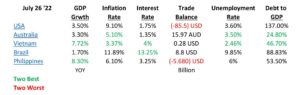

Australia & Viet Nam Standout

Actionable Ideas in each market:

- Conclusion Australia and Vietnam are the best two countries profiled on this list to manage the current Inflationary / Recession environment.

- Brazil responded quickly and with determination to its rising inflation rate. Interest rates are above the Inflation Rate. Something the US government dreams about! Brazil’s Stock Market appears best positioned to be positively reactive to falling inflation. Inflation declined in July Vs June numbers. LOTM likes two Brazil ETFs for price/moving average cross-over trading – EWZ (Large cap ETF) and EWZS (Small cap ETF). In related accounts we also own two Brazil FinTech companies PAGS and STNE.

- Australia with a low Debt to GDP and a positive trade balance are in great shape even though they are behind Vietnam and Brazil in raising interest rates to be above the inflation rate. We like Australia closed -end fund / US listed, symbol, IAF ($4.88) for interest rate (11%) and appreciation. 25% of fund holdings are in physical mining companies (which LOTM loves) and 25% of funds are in financials, which benefit from rising interest rates.

- USA with high trade deficit and very high debt to GDP, combined with real interest rate deficit to inflation is the worst looking place to be. Best deals in the USA market, IMO, are in the precious metal mining sector. Ideas for USA investors that are outstanding values with strong cash flows are available at this time. Consider industry leaders, GOLD, AEM, PAAS and emerging Juniors, SILV, VITFF and KRRGF. These six miners are strong financially, exceptionally good values, positive cash flows and have potential for 2X to 4X appreciation. Do not under estimate the rebound potential in the Miners.

- Vietnam is a hard country in which to buy individual stocks without a local account. Viet Nam’s interest rate is higher than its inflation rate, a strong positive, and desirable in a fighting inflation world, as mentioned with Brazil above. The VanEck ETF (VNM), traded as it crosses above or below its moving averages, is the best way to get exposure to Viet Nam from the USA. This ETF does price trend, so you can catch some good price trend moves. You have to monitor the price action and exit when the trend changes. Other than that, it is best to go to Vietnam, open an account with a broker you are comfortable with and follow their recommendations that meet your specifications. One must be present in Viet Nam to open a brokerage account. It is a simple process to do when present. Referral to a local VN broker is available from LOTM, if desired. We can also assist with Medical Tourism referrals if you want to combine travel, investment and medical all in one trip. I am heading over in September so let me know when you are coming!

- The Philippines could easily have a strong performing stock market with a lowering of global inflation. The GDP growth rate in the Philippines is strong. Blackrock offers an ETF, symbol EPHE. It appears to be a good vehicle for two to six month trading but other than that, we cannot recommend owning the ETF long-term. Locally managed, pre-construction, rental properties bought in new residential developments is a good way to get cash flow and appreciation. Pre-construction, per unit cost runs in the $35,000 – $40,000 per two bedroom unit. Post construction, these units sell for the $50,000 level plus or minus. Pre-construction buy-ins are how the builder finances projects. There is usually room for buy-rent-flip unless the housing market is in a falling mode and then the builder is caught also. Established Japanese builders of size and reputation are a best choice to work with. We can assist in this area if interested.

Conclusion:

If inflation rates come down in the US, and the Fed can ease off on interest rate hikes because of the lower interest rates, we expect the US Dollar to fall and money to flow to the more positive profiled countries. These would include Brazil, Vietnam, Philippines and Australia to different degrees and different reasons.

Written by Tom Linzmeier, July 26, 2022, editor LivingOffTheMarket.com

Pingback: LOTM: Two Actionable, Technical Buy Situations -