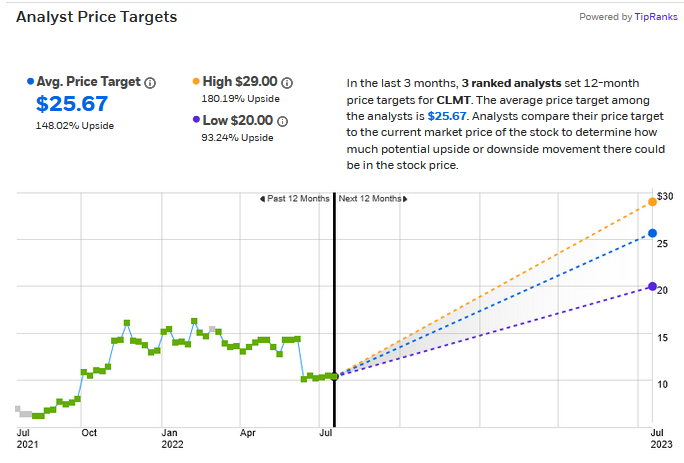

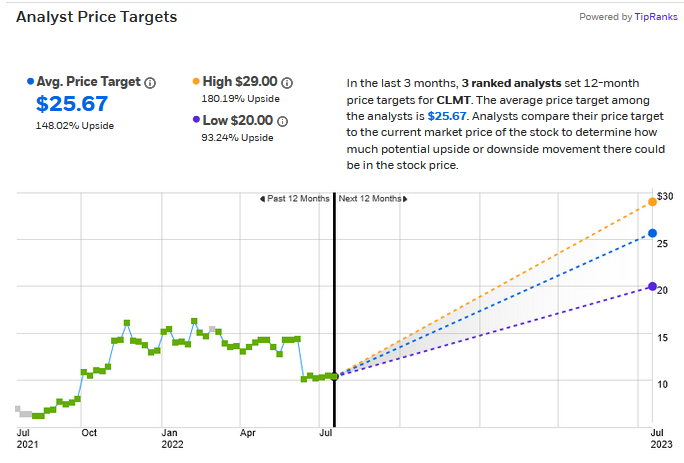

Calumet (CLMT)* $10.25 – “Three strong buys” by analysts Continue reading

Continue reading

![]()

Calumet (CLMT)* $10.25 – “Three strong buys” by analysts Continue reading

Continue reading

![]()

VanEck Vietnam ETF (VNM) for trading in the US Market: Continue reading

Continue reading

![]()

A Private Club for those who want to do it themselves, but with a support team!

Limited to Ten Founding Members

Purpose of the Club:

How does one compound money into a million: Continue reading

![]()

Bitcoin has no fundamental value “at this time” as a measure of its price. That makes it perfect for trading technically with one exception. It is a thinly traded and some big coin players do manipulate the action, so technicals only work part of the time. We must always be alert to sudden price shocks if working Bitcoin. For this reason, I prefer using Osprey Bitcoin Trust (OBTC)* as a surrogate for directly trading Bitcoin. It gives a slightly delayed reaction to directly trading Bitcoin. A type Continue reading

![]()

One year chart of Dow Holdings with Bollinger Banks:

![]()

A rapidly rising US Dollar is shaking up financial markets around the world. It causes problems in other countries through a shortage of US dollars to make payments on US Dollar denominated debt, for the purchase Continue reading

![]()