Technically Speaking:

Technically Speaking:

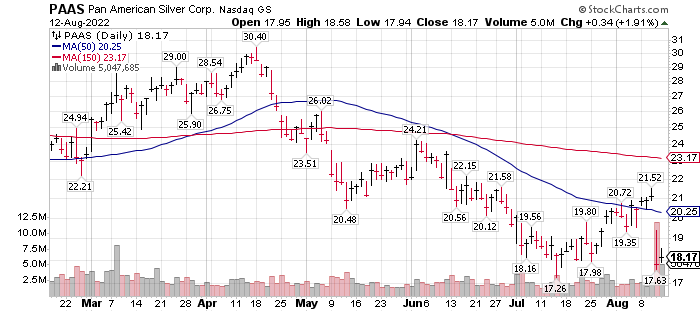

Very bad chart! Period. So bad – I am buying the stock! The positive in the chart above is the potential for a double bottom below $18 and the surge in Volume. Volume exploded on earnings release. The fundaments at Pan America are very strong. The Wall Street Adage is – Volume Precedes price.” We could see lower prices because “Volume Precedes Price,” right? We think you’ll see a 10% rally first but since we are so positive on fundamentals, we will buy now and either take a small positive trade or dollar-cost-average into lower prices and build a long-term position. No fear about “the company.” See management’s discussion link from six months ago, linked below.

Pan American Silver sold down hard last week. We think it is a great purchase for a trade and long-term investment.

- Pan American Silver: # 1 producer of silver in the Western Hemisphere. # 2 silver producer globally. Ranked # 1 globally, in total silver reserves.

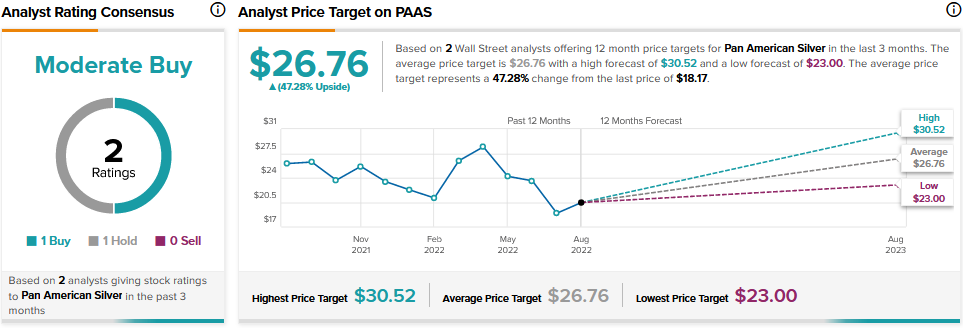

- Below are analysts price targets of two analysts (from TipRanks)

- Conference call from last week link here (38 minutes) and PAAS – website link

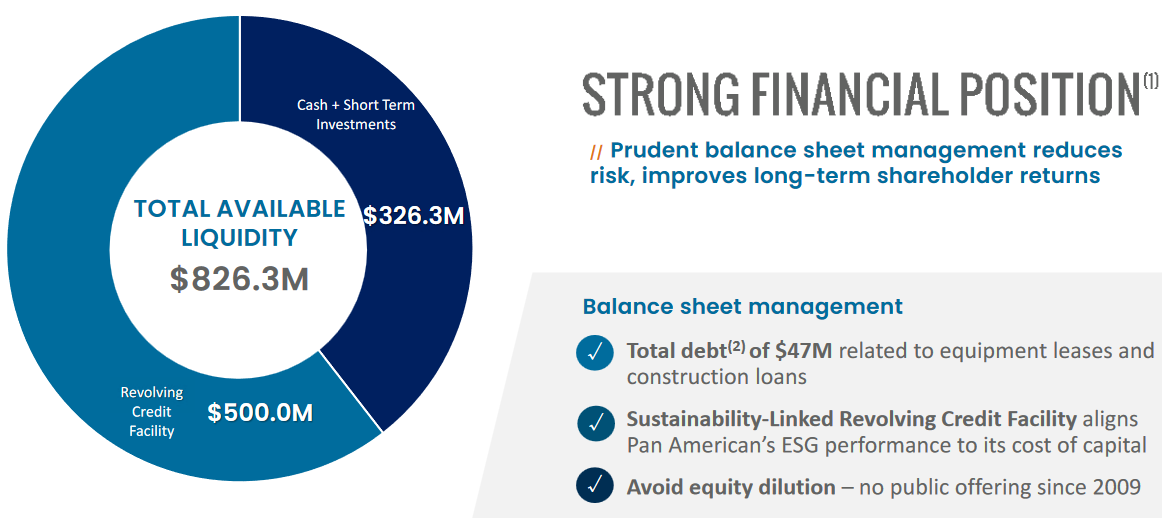

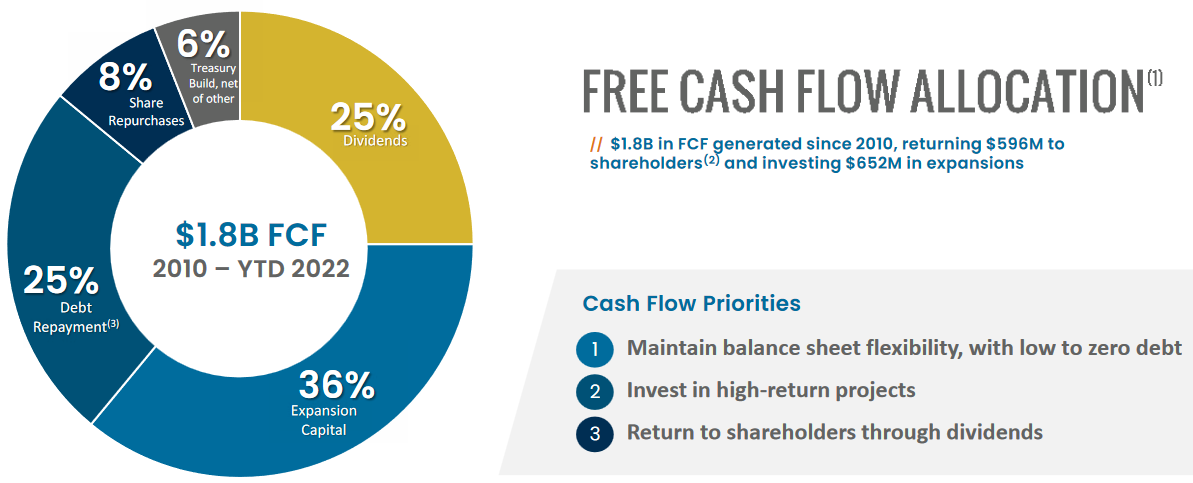

- They are exceptionally well run and very strong financially.

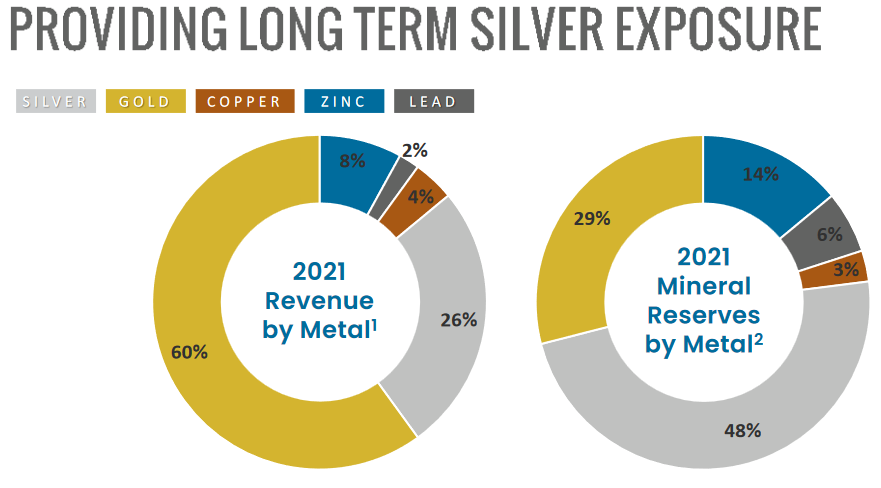

- Total production is split 26/60% between silver and gold . They hold silver assets in the ground, that are not priced in the stock that are among the biggest deposits in the world. Silver production as a percent of minerals mined will expand in the future.

LOTM related accounts have bought “some” PAAS shares for a trade. We will buy more next week and hold “some” for longer-term. Disappointing earnings, August 10, dropped the stock price. We believe it is a buying opportunity.

One could say “Worth more dead (in liquidation) than the current price”. Of course, we don’t want to go through a liquidation process and PAAS is very healthy financially, so worth more dead than alive is more a motivating phrase than reality.

Earnings news, August 10, caused a sharp drop in the share price that we believe is a knee-jerk reaction that is a quarterly event but not a threat to the company. 2023 is projected by management as a strong production year for PAAS. A 10% to 15% rebound is our expectation in the next 30 to 90 days.

On a two to four year timeline , we believe physical silver can trade 50% above the current price of $20.85. That projects a price target of $31.28. We think this is very conservative target. The recent energy, health care, climate and tax package bill just passed, focuses on addressing climate change. This will benefit silver and battery metals.

- Below are analyst views in last 90-days (from TipRanks). It is certainly possible we could see downward revisions in the coming weeks, but I am guessing the analyst view for PAAS is a longer view than the quarterly report.

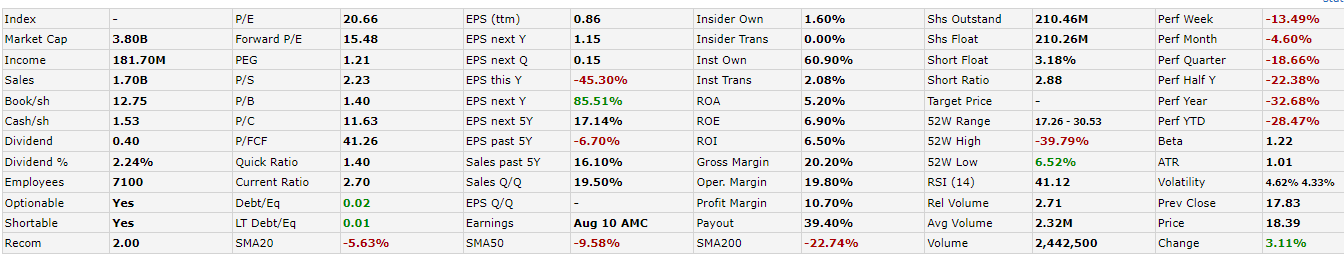

Stats From Finviz.com

Volatility of price can be your best money making friend if you understand your company. Certainly not a view embraced by everyone, but in our world, a truism. We respect our management because they have a track record that demonstrates their views, perspective and history. Therefore, If management says something, we accept what they say as their goal, intent and vision. That does not mean what they say will happen. There are many variables not under their control that could occur.

Know your Company:

- Most recent management interview I found on the company (PAAS)* six months old, excellent mine review and financial review. 30 minute video

- June 22, 2022, PDF company presentation link – PDF

- Buy Ross Beaty – founder and former Chairman of PAAS and 14 other publicly traded companies. Founded Pan American Silver in 1994 and built Pan American to the largest silver reserve company in the world and the #2 global producing silver miner. Beaty retired from Pan American, May 21, 2021. He is still involved and owner of shares of the company. The video below, in this paragraph, is a review of Ross Beaty, the man. In hearing the interview, you will know the culture of Pan American Silver. Ross also discusses his current investments and especially his new project, the founding of Equinox Gold (EQX) $4.31 in 2018 with a goal of building Equinox into a Top Ten Gold Mining company. More on Equinox in the future from LOTM. There is a lot to learn in this interview about life, success and dealing with failure.

“Ross Beaty: This Is How You Dig Your Way To The Top” with Rick Rule August 9, 2022. Rick and Ross have known each other since they were both in their 20s. Rick invested in the first company Ross started (in his 20s) and every Ross Beaty start-up since that event. 51 minute YouTube video.

Relevant snapshot images from the PDF referenced above.

National Observer March 12, 2018. complete story link

Ross Beaty will look you in the eye and tell you that he believes that “trees are spiritual beings,” and that nature is his religion. He’ll talk comfortably about our “ephemeral” time on earth and rant about our misguided obsession with Gross National Product. If you didn’t know better, you’d take Ross Beaty for one of B.C.’s homegrown hippies — another back-to-the-land type in his plaid shirt and rubber boots.

The thing is, Beaty is the founder and chair of the second-largest silver mining operation in the world, Pan American Silver Corp.

A field geologist turned serial entrepreneur; Beaty knows that his passion for nature conservation is hard for some people to swallow. “It’s easy for some environmentalists to condemn mining,” says Beaty. “But it’s not strip mining. We make a hole and most of the work is underground. We mostly do the work where there is very little or no biodiversity. We fill the hole back up when we’re done. Where do they think they get the metal for their bikes and wind turbines?”

LOTM: One of the nice things about life, is we get some choice in life about who we want to associate with. This is especially true in investing.

Written August 14, 2022, by Tom Linzmeier, editor, www.LivingoffTheMarket.com

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()