Why Isn’t the Market a Lot Lower?

Real News:

- Supply chains are disrupted.

- Inflation is at a 40-plus year high and that is understated

- World War III is being recognized to be in year two

- The Federal Reserve is Raising Interest Rates Aggressively

- Global Debt is not Repayable.

- “Food Shortages Coming” is being repeatedly announced by the President of the United States.

![]()

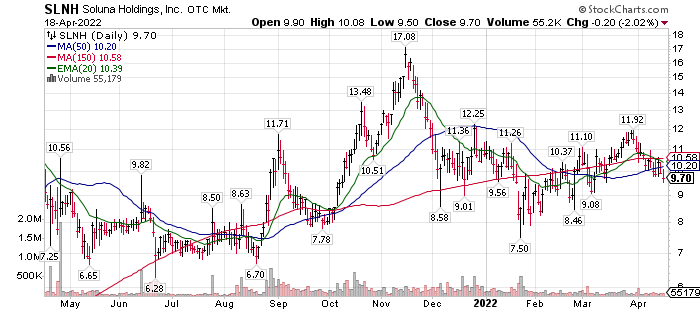

The price is roughly locked in a consolidation pattern with $12 as the top boundary and $8.50 as the lower boundary. Our fear factor is very low for the company. The lower the price, the more we expect to buy. The goal is accumulation and not risk aversion. You decide what aspect of risk management fits you the best. The $7.50 price in the chart above was on the announcement of Russia invading Ukraine. We’d like to say the bottom of the consolidation pattern is around $9.00 but it wasn’t, so we’ll use the lower base-line. If you see a $9.00 price or lower on Soluna we think of it as a gift.

The price is roughly locked in a consolidation pattern with $12 as the top boundary and $8.50 as the lower boundary. Our fear factor is very low for the company. The lower the price, the more we expect to buy. The goal is accumulation and not risk aversion. You decide what aspect of risk management fits you the best. The $7.50 price in the chart above was on the announcement of Russia invading Ukraine. We’d like to say the bottom of the consolidation pattern is around $9.00 but it wasn’t, so we’ll use the lower base-line. If you see a $9.00 price or lower on Soluna we think of it as a gift.