- Impact on Galaxy Digital from the financial collapse of FTX

- Take-over of Yamada by Pan American Silver and Agnico Eagle

There were two major events on companies of Interest to LOTM we would like to share a follow up comment.

I: Impact on Galaxy Digital from the financial collapse of FTX

Mike Novogratz Founder from Galaxy addresses the FTX collapse and how it impacts Galaxy Digital and the Crypto industry in Galaxy Digital’s third quarter earnings report this morning, November 9, 2022. If you are holding shares of Galaxy Digital, it is worth your time to listen to the direct comments from Management at Galaxy Digital.

Key summary from the call: Management stated the company has about one billion dollars of liquidity available at this time. Galaxy has about $77 million exposure to FTX. They had begun a withdrawal process from FTX of about $47.5 million when the date stopping withdrawals was announced. The FTX collapse in and of itself is a “hit” to Galaxy but not an end of Galaxy, the company. The estimate, worst case, is 4% of assets. How much they recover from FTX is undeterminable at this time. Galaxy does not believe they have counter-party risk to others who have exposure to FTX.

Our LOTM view at this time, subject to changing events, is to allow some time for the dust to settle before doing anything with the shares of Galaxy Digital. Galaxy is “the” Global leader in Institutional Financial Banking related to crypto and blockchain. They have deep experience in traditional Investment Banking and Risk Management. Former Goldman, JP Morgan & Morgan Stanley employees fill the upper ranks at Galaxy. They are not the new kids on the block that many of the other Crypto related companies are.

The financial industry (brokers / bankers / venture investing) is a boom & bust industry. It is uncertain how long it will take the industry to recover, but when it does, this industry has the ability to go from zero to 100 MPH very quickly. This is a way of saying, we’ll let the dust settle and plan to build share position going forward.

Good luck. This was a lighten strike at a time many thought the sky was blue in the crypto space. Assess where you are at in this process and decide what is best for you in your position in life. Remember each crisis also presents an opportunity. It is in tough times those of us who were athletes were told, this is “when the tough get going”. The assessment time is best spent on what is the most positive path forward for each of us. We going to work on dollar-cost-averaging our way through this. The out come could still be rewarding.

A second approach to keep a position is to sell and rebuy in thirty days. Having been a broker and working with many people over 25 years, this does not usually work. It is easy for sell in disgust and say you’ll buy back into harvest the loss and start over. The reality is few ever re-buy. It is like touching a hot stove burner for the second time. I have found if staying with the position is the option, it is better to dollar cost average first. Sell the higher cost share later after the 30 wash sale period has past. Holding the position without dollar-cost-averaging, is a poor third choice. Dollar-cost-averaging, shorten the time to recovery and you lose the benefit, however small, of the tax loss deduction. Take the time to hear the company position. It timely to the FTX event and crypto industry.

II: Take-over of Yamada Gold by Pan American Silver and Agnico Eagle

Two of the best companies in the mining industry have teamed up to take-over Yamada Gold (AUY).

Pan American (PAAS) holds the largest silver reserves in the world and is the second largest silver producer in the world. 2023 is projected by management to be a much improved production year for the company over 2022.

Agnico Eagle is now a merger of equals, created in Feb 2022 between Agnico Eagle and Kirkland Lake. Kirkland Lake and Agnico were two of the highest quality gold mining companies separately, prior to their merger. The resulting Gold mining company in our opinion is te best of the Large Cap gold producers.

The share price of both companies, Pan American and Agnico were down today on the news. We believe this is an excellent opportunity to buy shares of Pan American and Agnico, however the purpose here is to follow-up on previous our comment on Pan American Silver.

Pan American had a 52-week high price of $29.59. Today’s price is $13.64.

Two-year PAAS chart from Finviz:

We suggest dollar-cost averaging into the stock. The company has low debt, high cash level and is the western hemisphere industry leading silver producer. If you are a technical trader, wait for the stock to base and begin a rally. We think the probabilities are good you will be buying 20% to 30% higher. Just a thought.

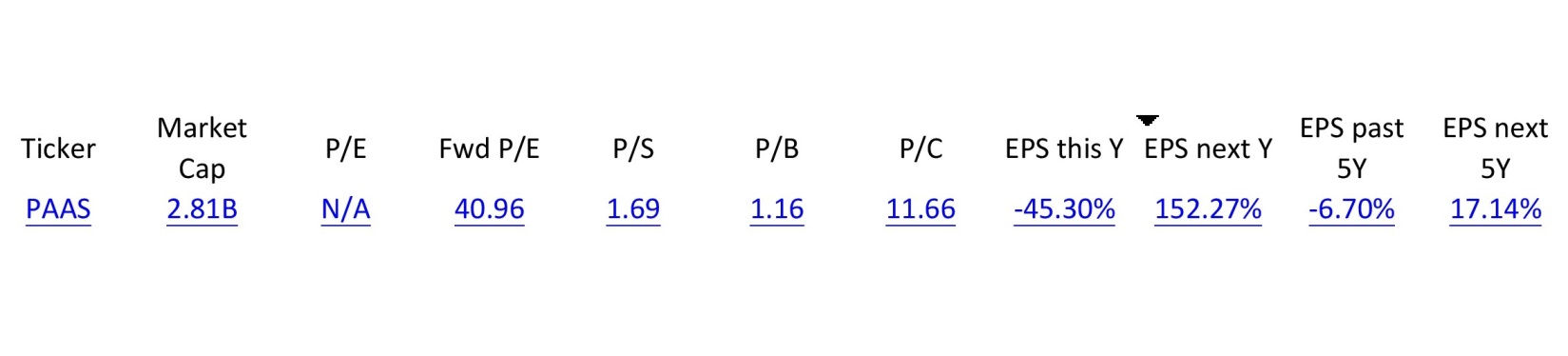

Stats from Finviz

With a bit of digging (linked here), you can find that Pan American has an estimated 1.8 billion ounces of silver not priced into today’s market cap. I will let you multiply 1.8 Billion ounces of silver X the price of physical silver today oat $21.17. Compare that to today’s market cap on PAAS of $2.81 Billion.

Buying Pan American as a healthy company with that amount of silver reserves in the ground and within the context of todays inflation rate is a no brainer IMO – if you appreciate value.

Below is a chart of the price action on physical silver for the chart analysts among you.

If you find this of interest, consider subscribing to Tom’s LOTM Blog.

Written November 9, 2022, by Tom Linzmeier

Accounts related to LOTM, and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()