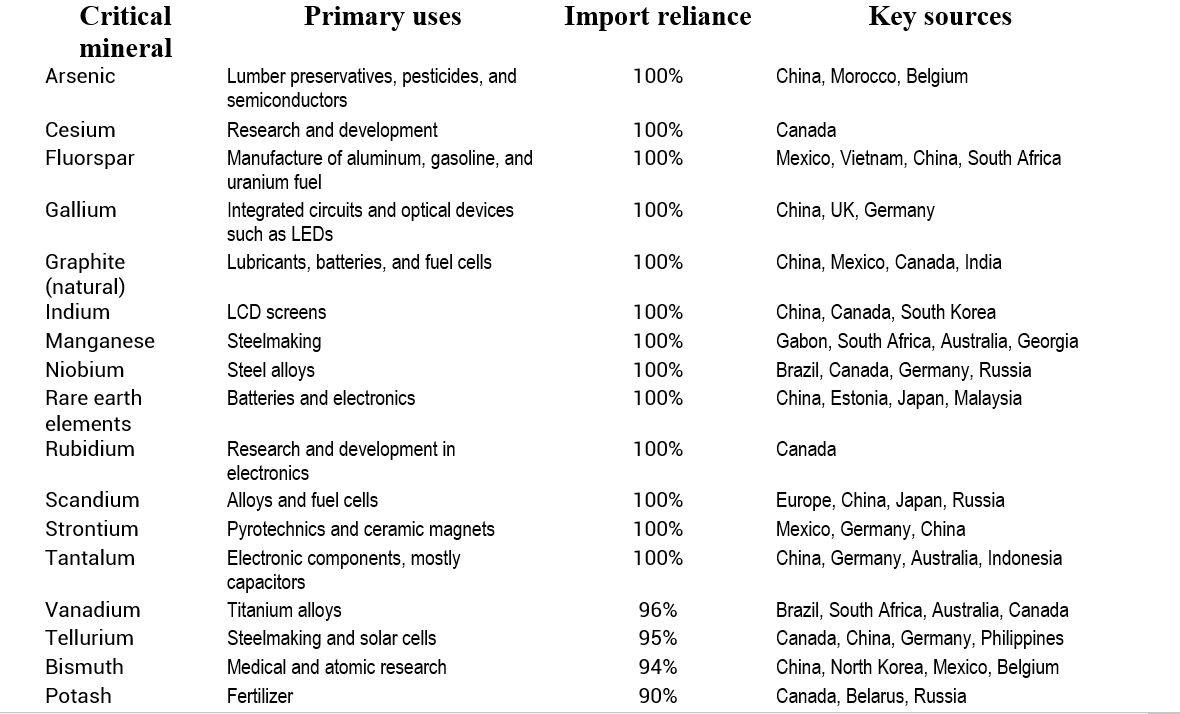

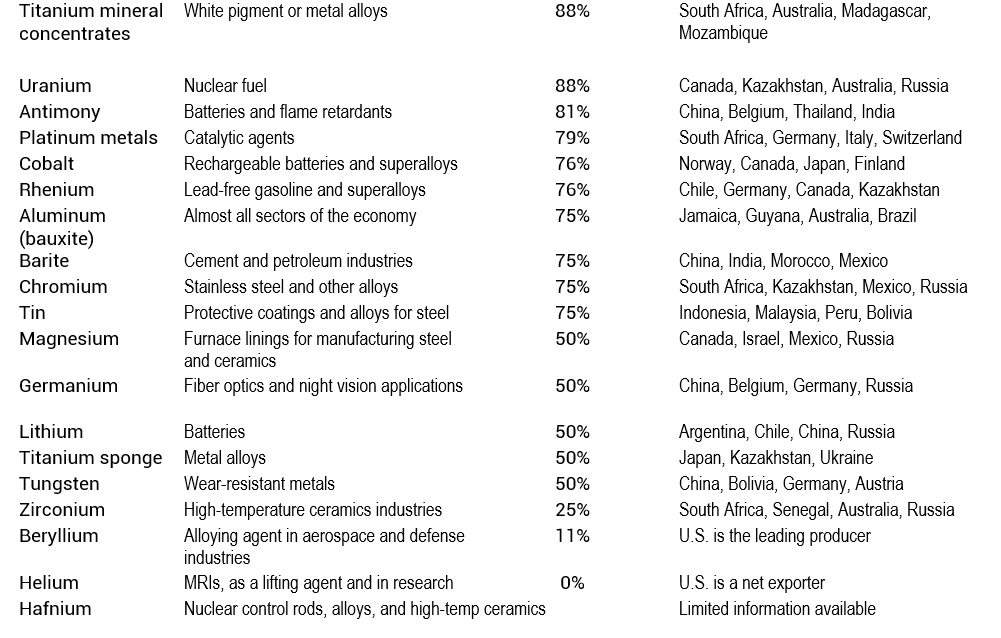

From: The U.S. is worried about shortages of critical minerals for electric vehicles, military tech

April 2021 PBS

When U.S. companies build military weapons systems, electric vehicle batteries, satellites and wind turbines, they rely heavily on a few dozen “critical minerals” – many of which are mined and refined almost entirely by other countries. Building a single F-35A fighter jet, for example, requires at least 920 pounds of rare earth elements that come primarily from China. Follow headline link for rest of the story.

What is interesting about the comments above and why Minerals will a major financial winner in this decade, is that there was no mention of excess printing by governments and the devaluation of Fait Currencies. If you add this logic to the comment above it increases the probabilities that this is the go to asset class for the current decade.

Warning! It will not be a straight line higher but rather, the trend is higher. Look for weakness to dollar-cost-average for position building or an opportune time to buy the dip and sell the rally. Nothing’s easy, but interesting, isn’t it?

You can Read, you can watch Videos, but nothing beats Personal Interaction for accelerated learning.

This game has levels of understanding that could take a lifetime of Trial and Error to learn.

Available for Coaching, Training or Mentorships

Contact LOTM For One-on-One consultations.

Rate: $150 per hour / Monthly Retainer, Lowers Rate

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()