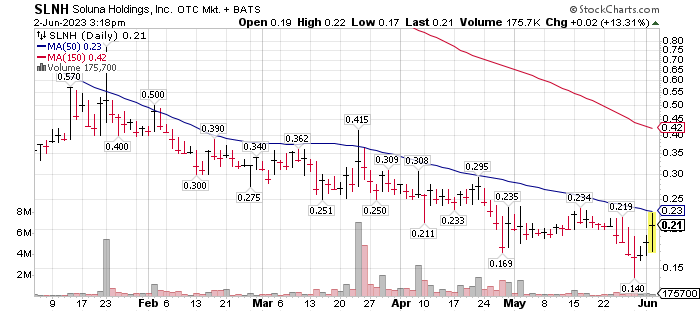

Nothing yet technically to suggest a reason to buy. Any buying in shares of Soluna stock should be done with an understanding of the business model, current fundamentals, contracts in place and scope of the market potential available to Soluna.

Below are excerpts from a Soluna paid, May 17, 2023 report, from Water Tower Research linked here. Water Tower Research is a public relations firm presented in the form of equity research firm. Ever though it is not an independent third party opinion it does represent the position of Soluna management at this moment in time.

Excerpt from the Water Tower report May 17, 2023.

KEY POINTS • Turnaround complete. In recent weeks, Soluna has received interconnection approval for all 100 MW at its flagship Project Dorothy, secured contracts and is energizing the first 50 MW (1A and 1B), reached a 14-month extension on its October convertible notes, and now sees itself being operating cash flow positive in 2H23. We expect these accomplishments will allow investors to see the value of its existing assets and its pipeline rather than focus on near-term liquidity concerns and regulatory approvals.

• Project Dorothy 1A and 1B are now fully booked. Soluna announced the closing of a $14 million partnership with Navitas Global for the 25 MW at Project Dorothy 1B. The deal includes a $12 million equity investment for 49% of Project Dorothy 1B and a $2 million loan to Soluna to complete construction at the site. The company plans to use the investment from Navitas to purchase Bitcoin miners for proprietary mining.

• Soluna is on a trajectory to reach operating cash flow positive in 2H23. With Project Dorothy 1A, 1B, and Project Sophie energized and filled with both hosting and proprietary miners, the company expects it will be operating cash flow positive during 2H23.

• Recent contracts and equity investments imply the value of the existing projects to be in excess of market valuation, making Project Dorothy 2 and the current project pipeline a free call option. Looking at the 2023 purchase prices paid by Spring Lane Capital and Navitas Global suggest the market value of the company’s ownership in Project Dorothy and Project Sophie to be greater than the current enterprise value giving no value to the 50 MW of Project Dorothy 2 (which has interconnection approval) or the pipeline of potential projects.

• Navitas Global investment is further validation of Soluna’s existing projects and potential pipeline. Navitas Global is now the second private equity firm that has become an investor in Project Dorothy, which we see as an additional market endorsement of the company’s project offerings and capabilities. The Managing Partner of Navitas Global stated, “this facility is poised to outcompete in all market conditions.” Not only should this make securing investors for developing the second phase of Project Dorothy easier (it already has interconnection approval), but it should also bolster the company’s prospects for potential projects in the pipeline as Project Dorothy is a replicable template.

• 1Q ‘23 financial results are meaningless to investors. The revenue and cash flow from Project Dorothy 1A and the hosting at Project Sophie are mid- to late 2Q events, while Project Dorothy 1B is expected to contribute revenue in 3Q ‘23. With Project Dorothy 1A and 1B fully booked and the October notes addressed, we expect investors to be focused on the ongoing contributions from its existing projects as well as the potential value of other projects in the pipeline rather than the results from the first three months of 2023.

LOTM: June 30, Soluna shareholders will vote for or against a reverse share split. The potential range in the prospective is 1 for five to 1 for twenty-five. We suggest the reverse split will be 1 for ten. The company to be relevant to institutional shareholders must trade above $1.00 per share. Since it is not a now above $1.00, the company will recommend a reverse split. We agree but hope the reverse split in 1 for ten or lower that one for ten.

It does not feel good to do but if “you” believe Soluna can survive and prosper going forward, then we suggest adding to the Soluna position to offset the dilution management did to get through the 2022 problems. Accounts related to LOTM own both the common shares (SLNH*) of Soluna and the 9% cumulative preferred shares (SLNHP*), of Soluna. Owning Soluna is an act of commitment and faith, not an assurance that Soluna will prosper from its business plan. Personally, I believe Soluna will succeed, perhaps in spite of themselves, and following resolution of the 2022 issues. The intangible factors available to Soluna out-weigh the visible company at this time. It is up to management to execute on these opportunities.

For Actionable Stock Ideas, consider a subscription to Tom’s LOTM Blog.

LOTM Style – We are more a controlled speculator, than diversified investor or short-term trader. We allow 100% loss/risk on some purchases. Often, we dollar-cost-average into losing positions. Volatility is our friend, not something to be feared. We let our winners win, as much as possible. We do not like paying taxes. We love value, yet watch charts. Our goal is to find value stocks that might double in one to three-years.

See our website for our doubling to a Million$ game. We were playing this game of doubles before Patrick Ben-David talked about it. Ideas in this blog are highly volatile and only for use by those who are comfortable with high-risk, high-reward investments.

Written June 2, 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()