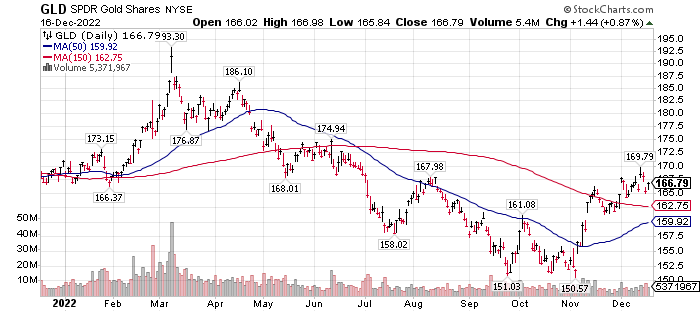

One-year GLD (Paper Gold Price): Double bottom marking the lows of stage one bottoming process. In early stage two chart pattern, the biggest appreciation stage of the four chart stages. Build positions on weakness in physical gold, Physical held in trust departments and Gold mining stock. We do not recommend buying Paper gold even though we display the charts. Paper gold (GLD) has no guarantee that gold is backed by physical gold and settlement by prospectus, can be in US fait dollars.

![]()