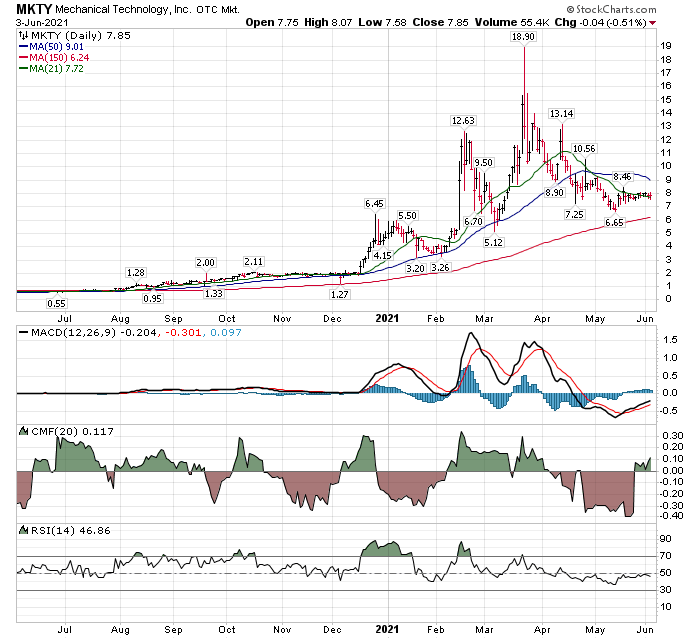

Based of the indicators above, my conclusion is that MKTY shares are under accumulation. It maybe that there is even a “cap” placed on the shares around the $8.00 area to prevent the shares from rising as the accumulation process fills out building its potential position. This is institutional work, we are observing.

- MACD has been on a trading / accumulation cross-over buy signal since mid-May.

- RSI bottomed in mid-May as well, but with the share price trading flat, RSI has lost its upward momentum. Currently we place a neutral opinion on RSI.

- CMF (Chaikin Money Flow) is showing accumulation (green) coming into the shares.

- Price is consolidating between the 50-day and the 150-day. A true buy signal will come when the price closes above the 50-day moving average – now at $9.01.

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()