Oct 17, 2019 Tom Linzmeier – Access Vietnam Group, LLC

The Pan Group, (PAN) US$1.25

- Difficult 2018 and 2019 to be followed by stronger revenue growth in 2020

- Growth opportunities outside Vietnam

- Capital investment brings strategic partner

- Solid leader inside Vietnam in the agriculture, to include aquaculture and food group

The Pan Group is a leading agriculture and food group based in Ho Chi Minh City, Vietnam.

Let’s look at the Macro View of why The Pan Group should do well over the short and long term.

Great Demographics

The Pan Group operates domestically in a near 100 million population country, that is young, highly educated and very upwardly mobile. The company (PAN) will grow with the rising expansion of incomes and growth of the middle class. GDP growth for Vietnam in 2018 was 7.08%. It is the, rising tide that lifts all boats, philosophy in which corporate growth thrives.

Ability to grow outside Viet Nam

In addition, The Pan Group has established key partnerships that provides access to distribution systems in SE Asia. This applies to both Imports for revenue expansion in Viet Nam and expansion as a Global Producer and Exporter. Growth not bound by geography! One such key partner and newly 10% owner of The Pan Group, is Japanese Sojitz Corporation

Connection to Financial Community

PAN is well connected in the financial community. Chairman of the Board, Mr. Nguyen Duy Hung, is also Chairman of SSI Securities. SSI holds a 13% shareholder position in The Pan Group.

SSI Securities is the largest brokerage firm in Viet Nam over the past five years. As of July 2019, SSI had a 18.7% market share of the Vietnam brokerage industry. The next closest competitor holds an 11.2% market share.

International Accounting Standards

Auditors are Ernst & Young, Vietnam. Growing up in the brokerage industry, one of the first things we were instructed to check off was; who are the accountants? Accounting standards are loose in Viet Nam, so it is important to, at the very least, see who the company’s auditors are. Ernst & Young is an international accounting firm and has a very good reputation around the world.

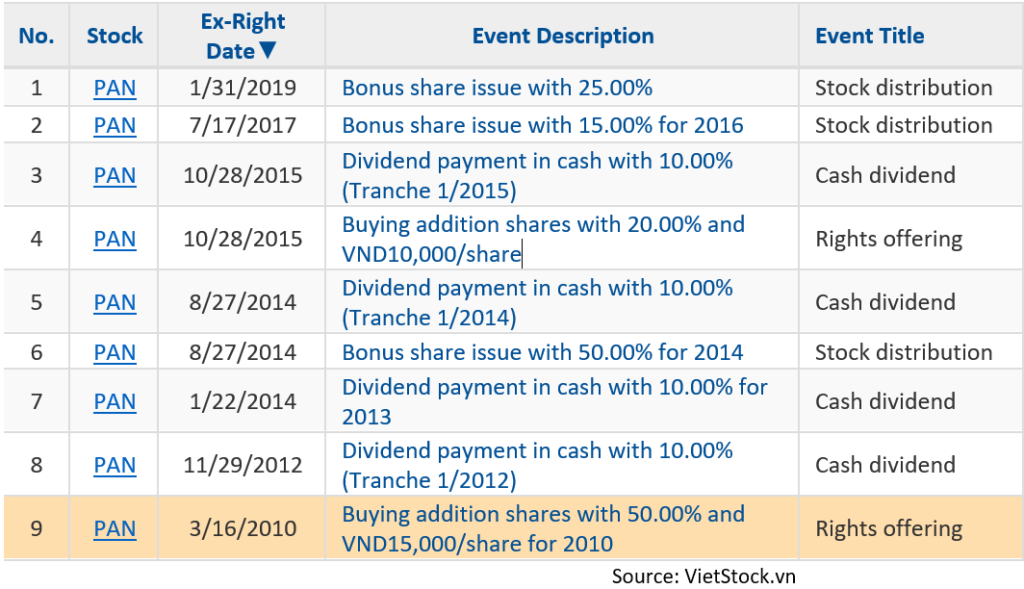

Share Holder friendly

Pan has on an irregular basis treated its shareholders well through cash and stock dividends.

Source: VietStock.vn

- Our purpose above is to show that The Pan Group can be a core holding in a long-term portfolio.

- To get a visual perspective of the company, you can see a short video of their operations at different subsidiaries linked here.

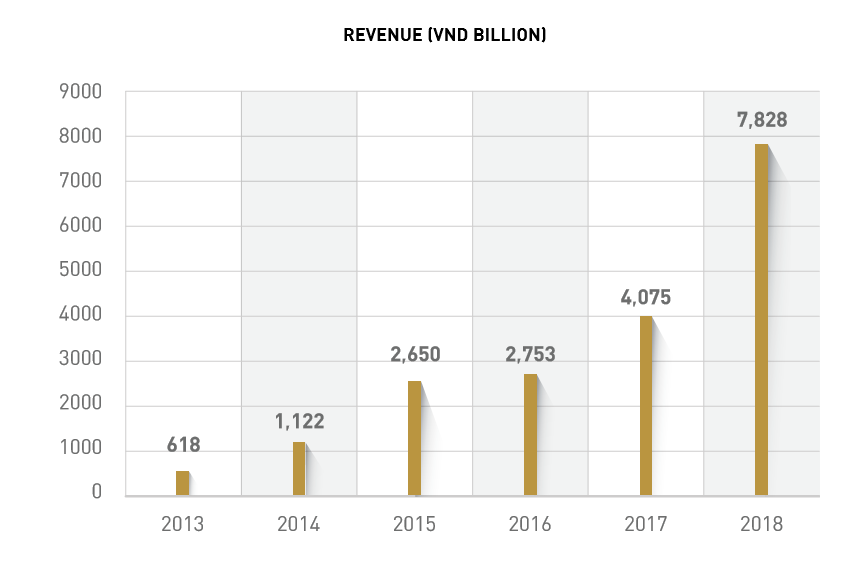

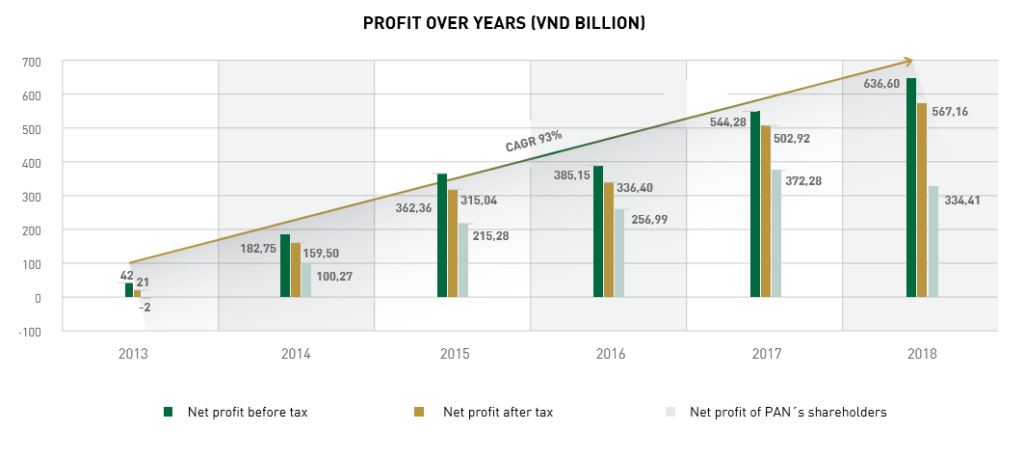

Revenue and Profit History:

Sourced from The PAN Group’s Fiscal 2018 company results

Why Buy Pan Group Now? – Timing of Course.

The share price has fallen due to difficult times in the Agriculture business in Vietnam.

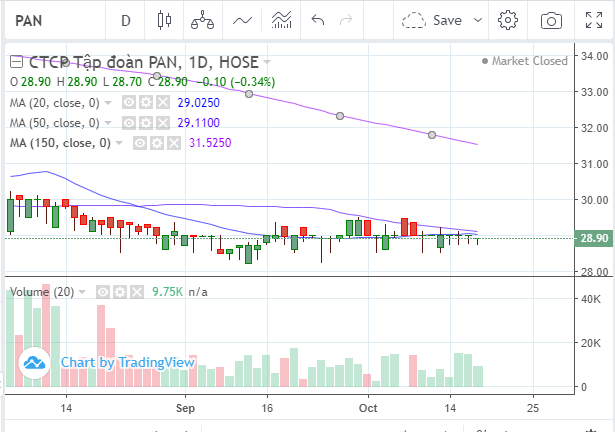

First the technical patterns. Longer term charts to see the big picture and then drop to a one-year and even a shorter chart with moving averages.

Five Year Chart: Strong Support at the Current Price

Note: on this chart the flat line. The shares have been trading at the price AVD $28.8 (US$1.25) on the five-year chart below. This is 1) a strong long-term support level and 2) is the recent flat line trading here in 2019. Stocks only trade like in a flat line state, if there is a big accumulator of the shares. In most cases, this buyer is serious enough to absorb the existing sellers in the shares. Eventually, the reason the buyer is accumulating the stock becomes known and the stock rallies. Certainly, this isn’t an absolute outcome. I have been in stocks where the accumulator stopped buying, and the price fell off the edge, to lower prices. It has been a minority of the time, however. In most cases, the stock price rallied.

It is worth noting, the slight dip in the share price in late 2017, just before the price rocketed higher. This too is normal activity. Call it gamesmanship. The big players scare out the weaker players just before a big move higher. It happens all the time in markets around the world. Expect it. All market makers need to do is withdraw support for the share price and the price will drop into the vacuum thus created. With algo trading it becomes even more frequent, because algo’s react to a formula that is predictable and reactionary.

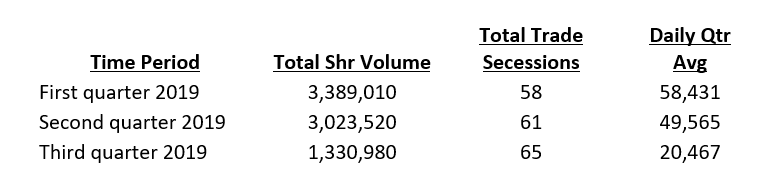

Trading volume in PAN is low and has shrunk as selling volume dried up. We need a big up-volume day and week to get an upward trend launched. Still, we look at the low volume as a positive sign that selling has dried up. We need a catalyst to launch a rally phase. Perhaps it will be in the next earnings announcement.

From the five-year monthly chart above, we zoom in on the one-year weekly chart below, to begin working on the timing of our entry price.

Note the volume lines. During this recent flatline period, the green bars are signaling more accumulation rather than the red distribution lines.

In the daily chart we add some moving averages. We keep it very simple. 1) Price crossing above or below a moving average as a buy or sell signal and 2) moving average crossing over another moving averages as a signal of confirming the price crossing the shorter moving averages.

For three to six month and longer timelines, we like the 20-day, 50-day and 150-day moving average (M.A.) set.

Currently PAN, is below all these moving averages so not on a momentum buy signal. But the price is just below the 20-day and 50-day. A rise above these trigger points would be the first indicator that “maybe” momentum is coming into the shares. This is what we will watch for to become fully invested in this position. In the short term we like the company, we like the environment (demographic growth) and we like the industry they are in. We believe they are a good Value at the current P/E ratio so we are comfortable buying 10 to 25% position of what could be a fully invested position. We will invest more as the prices crosses above the 20-day and 50-day moving average. We will add more as the 20-day crosses above the 150-day moving average and we would expect to be fully invested when the 50-day moving average crosses above the 150-day moving average.

Challenges At PAN!

This is an agriculture-based business. Agriculture is a cyclical business. It’s hard to control the weather or disease. We must recognize that as an industry challenge. As the company grows and they expand their import/export and distribution business, improve management efficiencies, they will move away from some of cyclicality of the agriculture business or be able to manage it better. It is a company opportunity to become better and improve, not a reason to avoid the company, in our opinion.

Late 2018 and the first six months of 2019 has seen difficulties of Vietnam’s agricultural sector. The African hog cholera epidemic broke out in Vietnamese provinces nationwide. A heatwave and drought in the North and especially the Central complicated the situation. Animal feed costs increased at a time of difficulty for hog farmers.

Every company has things they can work on to be better. At Pan Group we see challenges in improving their return on equity. Return on equity is a measure of management efficiency. Integration of their subsidiaries and acquisitions is one area in need of improvement. Improvement in workplace systems might be another. The PAN Group has inaugurated the largest rice and seed factory in Southeast Asia and a new confectionery factory in Long An. PAN Consumer Goods Distribution Joint Stock Company (PAN CG), recently established, will help to optimize the cost of distribution and storage and to promote the synergy from the current distribution system.

In summary:

- The Pan Group represents an opportunity to grow with Vietnam.

- It is a company that will also grow beyond the borders of Vietnam.

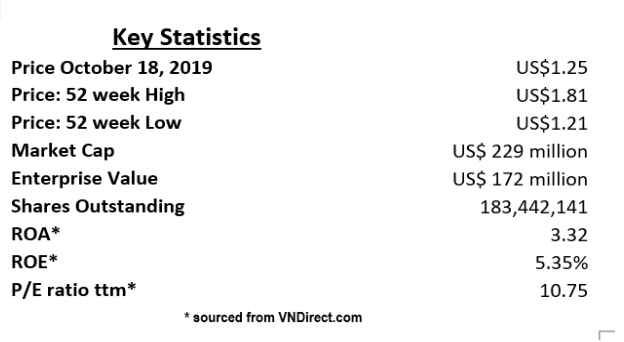

- PAN appears to be at an attractive buy-in price at about 10.7 times trailing earnings.

- The price is at a major price support level.

- The stock price is half the value it was just 16 months ago.

- You might consider a strategy of “Buy slowly and add to the position as the price rises above its various moving averages”.

- Expect a dip in price before we see a break-out in an upward direction. It is more common than not as market makers pull their bids to accumulate share as they sense a price increase coming. This does not “have to” happen but it is “normal” market activity.

Happy Investing.

Disclosure: I am/we are long PAN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Tom Linzmeier is a former stockbroker having retired from the Brokerage business in 1999 after 24 years. Tom left his last firm, Robert W. Baird & Co. in the USA as Sr. VP of sales. He is an author and a national workshop leader in the USA for 15 years. He is the Founder and President of Access Vietnam Group, LLC. Tom lives in Hanoi eight months each year.

![]()