Money Moves. Money flows to where it is treated best. This might include a number of factors. Some of these factors Include

What is the Interest rate?

What is the Inflation Rate?

How fast is the GDP growing in Country?

What is the strength or weakness of the currency?

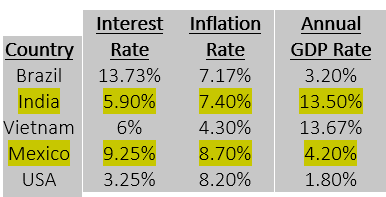

We are going to look at five countries today.

Yellow high-lite is simply for visual ease.

For investing there are rules of thumb guidance.

- If interest rates and inflation are falling it is a positive for investing in stocks and bonds of the country.

In the chart above we want to see the

- Interest rate at or above the inflation rate. Brazil, Mexico and Vietnam all have interest rates above the inflation rate. That is positive. This suggests the government is proactive or responsive to fighting inflation.

- If the GPP is above the Inflation rate that is also a plus. Two countries have their GDP above the inflation rate. Vietnam and India.

Since all four of the countries other than the USA have better numbers in GDP or Interest rates or both Vs their inflation rate, all four can be thought of as better places to invest than in the USA. Once the US Dollar begins to decline, we can expect money to flow out of the USA into the countries above money.

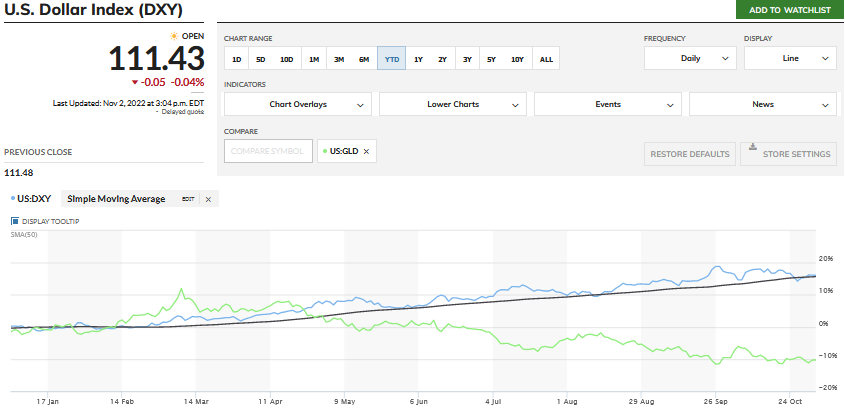

Gold & Silver is also a good place to be as or when the US Dollar falls. The chart below shows the relationship of the US Dollar (DXY in blue) and Gold (GLD in green). The black line is the 50-day moving average of the US Dollar. It starting to weaken but it also too early to say it has rolled over. GLD is “paper” gold with counter party risk, so I would suggest physical gold or gold miners above GLD, if considering gold.

Source MarketWatch

In Summary, you might consider starting to position outside the USA. From the numbers above it seems the US stock and bond market has a tougher performance road ahead of itself than other markets around the world.

To Subscribe to the LOTM Daily comments with actionable stock ideas, subscribe through SubStack, send us a check or use Zelle. Linked here for more information.

Written November 2, 2022, by Tom Linzmeier, for Tom’s LOTM Blog.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()