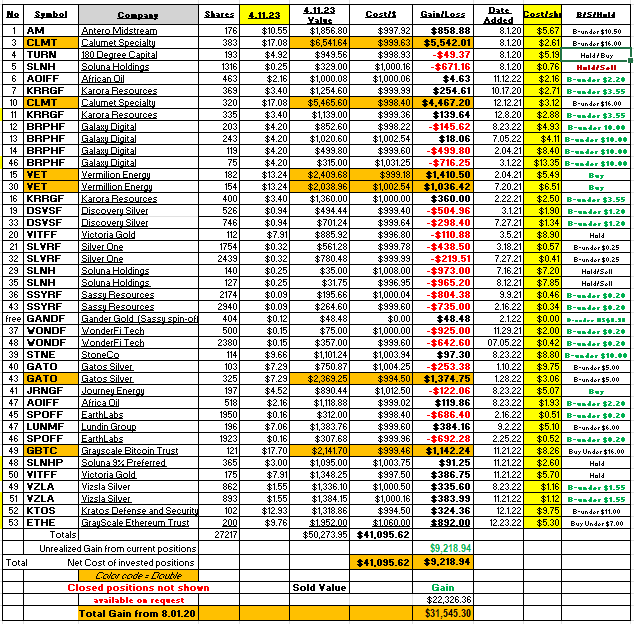

Start date: August 1, 2020.

Key to success: Multiple positions with initially equal investment positions. Limited Loss, even if 100% of investment and allowing winners to win. We need price doubles and better, to pay for the acceptance of 100% potential losses. It is part of a buy and hold long-term strategy. Harvest some of the winnings along the way but “fight” to let the winners win.

Focused Theme: Out of favor Industries that will benefit from revaluation as they return to favor. Commodities, Blockchain and Defense stocks are current target groups. We are looking at micro-cap funds and ETFs for participating in a stock market recovery. Still early for this last group.

Comments:

Soluna common and Soluna Preferred. Soluna is approaching a critical date. Loan repayment of $10 million dollar on April 25th, 2023. They do not have the funds. They need help from partner companies. This help will not be cheap and may not appear. Bankruptcy is a possibility. The March 31, 2023 10-K linked here is very ugly reading. Excerpt from 10-K: We anticipate that we will need to raise a significant amount of debt or equity capital in the near future in order to repay our outstanding debt obligations owed to our convertible noteholders when they mature. On October 25, 2021, the Company issued to certain institutional investors secured convertible notes in the aggregate principal amount of approximately $16.3 million for an aggregate purchase price of $15.0 million. Through original issuance until March 23, 2023, the noteholders have converted approximately $5.2 million of debt. As of March 23, 2023, we owed our convertible debt holders approximately $11.6 million of principal which is currently due on April 25, 2023. If we are unable to raise sufficient capital to repay these obligations at maturity and we are otherwise unable to extend the maturity dates or refinance these obligations, we would be in default. We cannot provide any assurances that we will be able to raise the necessary amount of capital to repay these obligations or that we will be able to extend the maturity dates or otherwise refinance these obligations. Upon a default in the convertible debt our convertible debt holders would have the right to exercise its rights and remedies to collect, which would include foreclosing on our assets. Accordingly, a default would have a material adverse effect on our business and, if our convertible noteholders exercise its rights and remedies, we would likely be forced to seek bankruptcy protection.

It is a grueling race to keep ahead of the 2022-23 issues.

To date, the string of problems that started in May of last year, have been resolved. The company is activating the Texas Dorothy project. Dorothy is expected to generate revenue of $24 million annually. SLNH has replaced the tenant at the Kentucky Sophia project. We cannot rule out a bankruptcy – we absolutely hope that does not happen. Certainly, the common stock has been diluted over the last year. There could be more dilution. The preferred is more attractive than the common but unknowable settlement if a bankruptcy happen. Lack of liquidity in the preferred doesn’t allow us to exit the shares in a constructive way. Risk & rewards are at extreme points in time. To say we are concerned is an understatement, but holding the position for now as other options are limited. We will know more very soon.

180 Degree Capital (TURN) – This has been an unproductive position. The valuation is excellent with the stock price at $4.86 and estimated Net Asset Value (NAV) for March 31, 2023 expected to be about $6.63. A discount of 26%. This is an unleveraged portfolio of micro-cap value stocks managed by activist owners (management at TURN). The risk level is low. When money returns to the micro-cap market space we do expect to see the share price of TURN recover to the $8.00 to $10 area. Expect LOTM to add to the position in the future. We are watching money flow into the micro-cap space at present as well as into the shares of TURN. Strong hold leaning towards buying additional shares in the future is our thought for now.

Oil & Gas related companies and Metal Mining stocks are very attractive to us. Money is flowing into Precious metal stocks. Perhaps becoming the hot market area. Oil and Gas seems to be regaining footing after a hard correction. We see excellent value in the oil & gas area. In our blog for paying subscribers, we suggested Royalty Trusts for variable cash distribution to owners.

The shift from Globalization to National interests has the USA on war footing. Defense stocks like Kratos (KTOS) are expected to do well. We do expect a kinetic war with China to happen. The USA would like to destroy the semi-conductor facilities in Taiwan “after” rebuilding them in the USA. China is ahead of the USA in a number of technologies, including Artificial Intelligence, Cybersecurity and Telecommunications. China depends on the technology from Taiwan and cannot build this technology yet domestically. The USA does not want China to have this technology. Therefore, we will push at China until they react. Controversial views I know, but reality as we see it.

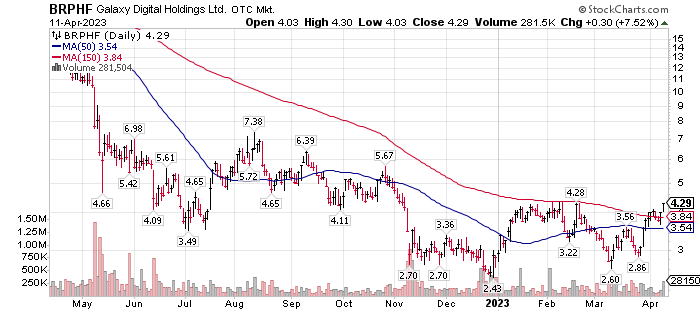

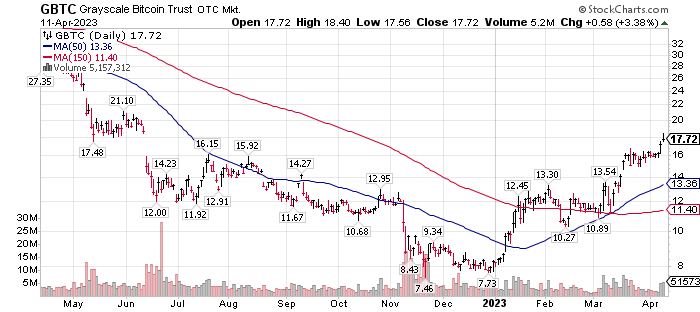

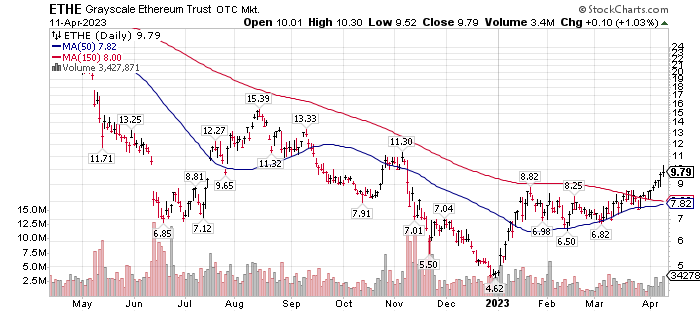

It seems there is a rebirth of interest in Bitcoin and Ethereum. Galaxy Digital’s (BRPHF) stock price is waking up technically. The first Quarter of 2023 was profitable as pre-announced by founder, Mike Novogratz in late March. In the four months since buying Grayscale (GBTC) the purchased has doubled. ETHE (Grayscale Ethereum) is up from $5.30 to $9.76 in a similar 4 month period – just shy of a double. Blockchain technology is real and changing the world. It is not embraced by the US government at this time for government’s self-interest reasons, but it blockchain is alive and well in many other parts of the world.

For Actionable Stock Ideas, consider a subscription to Tom’s LOTM Blog.

LOTM Style – We are more a controlled speculator, than diversified investor or short-term trader. We allow 100% loss/risk on some purchases. Often, we dollar-cost-average into losing positions. Volatility is our friend, not something to be feared. We let our winners win, as much as possible. We do not like paying taxes. We love value, yet watch charts. Our goal is to find value stocks that might double in one to three-years.

See our website for our doubling to a Million$ game. We were playing this game of doubles before Patrick Ben-David talked about it. Ideas in this blog are highly volatile and only for use by those who are comfortable with high-risk, high-reward investments.

Written April 11, 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()