Africa Oil is controled by the Lundin Group. The Lundin family is a well known family business in Canada. Founded by Adolf Lundin over 50 years ago, the Lundin Group comprises, 11 separate, individually managed public companies focused on the resource sector. Africa Oil is one of their 11 public companies. The Lundin Group itself, is a privately held organization.

AFRICA OIL ANNOUNCES ITS INTENTION TO LAUNCH A SHARE BUYBACK PROGRAM UNDER A NORMAL COURSE ISSUER BID

8:00 PM ET 8/10/22 | Dow Jones

VANCOUVER, BC, Aug. 10, 2022 /CNW/ – (TSX: AOI) (Nasdaq-Stockholm: AOI) — Africa Oil Corp. (“Africa Oil”, “AOC” or the “Company”) is pleased to announce that it has Board approval to submit an application to launch its first share buyback program under a Normal Course Issuer Bid (“NCIB”) scheme. The Company’s intention is to repurchase up to ten percent of its public float, the maximum permitted over a twelve month period under Canadian and Swedish securities law, subject to customary approvals. View PDF Version

Once approved, the buyback program would expand on the Company’s existing shareholder capital returns program with an annual base dividend of $0.05 per share, distributed in two semi-annual payments. A further update on the process and timing, including a launch press release, will be issued upon regulatory approval and once the Board has formally resolved to launch the NCIB. Link to full story Continue reading

![]()

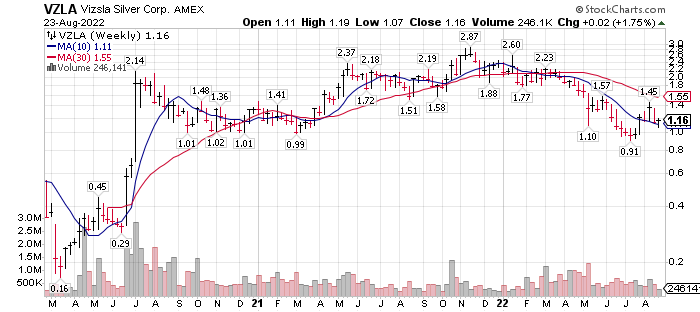

Vizsla Silver (VZLA)* $1.15

Vizsla Silver (VZLA)* $1.15