- Ark Genomics (ARKG) Hit and crosses 150-day MA

- Recon Africa (RECAF) The Good The Bad and The Ugly

- African Oil (AOIFF) same size as Recon Africa but producing and hit a major sized well off Namibia!

Ark Genomics (ARKG) $40.77

ARKG has hit its 150-day MA and the underbelly of what used to be support in the $0 to $41 area. With Chaikin Money Flow (CMF) suggesting someone selling (distribution) into this pop above its 150-day MA, we suspect a bit of a pull back. Traders who bought for a trade might take half their money off the table while longer term investors might hold through a pull back.

The choice is between a Bird in Hand – a small gain, Vs the “Potential Bird,” of a bigger gain with time.

As you can see in the second chart, Resistance is about every $10 level. $40 then $50, then $60, then $70. At this time, I am leaning into the belief that the market will pull back just before the November election or just after the November elections. For ARKG, I suspect the price can hit the top of te saucer pattern around $50 before a meaningful correction happens. Other factors to consider are trade taxable or in a tax free or deferred account. Are long term capital gains your goal. The correction in Genomic stocks has been pretty deep If you bought around $35ish area, you might not see that price again or, if you do, you might what to get greedy and buy more shares. It is never easy is it. Best path for your nervous system, is decide what your goal is and do it with no regrets. Look at the second chart. In the last year, how much time has ARKG spent above its 50-day moving average? Not much and most of it has been since June. That is bullish. The tug or war between Fear of Loss and Fear of Missing Out of a big winner. Sell some, own some is one form of sedative.

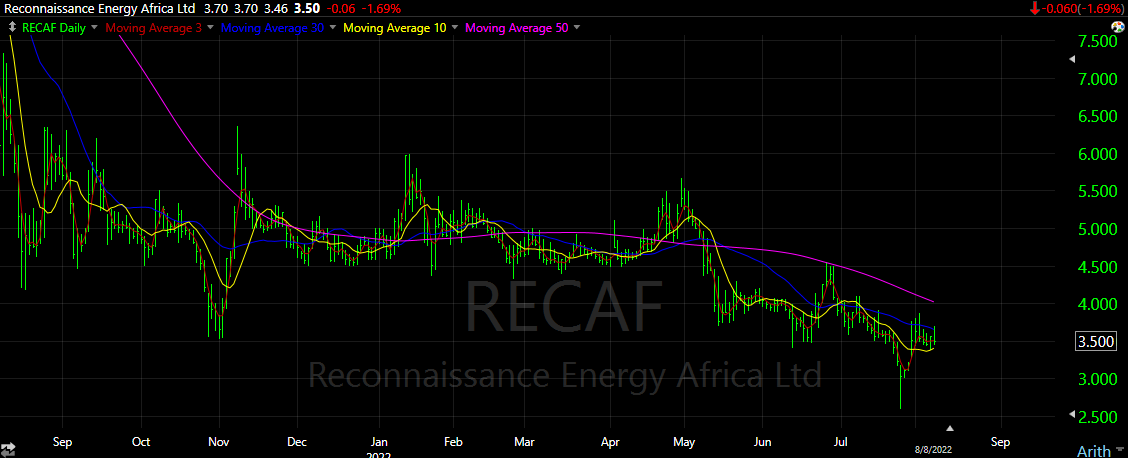

Recon Africa (RECAF) $3.50

Oh Recon, you were so good to us and now so disappointing. Here is the Good, The Bad and the Ugly on Recon.

The Good:

Recon controls about 28,000 square Kilometers of drilling rights. That is an enormous parcel of Land. On its first three test wells, they found oil or gas on all three. It is very unusual to hit on your first three wild cat wells. The government of Namibia and Botswana want Recon Africa to succeed. Raising money to explore this land grant was very easy.

The Bad:

Time. It talks time to explore and prove up a property and it is never smooth going. My guess is that it will be in the three to five year time frame to production. This period between discovery and production is similar to the Valley of Death. Stocks very rarely break out in this no man’s land of time. There certainly could be good news in this stretch of time. If they prove up a section of the property but not the entire property, Recon could sell or joint venture with a major producer. This could shorten the time line to a reason for the stock to pop. On the negative side they could drill three dry holes and that will not help an already struggling stock price. The chart is long time under its 450-day moving average and the last year has not been pretty for the stock. For the company, it was a great year so answer to yourself the question – what do I want out of this? Near term performance or a long-term homerun? Do I own the stock for a trade or the company for long-term multi-bagger?

The Ugly:

Environmental Groups are making Recon the posterchild in the war against Fossel energy. This is going to stop any time soon. We all want a clean environment. The technology and laws exist than can protect the environment however it is the enforcement of the laws where things go wrong. If the close eye of environmentalist keep the heat on for enforcement and compliance with laws, then that is the glass half full side.

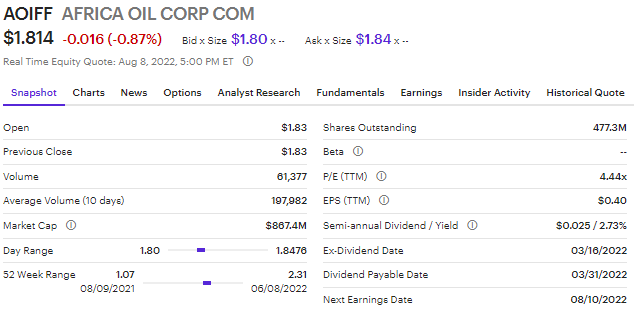

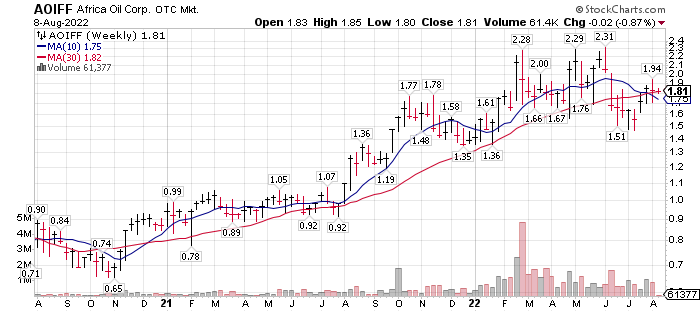

Africa Oil (AOIFF) $1.82

Alternative to Recon Africa is another Vancouver, British Columbia company, Africa Oil AOIFF.

AOIFF is a producing oil company with production off the coast of Nigeria. From this oil field, AOIFF generates enough profit to have a trailing P/E ratio of 4.4. This factor alone make Africa Oil more conservative than Recon Africa.

This chart looks like it is at the beginning of a stage four chart pattern. Stage four is the declining zone of the four chart patterns. Therefore, you might want to put this on your watch list or better yet buy a few shares in your portfolio, so you don’t forget it.

So, this company already produces and is cheap on a fundamental basis. They are 6% net owners of a big discovery off the coast of Namibia. This discovery is years away from production but perhaps closer than Recon Africa’s time to production. Yes, the same off-shore Namibia, Recon is drilling on-shore. The strike off the coast of Namibia is so big, even the 6% net ownership held by AOIFF is meaningful.

Africa Oil (OTCMKTS: AOIFF) Shares Cross Below 200 Day Moving Average of $1.82

Posted by admin on Aug 6th, 2022, Defense World.

Excerpt

A number of analysts recently commented on AOIFF shares. Barclays lifted their price target on Africa Oil from SEK 23 to SEK 24 and gave the stock an “equal weight” rating in a report on Friday, July 15th. Scotiabank raised their target price on Africa Oil from C$3.00 to C$3.25 in a research report on Wednesday, June 8th.

Ownership/Management: The Lundin Family of Canada controls the company shares and management. This is a good thing. The Lundin Family is very well known and respected in Canadian Natural Resource development. Consider this an ace in the hole as far as African oil is concerned.

Rumour Has It (Adele): Rumors are about that Africa Oil’s 50% owned property in Kenya has a party from India interested in buying a significant part of the property. Late stage negotiations mentioned at that. A rumor, but potential for a positive surprise. As with most rumors, I have no source to list. Do not buy for this reason but it could be a pleasant surprise.

About: Africa Oil has exploration assets located in Guyana, Kenya, Namibia, Nigeria, South Africa, and in the Senegal Guinea Bissau Joint Development Zone. The company was founded on March 29, 1983, and is headquartered in Vancouver, Canada. Eight Analysts provide coverage on Africa Oil.

Summation: Arica Oil is a “good deal” value wise, however the technical chart is topping. At less than 5 times earnings, even paying a small dividend and a big discovery just made, we are not fearful of Africa Oil. It does seem that a taking a small position and dollar cost averaging into a share position with a two to four year time line could get you a double or better. Market cap is about C$880 million with cash of C$140 million.

This company is real. By this I mean Excellent and proven ownership/management, growing revenue, positive cash flow, modest debt and drilling in a “hot” area of the world Africa. The company is shareholder friendly with the small dividend and share buy-back intent. African oil (geographically) is an alternative oil and gas source for Europe as they move away from Russian fossil fuels.

Written Aug 8, 2022. by Tom Linzmeier, editor, LOTM Newsletter

We available for consulting, training & coaching in Equity investing. If you think we can help you recover from market correction, financial disaster or help you find your next double, contact us. We are problem solvers at heart.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()