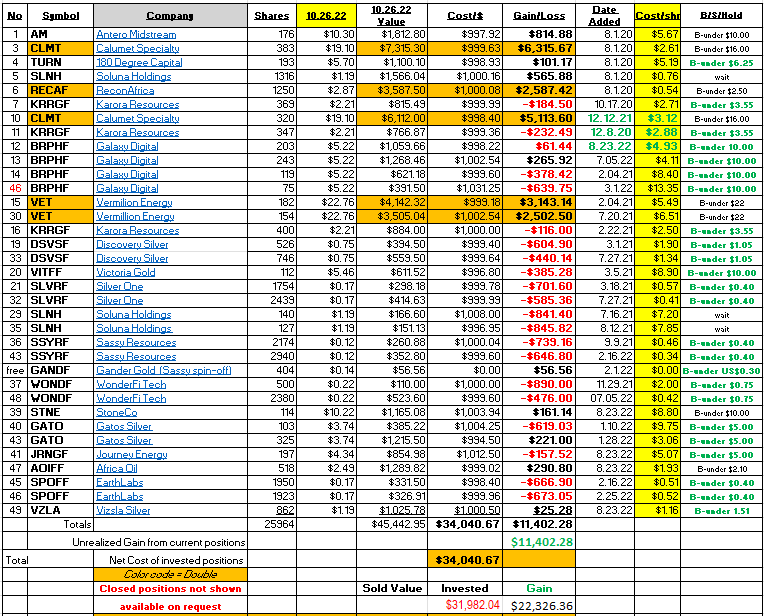

There is a lot happening in the Market that is not usual. For one thing – There are voices from some very good market people over the past month, calling for an additional 25% to 50% crash. That was over the past month. The last three weeks have been up! We hear them loud and clear. However, we are close to some important market indicators giving buy signals. In our grid above we are seeing a number of positions’ share prices rise above the buying limits we have in the B/H/Sell column. One of the positions, Calumet is at a multi-year high price. Currently we have seasonal strength into the yearend. We will share more as we move forward. Happy to have the rally we currently have.

We like the positions we hold. Soluna is the only one having difficulties that threaten the company, but surprisingly, I not too concerned. I think Soluna will be fine. They have 1.2 Gigawatts in Letters of Interest for potential work. This is literally more than six years of work at 200 megawatts per year. I suspect they can find a financial partner to help them through this mess. It is a big assumption on my part. LOTM just did a review on Soluna linked here. Accounts related to LOTM purchased shares of Soluna common and Soluna Preferred each of the last three days.

EarthLabs (SPOFF) sold their consulting business (announced today) for $24 million Canadian and assumption of $6 million in debt. I am not sure the business plan going forward but $30 million in benefits is a big number for a very small company like EarthLabs. I have to this this is a positive for the company.

The ExplorTech division comprises the EarthLabs’ GoldSpot Discoveries consulting group alongside Ridgeline Exploration Services Inc. and Geotic Inc. Its sale would reduce the company’s R&D costs and G&A expenses by approximately 70% year over year, creating a leaner, autonomous product portfolio of tech driven mineral exploration and financial tools.

Upon closing, EarthLabs will have approximately $53.7 million in cash, securities and equity investment; royalties and royalty options on 21 projects (it is currently the largest royalty holder in Newfoundland); and a product portfolio that includes Resource Quantamental, CEO.CA and DigiGeoData.

Shares outstanding are about: 136.6 million. C$53.7 million in assets works out to about C$0.39 per share in assets. The current share price in USD is 40.17 per share. I assume the $53.7 million in assets mentioned is in Canadian dollars. Converting that to usd per share in assets is US$0.2899. The current share price is trading at a 41% discount to asset value. We have stated that EarthLabs is the cheapest way to gather assets in the natural resource industry. We still believe that. We are long term holders and buyers of the stock looking for a much higher price.

Our LOTM Theme remains the same. Commodities, Blockchain/Crypto and Emerging Markets with a focus on Brazil at this time.

Consider subscribing to LOTM Daily Ideas and not missing any issues of our Blog!

We will go behind a pay wall, November 1, 2022.

The cost is a one-time payment of $239 for 14 months, ending Dec 31, 2023. That is a Monthly rate of $17.07.

Sign up through

1) Substack or

2) Send a check payable to Access Vietnam Group.

Mailing address: Tom Linzmeier, 339 Summit Ave #4, Saint Paul, MN 55102.

3) Direct deposit by Zelle to US Bank, Account name: Access Vietnam Group, phone linked: 651 245 6609.

Written October 26, 2022, by Tom Linzmeier, for Tom’s Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()