- Twenty of our highest conviction gold & silver junior miners. Yes, the industry is that over-sold!

“Mining stocks are as inexpensive to the price of physical metals as I have seen in my career.”

Ross Beaty founder Pan American Silver (PAAS*) and largest individual shareholder of PAAS. Beaty is also the founder and Chairman of Equinox Gold (EQX)

Billionaire Ross Beaty: “All Is Good for GOLD” YouTube Video 9/14/23– 23 minutes

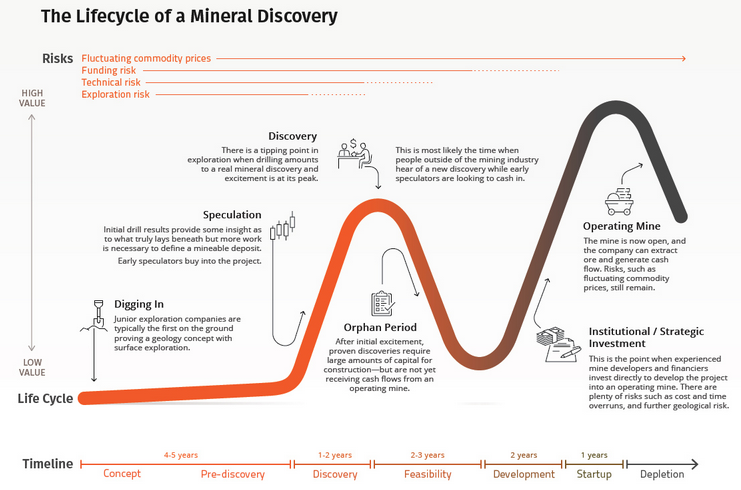

Sourced from the Visual Capitalist

The graphic above is from Exploits Discovery on the stock price cycle of a exploration miner to production miner. The curve is known in the industry as The Lassonde Curve. It explains the two phases of a stock’s progress where the biggest gains in the share price happen – linked here for further explanation.

The share price trades at very low market cap until a significant discovery is made. Once (or if) a mineral strike is found, the share price can run 5X to 20X in a short period of time. The share price then declines following the mineral discovery phase and goes quite until just prior to the company goes into the mining production phase. Then we have another run upwards but not as dramatic as the “mineral discovery” phase. Following this phase, the miner’s price usually become slow price growth / trading stock. There are two exceptions. The two exceptions – (1) a sharp runup in physical mineral prices or (2) a sharp drop in physical mineral prices.

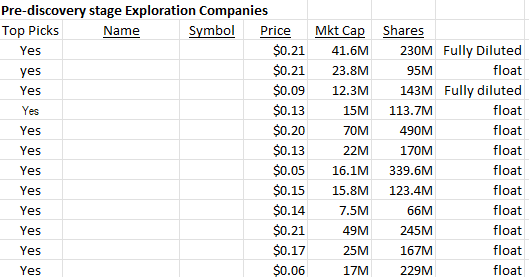

Listed below are 12 pre-discovery exploration companies, we believe have “probable” odds of finding large enough mineral strikes to become productive mining operation. These are companies we would place as early Lassonde Curve position to be potential 5X to 10X price movers with a production scale discovery. There are many variable risks involved in mining so one should assume that some of these companies will not survive for any one of a number of conditions. It is best to buy equal dollar amounts in at least five companies and preferably ten or more companies in this position. “You” are the home run hitter looking for the big hit, knowing the odds of some swing and miss opportunities are expected. Finding three 5X or more names out of ten makes you very profitable. Above that, the rest is an Ah Ha moment. Owning enough similar profile exploration companies is the money management formula that makes this work.

Names are reserved for paying members of LOTM

I am happy to send to new subscribers, on request, a working spreadsheet with links to the individual company presentations. Most have August to September origination of presentation dates. In looking at the market caps, you see two things. These are very illiquid. Use limit orders at all times. Because of the illiquidity, you might want to plan on selling into rising price trend – when it’s time to sell. Selling into a falling price trend will be difficult to get the price you want. The faster the rise, the faster you sell. Have your target prices set. You will want to sell with pre-market orders entered. Keep in mind the routine of a farmer. There is a time to plant and a time to harvest. This is the time to plant. Sometime in the next one to four years will be a time to harvest. The total return goal is three to five times what you “planted.”

Remember that this is before the acceleration phase of the Lassonde Curve. Think 5X to 10X on individual stocks as your goal. Sell small partial positions along the way so you have room to reach the top. This is not a good activity for an all or none strategy.

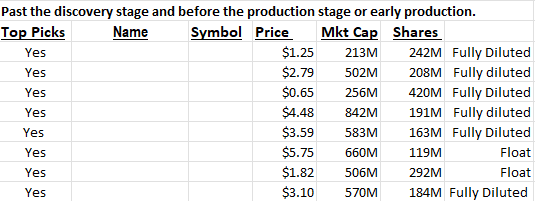

Lower risk but a higher probability of success is the group of names below.

Names are reserved for paying members of LOTM

This second group of companies have made the “big discovery.” They have 5X-ed to 15X-ed or more already. This group has pulled back in price from those highs and are now trading at attractive pricing and valuations.

The game is the same. Buy equal dollar position in five or more of the names.

The time-line for results can be assumed to be 24 months to 60-months. Five years will not be required IMHO, but I’d rather be long (time forecast) and wrong, than over-sell the idea. I’m pretty sure you be a winner as the first group is in the areas where big strikes have been found and the second group has already established, they are on big deposits. Keep in mind that this is now a very depressed period for miners Vs what the physical price are today. This fact alone make the rewards more probable. Timing is the harvest is the biggest unknown.

It is possible the stock market in general could experience a liquidity crisis. No one knows this for sure, but it does happen from time to time. Typically, gold and silver miners are the hot stocks first to rally out of a liquidity crunch. Don’t get excited on a down draft and sell should a liquidity crunch happen. Your value is in the ground, not in the stock price. Volatility is not to be feared but an opportunity. Know your companies.

Look at the Market Caps of the first group. Then look at the Market Caps of the second group. The second group has made the first 5X to 15X move. A Three X to five X move in the second group is now the goal. The risk is less in the second group, so the reward is less.

Discipline and planning are the critical factors in profiting from this strategy. Spend time getting to know each story.

Remember – the US Government is giving you a gift. They are restricting mineral supply through regulations while legislating demand for the all-electric movement. There is no way we can go all-electric, without more minerals than is physical possible. Our government does not realize this yet. Profit from what the government wants to have happen!

These names above are silver and gold miners.

Copper is another set of mineral miners, so bear this in mind. Have fun with this project. I’m available if you have questions.

Videos worth watching:

A no BS prestation on what it takes to be successful in owning Junior Miners:

“Pro Mining Investor Mark Zaret Reveals “The Only Way” to Small-Cap Success” YouTube Vid – 42 minutes

“Junior Gold Stock Investors Will Be Rewarded says Pro Mining Investor David Erfle” YouTube Vid – 20 minutes

You can assume accounts related to LOTM have positions in all these names or soon will.

Pass this along to a friend if you think it worthwhile.

For Actionable Stock Ideas, consider a one month subscription to try Tom’s LOTM Blog.

LOTM Style – We are more a controlled speculator, than diversified investor or short-term trader. We allow 100% loss/risk on some purchases. Often, we dollar-cost-average into losing positions. Volatility is our friend, not something to be feared. We let our winners win, as much as possible. We do not like paying taxes. We love value, yet watch charts. Our goal is to find value stocks that might double in one to three-years.

See our website for our doubling to a Million$ game. We were playing this game of doubles before Patrick Ben-David talked about it. Ideas in this blog are highly volatile and only for use by those who are comfortable with high-risk, high-reward investments.

Written September 18, 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()