We are excited about the sell off happening in the market today! Why would I say that when any number of companies we own are being dumped? Simple. We are setting up for our next crop of big winner for the next equity rally.

LOTM started writing for the general public on Continue reading

![]()

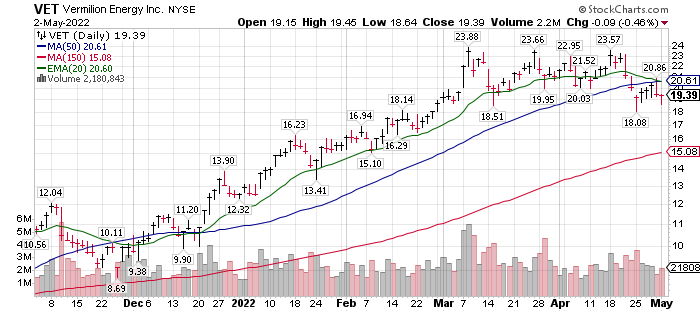

Vermilion (VET)* price is in an intermediate

Vermilion (VET)* price is in an intermediate  Written 3:14 PM April 26, 2022.

Written 3:14 PM April 26, 2022. Technically, the shares are

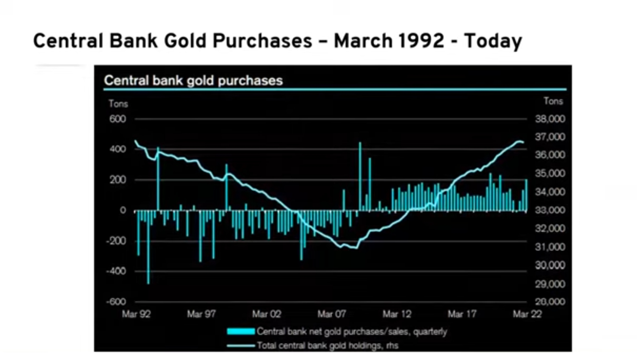

Technically, the shares are  Screenshot from Blockworks video

Screenshot from Blockworks video