- WonderFi – Coinsquare and CoinSmart Combine in Three-way Merger.

April 3, 2023 – Cryptocurrency-related firms WonderFi Technologies (WONDF), Coinsquare and CoinSmart Financial (CONMF) all have merged their respective businesses to provide Canadian users various crypto-focused solutions, the companies said Monday.

The combined company, which have over $600M in assets under custody and a registered user base of about 1.65M. The combined companies will offer retail and institutional crypto trading, staking products, B2B crypto payment processing and will also soon include sports betting and gaming.

Upon completion of the deal, expected in Q2, WonderFi (WONDF) shareholders will own approximately 38% of the combined company, Coinsquare shareholders will own ~43% of the Combined Company, and CoinSmart shareholders will own ~19%, on a partially diluted basis.

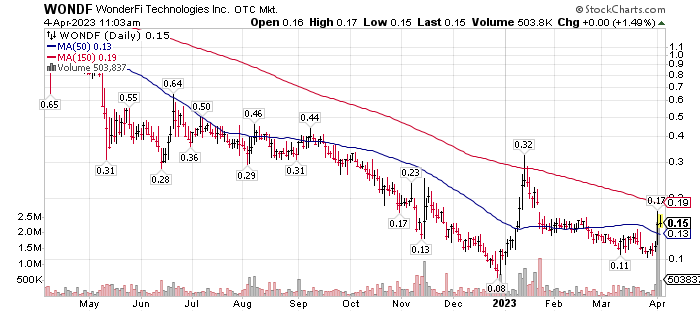

LOTM believes WonderFi has the people and money to survive the crypto winter. We are not aggressive buyers but consider the position a hold. We also believe the Crypto winter is behind us. We will wait for news to develop on the completion of the merger for now.

Globe and Mail April 3, 2023 Story Link

WonderFi, CoinSmart, Coinsquare to combine into Canada’s largest crypto trading platform

WonderFi Technologies Inc (WONDF), CoinSmart Financial Inc. (SMRT-NE) and Coinsquare Ltd. have reached a three-way merger agreement to create Canada’s largest cryptocurrency trading platform in a bid to compete against global giants across the controversial sector for digital assets and blockchain technology.

The deal is expected to be finalized by the end of the second quarter. Pending regulatory, court and shareholder approvals, it would put together nearly $600-million in combined assets under custody from a customer base of around 1.65 million Canadians, according to a joint announcement on Monday.

Upon completion of the transaction, shareholders of Toronto-based Coinsquare will own 43 per cent of the combined company, while Vancouver-based WonderFi will get 38 per cent, and Toronto-based CoinSmart 19 per cent on a partially diluted basis. Users for all three companies will soon be able to invest in equities, place wagers, trade, earn and pay with crypto in a single platform, said Dean Skurka, president and chief executive officer of WonderFi.

The newly combined company is not expecting to change its name to a single banner any time soon. It will have a board of directors comprised of nine members, with four proposed members from Coinsquare, three from WonderFi and two from CoinSmart.

The merger brings to a halt a months-long, considerably heated back and forth between the three companies.

In September last year, Coinsquare announced it would buy CoinSmart for about $29-million in cash and shares. That deal was expected to close by the end of 2022. But in January, Coinsquare announced it was pulling out of the agreement, which CoinSmart said took it by surprise and called “completely bogus.”

Just after that termination, WonderFi alluded to talks of another deal, stating it had “held preliminary discussions with various third parties.” Although WonderFi declined to comment further at the time, CoinSmart said in early February it was willing to seek monetary damages in court to enforce its deal with Coinsquare.

The disagreements came to a “successful end” at a dim sum restaurant in downtown Toronto in late February, said CoinSmart CEO, Justin Hartzman on Monday. Arranged by Bobby Halpern, who is described by the companies as a “deal-making architect,” a lunch between the executives of Coinsquare, CoinSmart and WonderFi ended with rough notes on a piece of paper, which later became the legal terms and conditions of their agreement over the next month.

“Who would’ve thought this rare, three-way deal would get done over some sticky rice and shrimp dumplings?” Mr. Halpern said.

The three companies have already been registered with regulators to operate in all 13 of Canada’s provinces and territories. Coinsquare, however, is registered as a dealer and marketplace member by the Investment Industry Regulatory Organization of Canada – the first crypto exchange in the country to do so, as others continue to seek that status.

The combined company will consolidate under Coinsquare’s investment dealer registration with the New Self-Regulatory Organization of Canada, a recent amalgamation of IIROC and the Mutual Fund Dealers Association of Canada.

Coinsquare, CoinSmart and WonderFi brought in a total of roughly $37-million in revenue last year.

For Actionable Stock Ideas, consider a subscription to Tom’s LOTM Blog.

Our Style – We are more a controlled speculator, than diversified investor or short-term trader. We allow 100% loss/risk on some purchases. Often, we dollar-cost-average into losing positions. Volatility is our friend, not something to be feared. We let our winners win, as much as possible. We do not like paying taxes. We love value, yet watch charts. Our goal is to find value stocks that might double in one to three-years.

See our website for our doubling to a Million$ game. We were playing this game of doubles before Patrick Ben-David talked about it. Ideas in this blog are highly volatile and only for use by those who are comfortable with high-risk, high-reward investments.

Written April 4, 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()