- Chinese trade domination

- Chinese technology advancement

- Bi-polar Global Currency Developing

- Investment areas to position in to take advantage of this long term trend.

Bi-polar Global Currency & Supply Chain Developing

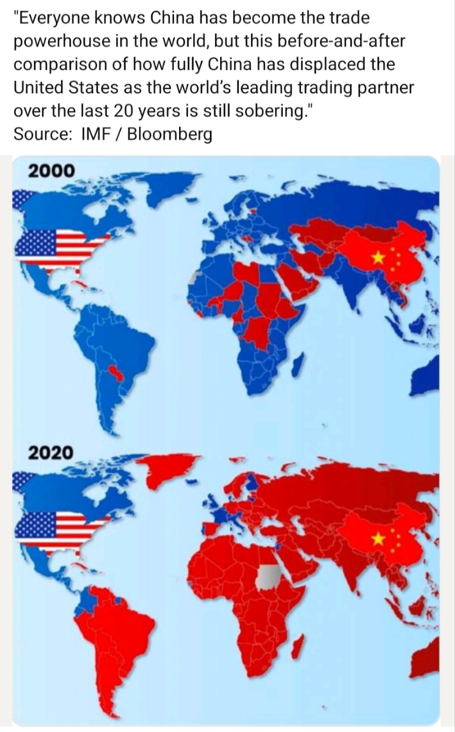

The two maps below illustrate the change in global trade from 2000 to 2020. Dynamics have change with China reversing Financial and Trade importance on the global stage from the United States. Countries such as Germany and Saudi Arabia, traditionally allies to the USA, have shifted to moving towards China in trade and financial relationships.

The USA has responded with sanctions against China’s technology (think Huawei) and restricting China’s ability to buy high level semiconductors (Chips Act). The USA has also responded by downsizing from being part of a China global supply chain to moving towards a bi-polar world supply chain system. The trend in motion currently is a realigning the USA supply chain to the western hemisphere. North America, Central America, South America and Western Europe. When viewing the map above of China’s current influence, this realignment is not going to be easy. The USA is using force and heavy influence in moving to re-establish US Influence. Ukraine and Taiwan are part of the USA pushing to stop United States declining influence.

- “China & America’s Economic” – Matthew Pines on YouTube video, Jan 8, 2023. Length 2:03 hours.

Two hour in depth review of the Geo-political environment between USA/China/Russia. This is an in-depth discussion on geo-political and investing trends currently in motion and its potential to expand.

This includes a discussion:

- Potential of shifting from proxy wars to direct kinetic hot war.

- Global trade and supply chain realignment – re-shoring manufacturing to North and South America.

- China and Russia building a new global payments system using a combination of currencies and commodities.

- Bitcoin being used as a US trade and currency monetary network in defending USA dominance in international trade payments.

Investing approaches:

China and Russia have been moving towards a currency/commodities based global payment system. It is highly probable that gold and copper will be part of the commodity portion of the currency/commodity package. Gold as the traditional, 5,000 year history of value. Copper, because of copper’s importance in economic growth of building construction and the electrification of the globe. Also, as political influence in bringing copper producing countries such as Peru, Chile, Brazil and Democratic Republic of the Congo into the new global currency.

In general opportunities in investing fall into these groupings to different degrees.

- Bitcoin – At this point in time Direct investment in Bitcoin is like investing in an exploration/development company such as Vizsla Silver (VZLA)*. You know there is value there today but until the product is turned into a producing asset you cannot judge the true worth. Bitcoin on this correction has shown ten plus years of very successful appreciation but the future value is yet unknown. LOTM believes Bitcoin has many uses not yet put into motion. Used a geo-political tool to the advantage of the USA while many countries restrict crypto currencies is a potential advantage if the USA chooses to act in this direction. Grayscale Bitcoin Trust (GBTC)* and Osprey Bitcoin Trust (OBTC) are trust options instead of direct ownership of bitcoin.

- Commodities, Metals both precious and industrial. Multiple countries have been decreasing ownership of United States Treasuries for a decade or more while increasing their ownership of Gold. Energy is “the most important” resource for any country. Nuclear/Uranium is the only baseload energy source that can replace fossil fuels. A diversified portfolio might consider an allocation into nuclear energy exposure. Periods of war or conflict are consumers of all commodities and result in inflationary periods. Supply constraints, such as ESG, that limit supply in a period of accelerated consumption of commodities will cause bottlenecks that result in a run up in commodity prices. China buys 30 tons of gold in December 2022.

- Cybersecurity and Defense companies. The global order is changing. Typically, this leads to kinetic wars. Kratos (KTOS) is a position in Ten Under $10 for the Double. Kratos is involved is cybersecurity, space projects and military defense products.

- Space, This could be included in cyber security and defense but should be treated as a standalone topic for investment purposes. Satellite communication systems are space based. This will be a first strike target in and kinetic war. This is not a future investment opportunity; it is a very active movement today. We are looking at Rocket Lab USA (RKLB).

- Reshoring. Robotics, Artificial Intelligence (AI), Software, Construction and facilities Construction materials are all areas that will benefit from reshoring manufacturing from SE Asia to North and South America. Mexico stands to be a very big beneficiary of US reshoring manufacturing to North America.

Summary:

The opportunities for investing success are high. Markets will cycle over time. We are currently still in a bear market. Bear markets are good times to selectively accumulate over-sold companies for long-term ownership. They are also good times for short term traders. One has to be nimble when trading than if dollar-cost-averaging (DCA) into longer-term positions, but bear market rallies can be very dramatic. It is also very hard to forecast the end of a bear market as different sectors will bottom at different times. This is where knowing your company and its fundamental value comes into play. It does not mean the value will keep the stock from going lower, but you’ll sleep better if comfortable know that value you bought is real and can recover.

Written January 9, 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()