In this new Dividend series, LOTM, will bring Ten Dividend stocks that we believe are good long-term holdings that you can dollar-cost-average in building share positions . Some like Fortescue, pay a higher than normal dividend. You should interpret this as “the market” is fearful of a recession and slower global economy. The market could very well be right so allocate funds appropriate to your financial situation.

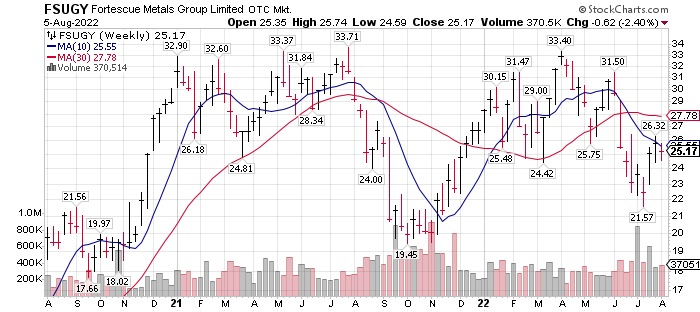

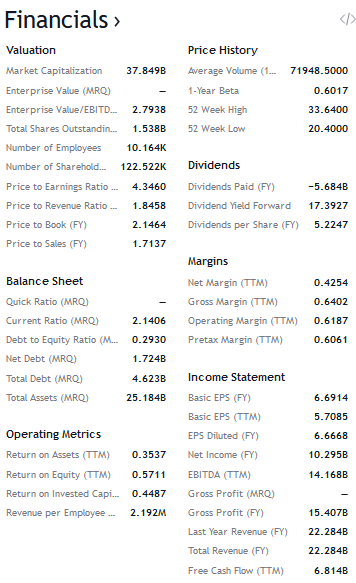

Fortescue trading in Australia, symbol FSU – ADR in USA symbol FSUGY $25.20 Aug 5, 2022, Trailing Dividend is 17% – P/E ratio of 4.3 (TradingView below)

Transitioning from being a leading Iron ore provider to China

to a

Global provider of Hydrogen & clean energy.

Company Profile – FSUGY

Business Description

Fortescue is an Australia-based iron ore miner. It has grown from obscurity at the start of 2008 to become the world’s fourth-largest producer. Growth was fueled by debt, now repaid. Expansion from 55 million tonnes in fiscal 2012 to about 185 million tonnes in 2022 means Fortescue supplies nearly 10% of global seaborne iron ore. Further expansion above 200 million tonnes is likely once it completes construction of its 22 million tonne Iron Bridge magnetite mine. However, with longer-term demand likely to decline as China’s economy matures, we expect Fortescue’s future margins to be below historical averages.

More recently, Fortescue has diversified into green energy, with ambitions to become a major supplier of green hydrogen and green ammonia. Its efforts here are at an early stage.

Website Link: Source: Morningstar: https://www.morningstar.com/stocks/pinx/fsugy/quote

YouTube on John Andrew Forrest, Founder Fortescue – the person:

The People Who Built Australia, Sunday 13 June 2021.

Can renewable energy turn Australia into a global superpower?

Above and below links: Andrew ‘Twiggy’ Forrest and tech whizz, Mike Cannon-Brookes aim to dominate Green energy. Forrest and Cannon-Brooks are the lead investors in Sun Cable.

Sun Cable, owner of the largest Solar Farm in the world is laying, now, a cable between the solar farm in Australia to Singapore. When completed this cable is expected to provide Singapore with the majority of its electricity from the Australian Solar Farm.

Sourced from TradingView Aug 5th 2022

YouTube on John Andrew “Twiggy” Forrest the person:

- The People Who Built Australia, Sunday – 13 June 2021.

- Can renewable energy turn Australia into a global superpower?

Above and below links: Andrew ‘Twiggy’ Forrest and tech whizz Mike Cannon-Brookes aim to dominate Green energy

John Andrew Forrest and family are the second wealthiest family in Australia.

Up 5% in a month, is the current Fortescue share price a buy or a sell?

Is it buy, hold or sell for Fortescue shares today?

Sebastian Bowen ❯ Published August 4, 2022, Motley Fool

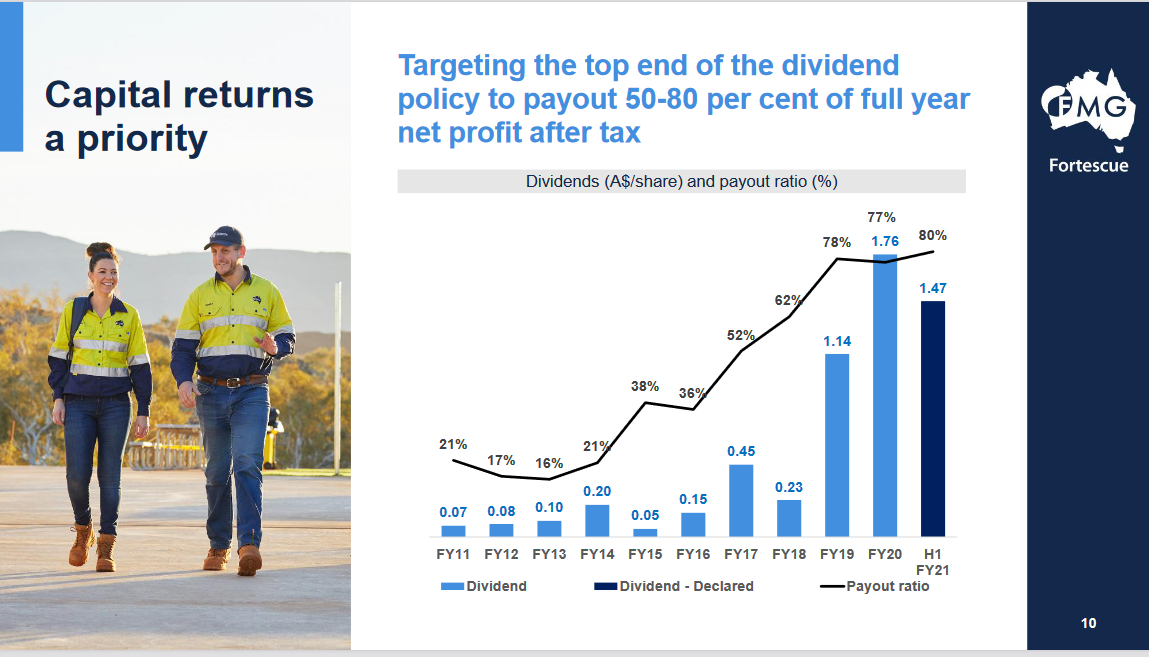

LOTM: The above Motley Fool article is neutral at best. Fortescue is a long-term position that pays a higher than normal, but variable dividend. The dividend, about 17% in two semi-annual distribution with a year-end bonus (maybe) is totally dependent on the company’s earnings.

LOTM likes FSUGY as a core holding.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()