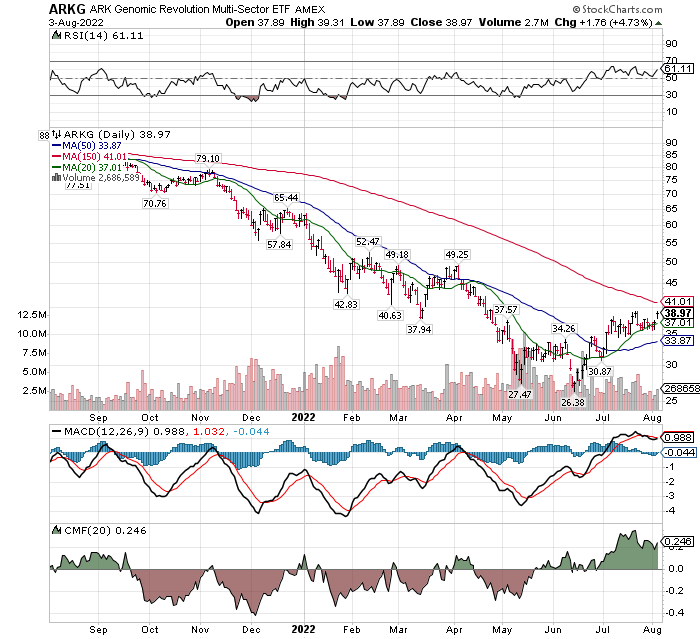

ARK Genomics (ARKG) $38.97 Has crossed it initial buy signals and is close to triggering a Stage 2 chart pattern. Everything looks good so far. The biggest concern is the issue of the current rally phase being a rally within a Bear market. That question I can’t answer. My guess is that after a recovery back towards the $45 to $50 area, Genomic stocks will chop side ways for a while – perhaps a long while.

Signals that created “a probable bottom has been made,” include:

- RSI rising to above the 50% level

- MACD has a rising cross-over where its short differential line crosses above its longer differential line

- CMF is above the zero-line (green color)

- Price above its 50-day moving average.

Second price-leg higher signals.

- 20-day MA crossed above its 50-day moving average. Confirmation of the first-leg higher action is real.

- Price has consolidated the first-level breakout and appears to be starting the second-level breakout.

- Price targets are at 150-day moving average and price resistance levels at $45 and $50.

Risk Management Policy:

Upside price targets for trading goals are very clear. Place your stop loss at 1/3rd the trading percentage goal.

Longer term investors consider dollar-cost-averaging (DCA) at least three times with a stop-loss 10% below the average of the three DCA purchases.

DIVIDENDS!

High Dividend Teaser:

We are finding plenty of 11% to above 20% dividend paying situations available in the Market. babies have been thrown out with the Bath Water. Honestly some of these are mutual funds with 35 to 50 positions, so there isn’t much company risk. These aren’t everyday names and there are warts on someone them. The biggest issue seems to be they are illiquid at a time when institutions don’t want illiquid situation.

Here is an example:

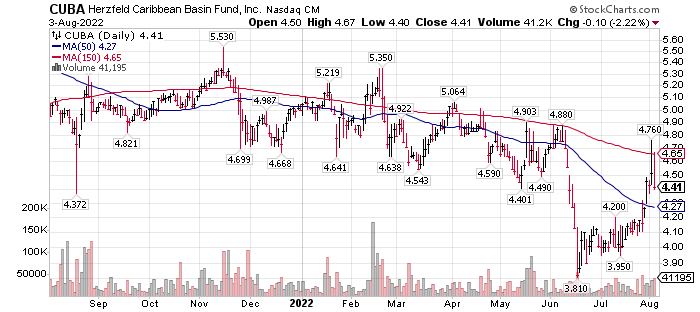

It is a closed end fund with about 35 different companies held in the fund. The shares outstanding are 5.83 million shares. Insiders own 16%. Tiny float. But with a 20% plus dividend in cash or stock.

The Herzfeld Caribbean Basin Fund Inc. name is web site linked

So, if you are comfortable with companies with operations in the Caribbean or headquartered in the Caribbean, you might find this appealing. Who knows, with the re-shoring of manufacturing from SE Asia, some of it might get re-shored in the Caribbean. Dividend history linked here. The next x-date is August 20. Dividend expected is $0.2645.

We have had a decade of success with Passive investing. Now we are returning to a Hunter-Gather style investing market. Globalism is ended. Tribalism (Nationalism) is on the rise. The return of Active investing. Lots of opportunities but you have to understand what you are hunting and gathering. Dividend payers are highly desired. Trading of volatility is required. Buy dividend stocks before they become the trend. Most growth style investing will take a back seat to Commodity trading. This is why we are adding Dividend payers into our quiver of arrows for the foreseeable future.

Something to think about!

Have a great day.

Written Aug 3th, 2022, by Tom Linzmeier, www.LivingoffTheMarket.com

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()