Times are interesting to say the least.

Issues that are causing stress in equities, commodities and bonds include:

- Supply constraints in energy and other commodities.

- War in Eastern EU and potential conflict in South China Sea area.

- Sovereign Banks struggling in multiple countries.

- Rising interest rates that are crushing the economy but not solving the inflation problem.

- The first leg down in Equities is due to rising interest rates. A second 20% to 30% drop could be in front of us from a corporate earnings collapse in 2023.

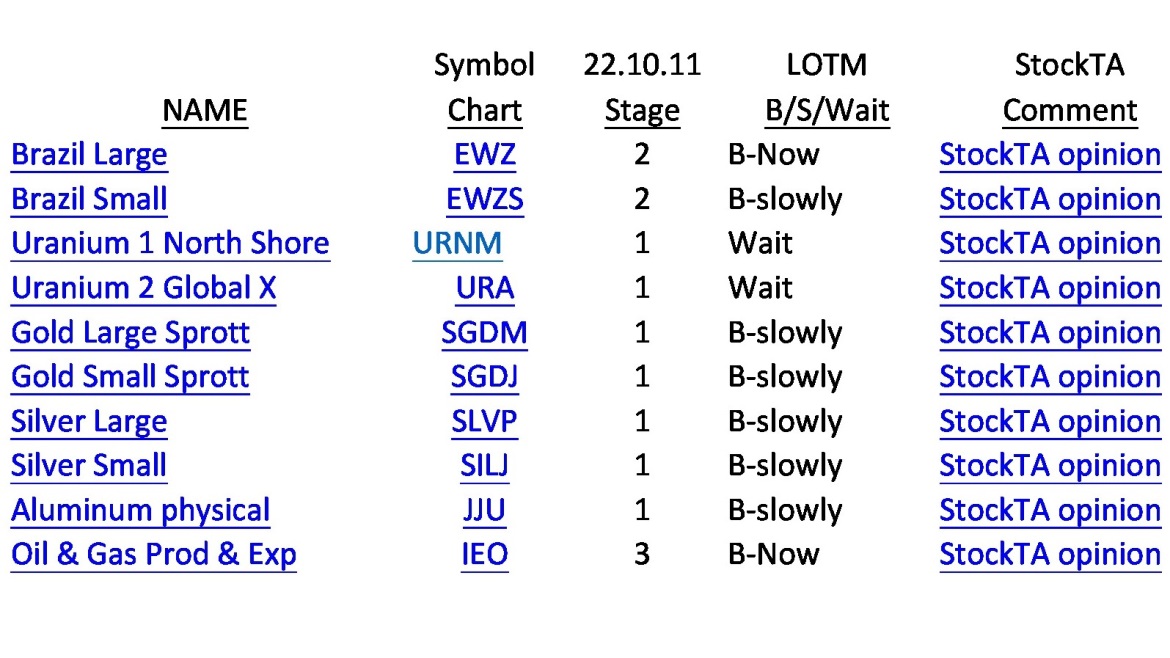

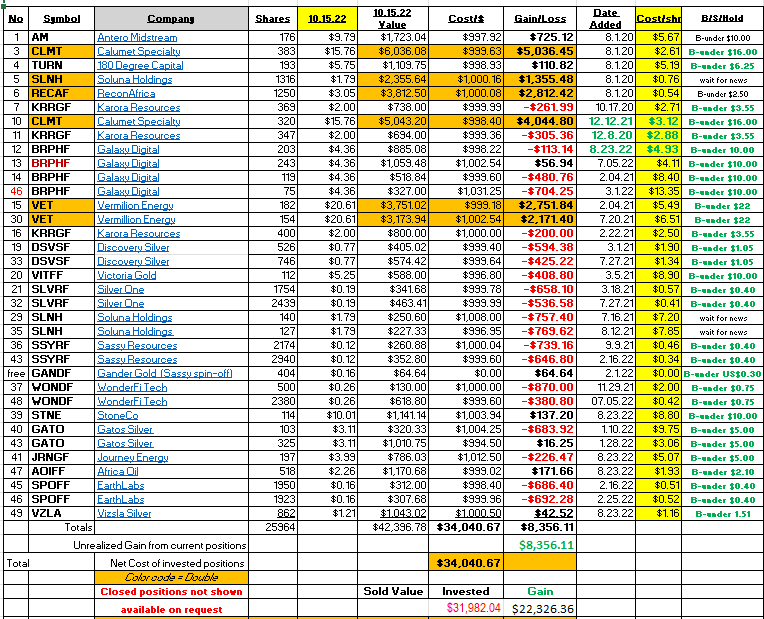

In the above environment, we believe in investments with a theme around Oil & Gas, Precious Metals and Bitcoin is warranted. Continue reading

![]()