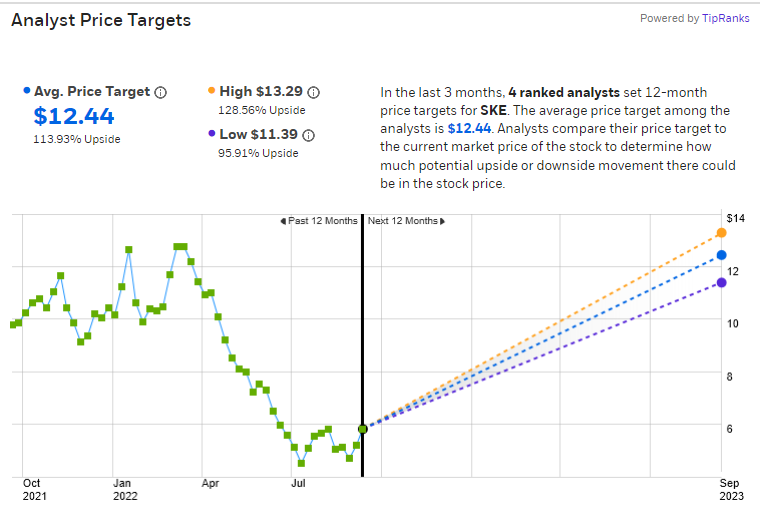

Skeena Resources (SKE) $5.82

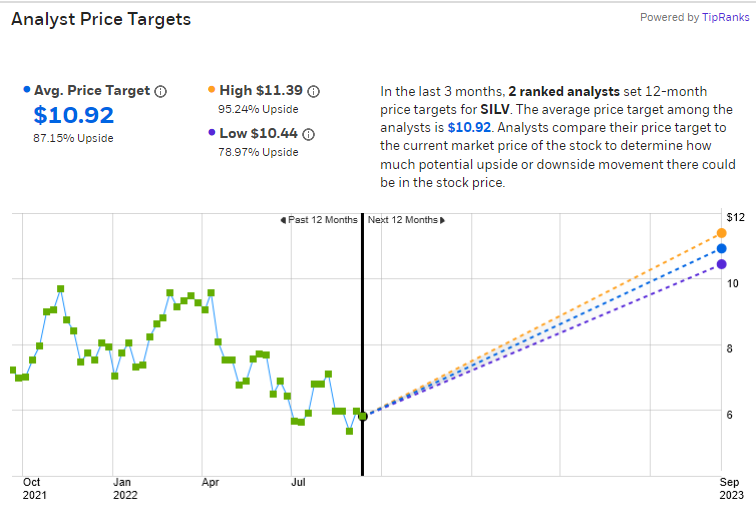

SilverCrest (SILV)* $5.83

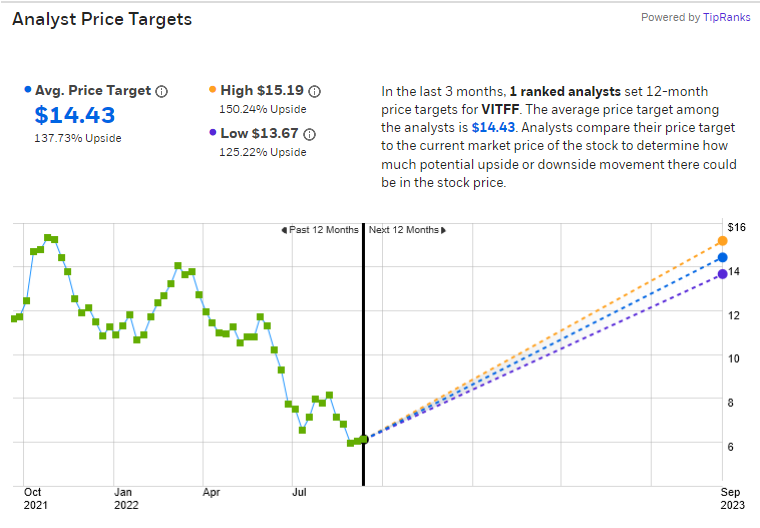

Victoria Gold (VITFF)* $6.05

Skeena Resources (SKE) $5.87

SilverCrest (SILV)* $5.66

Victoria Gold (VITFF)* $6.05

Please note. Accounts related to LOTM have and will trade in these companies without notice to readers.

The gold & silver mining sector is out of favor, at near all-time lows vs the price of physical metal.

All three of these mines are open pit with potential for underground operations to different degrees. The open pit aspect of their business has lower cost of capital to begin mining and is a fast ramp to profits. First year profitability of production for Victoria (2021) and projected first year of production for SilverCrest (2023).

Victoria (VITFF) will complete its second full year of production in 2022. It is a very profitable operation though lumpy in cash flows. During its first full year of operation, the company initiated a rapid debt reduction program. The stock has sold off in a quiet but deep correction. VITFF’s operation is located in Yukon, Canada. Victoria is primarily a gold producer. Lots of chatter about being a take-over but we don’t recommend buying for that reason. It is a plus if it happens.

- Mine to Mint – Victoria description 2022 – 4 minutes

In contrast to Victoria, SilverCrest (SILV)* started its first production in July of 2022. For full year 2023, SILV is projected to trade at a 7 times 2023 earnings number. SILV located in norther Mexico, has a large land package and is a top five grade of silver in grams per ton.

- First Pour – SilverCrest 40- seconds

Skeena (SKE)* located in British Columbia, is a developmental stage company. They have completed their feasibility study. The grade of gold at 4.2 grams per ton is very high for an open pit mine. Typically, gold is a commercially viable project at 1 to 2 grams per ton assay.

- Skeena’s Eskay Creek’s Pathway to Production – 4 minute video

Cost of production is very low on all three companies. Access to infrastructure is excellent for all three companies. Skeena will need a couple of years to get to production.

Company Market Cap Enterprise Value

SKE $381M $336.7M

VITFF $390.4M $676.7M

SILV $852.3M $898.8M

Definition of Enterprise Value: Market Cap + Debt – Cash

Written September 14, 2022, By Tom Linzmeier, editor Tom’s Blog at www.LivingOffTheMarket.com

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()