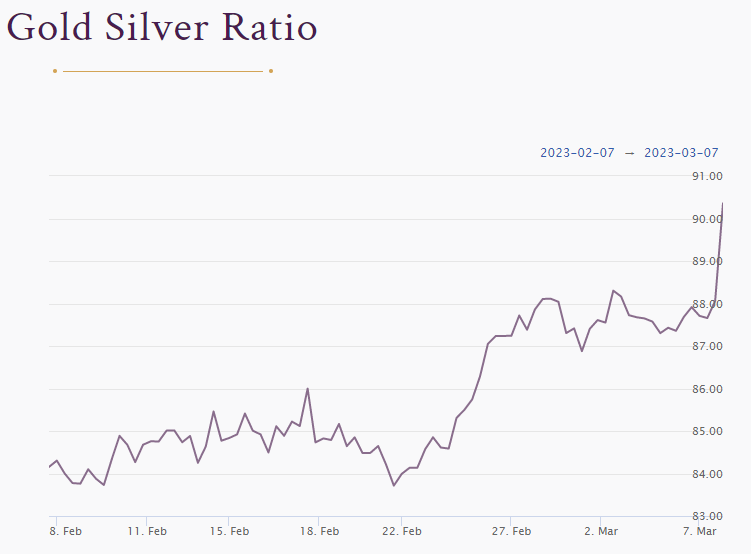

March 7, 2023 Gold to Silver Ratio 90.4 (Link)

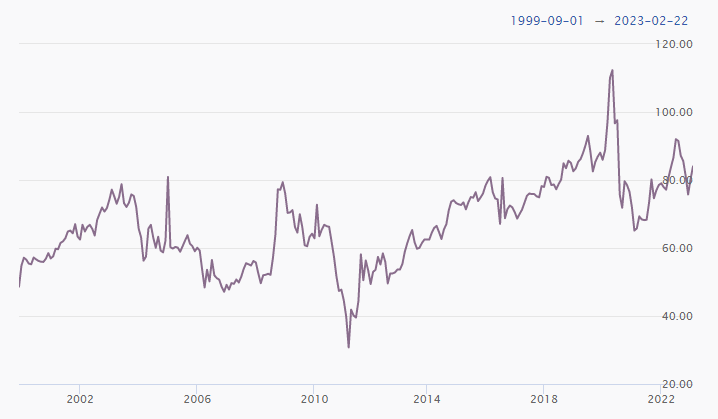

Historic Gold silver Ratio 21 years ending Feb, 22, 2023

A Gold Silver Ratio reading above 90 oz of silver to buy 1 oz of gold, does not happen very often. A more normal number is between 60 and 70 ounces of silver for one ounce of gold. Silver has rallied to as high as 35 to 45 ounces of silver for one ounce of gold.

Monday’s LOTM blog shared eleven, Silver exploration and producing companies. We like all eleven. For some diversification (rather than picking one or two names) we suggest owning a big producer like Pan American Silver (PAAS)* & a smaller producer like Gatos Silver (GATO)* along with a district size, exploration company like Vizsla Silver (VZLA)* or Discovery Silver (DSVSF).*

The point in sharing this is that silver is cheap and the upside is great. Three to ten-fold upside potential is what we expect. The time periods are harder to lock in. Our best estimate is between now and three to five years. Buy physical silver or buy the exploration and producing mining companies. All are attractive values. Mining and exploration gives you leverage without borrowed money. That leverage will cut both ways. Upwards and downwards, so play within your capacity for loss.

Art of SPECULATION:

LOTM blog is best suited to aggressive speculation than for investing or trading. You get to choose how you apply the information. Yes, we have lost some companies to bankruptcy over the years but we work hard to find companies with big upside potential that are survivors – whatever is thrown at them. Work a risk management approach that is suited to your personality and your financial situation.

Below are two short videos that are well worth sharing. Both are both opportunity and knowledge building.

Rick Rule on Mistakes & Lost Money – presented on YouTube by Resource Talks

The first video (above) is a twenty minute video of Rick Rule, gives an unintended master class on speculation. His chosen vehicle is the mining industry. Just by algorithm or unintended consequence, a video with Cathie Wood, founder of the Ark Funds, explains her style of investing – which happens to be the same or very similar to Rick Rule. Her description uses different descriptive words but in fact is the same style.

“This Will EXPLODE From $8 Trillion to $210 Trillion”

Cathie Wood’s Prediction on YouTube

Cathie’s chosen vehicle to operate within, are futuristic growth industries. Robotics, Artificial Intelligence, Space, Genetics and Blockchain.

Both Rule and Wood’s styles are similar to what we use at LOTM. It is a speculators approach. Wood has refined her approach to target, concentrate and focus on a specific theme. Rule is the same with a tight focus on Natural Resources.

When the market corrects, as it has, Wood down sizes the number of companies she owns to a smaller number of companies. In her case, from 50 companies to 35. In my case, from ten companies to three positions, is common practice.

The LOTM name for this approach is to “Circle the Wagons.” Sell the weakest companies, take the proceeds and add to the strongest companies with the best opportunity for price recovery. I did say strongest companies, not stocks. It is a big distinction. This “Coiled Spring” approach through dollar-cost-averaging and some tax management selling, allows a faster asset value recovery when the market doers recover. This approach is more volatile than what most investors want. That is why we consider it speculating. LOTM is more speculator than balanced investor or trader.

Guide-lines all three of us use are, 1) we are looking for greater than “normal” upside returns. 2) our time lines are longer – three to five years. 3) we are usually early to buy, trying get the lowest value cost as possible. 4) we are not being afraid to dollar-cost-average into positions as long as our original investment theme stands. 5) we try to let our winners run yet take our cost off the table as a stock is working higher.

These are trying time but this is the time fortunes are built in the coming bull market. This is the time to pay attention, do your homework / research and plant those acorns so the next bull market grows them into giant oak trees. Make a plan, focus, concentrate and execute the plan.

For Actionable Stock Ideas, consider a subscription to Tom’s LOTM Blog.

Written after the market close March 7th, 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()