Gatos Reports Record Quarterly Production for the Third Quarter of 2022,

Increases Production Guidance and Lowers Cost Guidance for 2022.

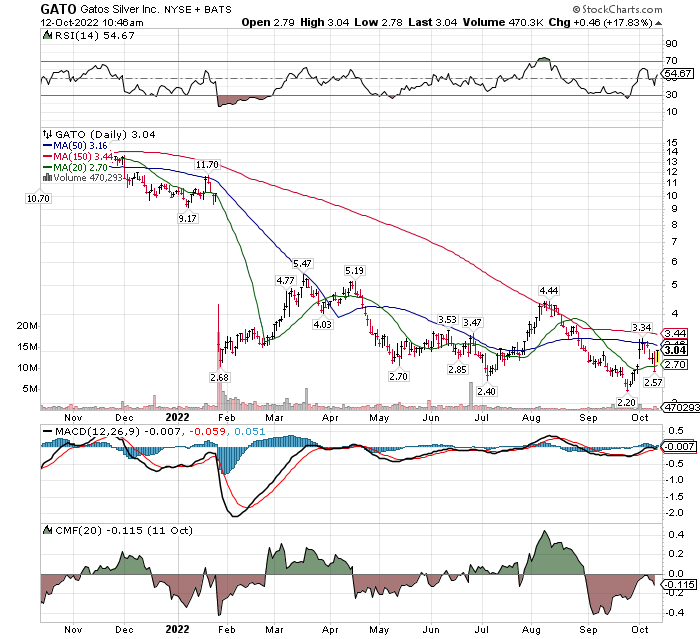

Stage one chart pattern. This is a basing chart pattern. The lows are likely in for a foreseeable time period. If the stock declines, it would likely be market related and not company or industry related. Fundamentals are healthy so survivability is not an issue. Dollar-cost-average (DCA) approach to risk management is suggested.

- RSI is above the 50% line. Positive.

- MACD is neutral, ready to go positive probably will with today’s price action.

- CMF – an accumulation or distribution indicator, is ready to go positive.

LOTM related account owns Gatos. Our long term (two to three year price goal is $10 to $12.

| Analysis | Overall | Short | Intermediate | Long | |

| Bearish | Neutral | Bearish | Bearish |

Price and technicals are in position to turn positive in a short period ‘if’ the price rises above the 50-day and 150-day MA. The 150-day MA is at $3.44. Current price is 10/12/22 is $3.21.

Gatos is seen as a value and fundamental purchase at this time – not a technical buy. But – technical going positive would add new buyers to the stock.

LOTM is very optimistic on the silver industry from a limited supply and high demand perspective.

Written October 12, 2022, by Tom Linzmeier for Tom’s Blog at https://lotm.substack.com/

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment appropriate for you

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()