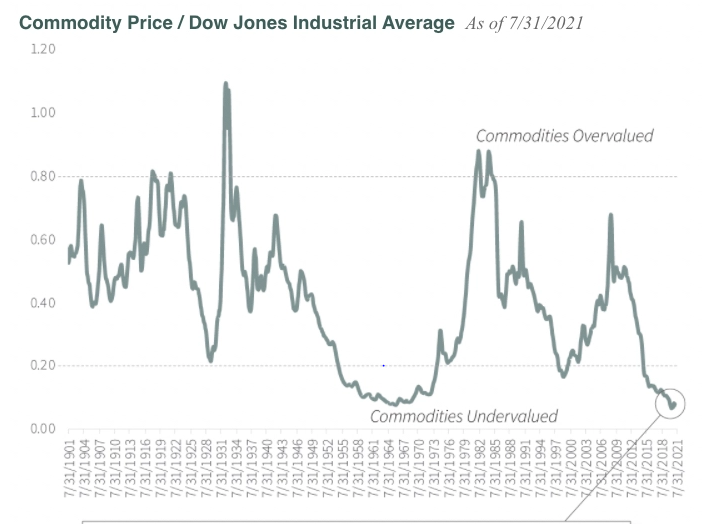

This morning, our shared image shows the relationship between the Dow Jones Average and Commodity Prices over 120-years.

In a “Normal” marketplace, we all think of buying low and selling higher.

I’m not sure why in the stock market, we as humans have a Fear of Missing Out (FOMO).

Maybe higher prices act as emotional triggers to pay higher prices. We get trigger and shift from a logic/intellectual perspective to an emotional/feeling perspective. If we can reverse this triggered emotional FOMO state, and return to our critical thinking state, we would all agree that, yes buy low-sell high is how you make money (I hope).

Today, commodity producers are not only the cheapest historically to Equity prices. Commodities have (in general) have strong balance sheets and strong cash flows. This is why we are overweight commodities. They are cheap and at historically low prices and not many care. Just how we like to do our buying.

As shared in prior emails, our primary commodity focus is on Metal miners – Gold, Silver, Nickel and Uranium – as well Energy related holdings. Nat Gas and LNG are our favorites in Energy. Longer-term Uranium will do very well but we are unsure of the time – line for Uranium.

Think critically now, more than ever, about everything. The markets are about to get very interesting, very soon.

Buckle up!

Available for Coaching, Training or Mentorships

Contact LOTM For One-on-One consultations.

Rates are $125 per hour / less for retainer

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()